By Danielle Neziol, BMO ETFs

(Sponsor Content)

Canadians are facing a lot of sticker shock lately. My grocery bill was how much? My mortgage payment is going to increase by what per cent? Don’t even ask me what it costs to fill up my car these days. With more money going to living expenses, it has become harder to save than ever. One simple way to get ahead is to be more aware of what we are spending — especially in times like these — and to review our monthly expenses to see where there are opportunities to make cuts.

Our investment portfolios should be viewed no differently. If you are an investor who holds a mutual fund or an exchange traded fund (ETF) there are fees attached to your investments. It would be prudent to review the cost structure of the funds you hold to ensure that the fees make sense relative to the fund’s investment mandate. It would also be wise to review the cost of the funds you hold to see if that fee is competitive relative to similar products in the market. Fees detract from total portfolio returns, so anything an investor can do to manage these costs can help keep more money in their pockets.

Management Fees and MERs

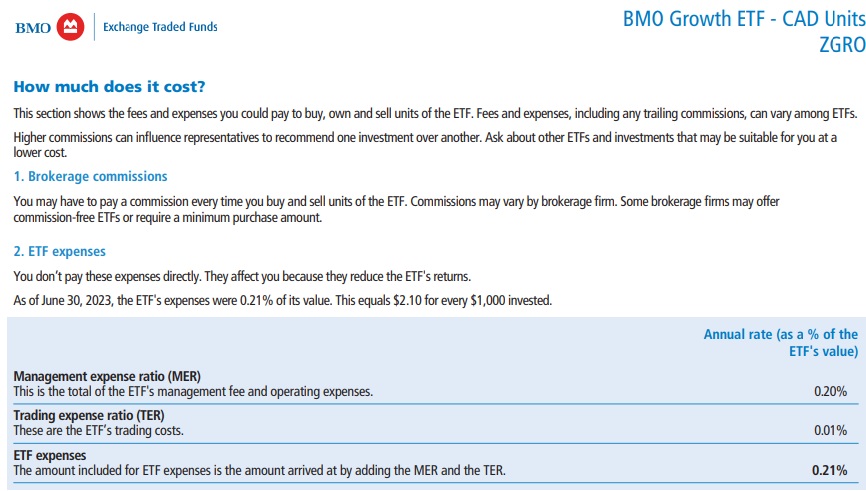

Every investment fund has a management fee. This is the cost a fund manager charges to manage the portfolio operationally (buy and sell securities, rebalance, etc). The Management Expense Ratio (MER) is the bottom-line cost to the investor. It includes any taxes charged to the fund, as well as any added fees (such as leverage). An investor can look up the management fee and MER within the Fund Facts and ETF Facts of their funds. These are regulatory documents that can be found for every fund issued in Canada. Some asset managers advertise very low management fees but have higher, less advertised, MERs, so investors should always do their due diligence on the total fund cost to fully understand the bottom-line payment that they are making every year.

The MER is subtracted from daily returns. Therefore, it has a direct impact on the total return of the fund. And as investors we know that overtime, our total returns help build our overall wealth. Therefore, the lower the fee on the investment, the more money there will be for the investor at the end of their investment period.

Comparing Fees

Once investors are aware of the fees they are paying for their investment products, they have the ability to “shop around” to see if there are any products that may be a better fit in their portfolios or which offer lower fees. When comparing fees it’s important to understand what you’re getting for in return for what you’re paying for. Broad market index funds generally have the lowest fees in the market. For example the BMO S&P 500 Index ETF (ZSP) has an MER of 0.09%. Index funds tend to have the lowest fees because operationally they are easier to manage. A Portfolio Manager will go out and buy the stocks within a particular index, and rebalance when needed.1

Actively managed funds can come with higher price tags. This is because an active manager has more overhead- research teams, technology resources, data needs, intellectual expertise: costs which all add up. Active managers seek to provide “alpha,” which means outperformance versus the broad market. This is the value they seek to provide for the higher fee they charge. Therefore, for higher-fee active products, investors should do their due diligence: is the active manager providing performance beyond the fee hurdle and the broad market? Is this performance consistent?

We have seen a boom of income-focused ETFs in the past few years that use options strategies. Options overlays are more work from an investment management perspective, and therefore may be associated with higher fees relative to a broad-based index fund. For example, BMO’s covered call ETFs all have MERs of 0.75%, which reflects the management of the underlying stock portfolio plus the options portfolio of the ETF. Many options-based ETFs also incorporate leverage, which can be costly (and which is only captured in MER, not management fee). Therefore, investors looking at these types of funds should research MERs and understand what they are actually paying for.

Trading Fees

Investors also must consider direct costs to buying and selling ETFs. There is sometimes a commission to buy and sell; however, this varies among trading platforms. For investors who want to reduce the amount of trading they do annually and keep commission costs low, Asset Allocation ETFs can help eliminate trading expenses. Asset allocation ETFs hold baskets of globally diversified fixed income and equity ETFs, and are set at predetermined equity and fixe- income weights. As markets move, the weights of holdings change (when markets go up equities take up a larger weight than fixed income and when markets go down fixed income becomes overweight). With asset allocation ETFs, rebalancing is done automatically, which means less trading and less commissions for the end investor.

Fees in Canada trending Down

With inflation pushing costs of most goods and services up it’s nice to know that the fees on investment products are not impacted by inflationary pressures (thank goodness!). One of the great benefits of ETFs is that their low-cost fee structure put pressure on the Canadian fund industry to lower overall fees. The added competition helped bring down the average fund fee in Canada as many fund managers decided to reprice their products to compete with lower-fee investments.

ETFs listed in Canada have an asset-weighted average expense ratio of 0.30%, representing all index and active strategies.2 Most broad market index ETFs are priced in the 0.10%-0.20% MER range while most active ETF strategies are priced in the 0.75%-0.90% MER range.3 But there are still funds out there charging 1-2% per year, and sometimes even higher. On a $100,000 investment, a 2% MER represents a $2,000 cost every year. Over many years, this can really add up, especially when we consider compounding returns. Therefore, investors must do their due diligence to see what fees they are paying and if those fees make sense to them.

So, as we review our annual expenses this year, Canadian investors should not ignore a review of the expenses associated with their investment portfolios. There could be opportunities here to cut back on fees, which will provide more savings at the end of the day.

1Note that index investing is subject to tracking error. This is the difference in performance between the index and the fund, which can be caused by fees, trade timing and daily market movement.

2Source: etfgi.com, December 31, 2023.

3Source: Morning Star Direct, December 31, 2023.

Danielle Neziol is Vice President of Online Distribution for BMO ETFs. Danielle has been part of the BMO ETF Team for over five years working in ETF product development, strategy, and most recently in ETF education for direct investors. In the past she has been engaged with with the exchanges, capital markets desks, index providers and portfolio managers to bring ETFs to market and today she is focused mostly on applying her expertise in the ETF business to support and educate investors.

Danielle Neziol is Vice President of Online Distribution for BMO ETFs. Danielle has been part of the BMO ETF Team for over five years working in ETF product development, strategy, and most recently in ETF education for direct investors. In the past she has been engaged with with the exchanges, capital markets desks, index providers and portfolio managers to bring ETFs to market and today she is focused mostly on applying her expertise in the ETF business to support and educate investors.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.