In October I penned this blog post, The Balanced Growth Portfolio. The Investor’s Sweet Spot. A Balanced Growth model with typically be in the area of 70-80% in stocks and the remainder in bonds. It’s a growth portfolio, but with a modest allocation to bonds to reduce the price risks. As I often write, those bonds work like shock absorbers through market volatility or market corrections. They help smooth out the ride.

I’d call this model the sweet spot as it might offer the best balance of very good total return potential with less risk compared to an all-stock portfolio. It many periods it will deliver the best risk-adjusted returns.

In fact, in many periods the Balanced Growth portfolio model can deliver the same returns as an all-stock model, while taking on less risk. Stock market corrections become the great equalizer. The pure equity model will certainly outperform in a long bull market run, but then the stock market corrections come along and bring the stocks down to earth while the Balanced Growth model then moves into the lead. They might play a game of tortoise and the hare for many years or decades.

See my above post link for charts on that comparison.

Let’s look at the ETF holdings of Canadians

Industry statistics are published by the Canadian ETF Association. You can access the December 2018 report and commentary here.

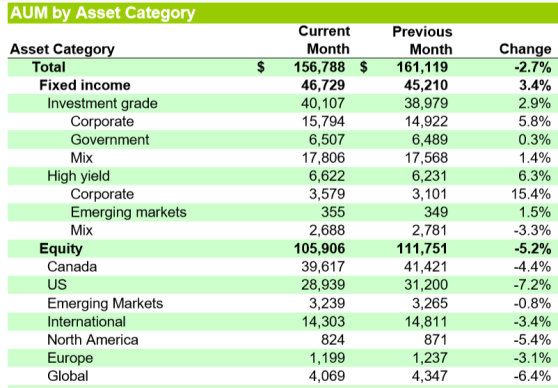

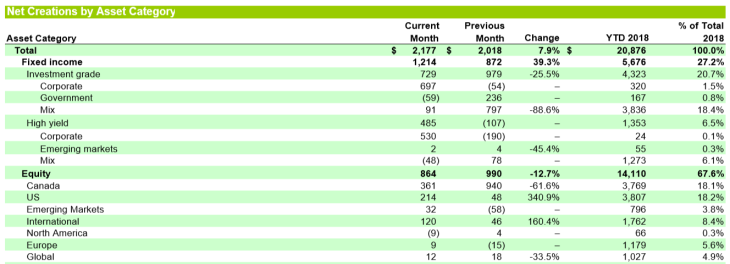

The chart at the top of this blog shows the monthly breakdown of assets held in ETFs. Current Month is month’s end December 2018, Previous Month is November, of course. Keep in mind that the assets will be affected by the total inflows and outflows (purchases and sells) and also the market variance. The stock markets fell in December and that will bring down the total stock assets number.

We see that Canadian ETF investors are in that sweet spot of near 70% equities and 30% bonds. And the good news is that while the stock markets were pulling their little December hissy fit, investors were adding new monies to their ETFs: both Fixed Income and Equities. And you’ll see that Canadian ETF investors are acquiring within the Balanced Growth band.

We see that investors did respond to the stock market price risks and moved more monies into the fixed income side of the ledger in December. No problem there. Sometimes Mr. Market gives us a little love tap and reminds us that markets can go down in a hurry. We get a very considerate warning shot across the bow. On that here’s my Seeking Alpha article from one year ago Mr. Volatility is Asking You, Taunting You – So You Wanna Go?

Many of us might be getting a little flabby with respect to our risk taking ability. We have not been tested much in the last decade coming out of the Great Recession. We should always remember that markets can be volatile and they can fall by some 30%, 40% or 50% or more in a major market correction. I reminded readers of those risks in my first post to the Tangerine Forward Thinking blog with Why You Might Still Want Bonds In Your Investment Portfolio.

Ensure that you know your risk tolerance level and that your portfolio is best matched to you risk tolerance level. Have a more than solid investment plan but consider that emotional risk. From that Seeking Alpha article and offered by the most ferocious heavyweight boxer of all time, Mike Tyson …

Everyone has a plan until I punch them in the face.

Yes, Mr. Market may punch you in the face one day. Are you ready? I can take a punch in the market and in the boxing ring. I grew up with a boxing ring in the backyard so that my older brother could practice punching someone in the face as he prepared for and kept in fighting shape for playing Junior ‘hockey’. He only ever lost one hockey fight. Me and my face take full credit. Mr. Market has thrown a few punches too.

All said, be prepared.

How are Robo-Advised Canadians putting monies to work?

Keep in mind that many investors will create their own ETF Model Portfolios through their discount brokerage. But of course there’s a massive move to the Canadian Robo Advisors, where investors can access digital and human advice that will then lead to the recommendation of risk-appropriate ETF portfolios. That risk assessment is key.

I checked in with Justwealth and they offered that their clients are investing closer to the traditional Balanced Model at near 60% stocks to 40% bonds. Keep in mind that Justwealth offers target dated model portfolios for their RESP plans that will reduce the stock exposure as the student gets closer to date when they need to start harvesting those assets to pay for schooling. Chief Investment Officer James Gauthier also offered …

Our most popular model is actually 80/20, but it is typically used by younger clients with smaller balances. When you factor in older clients (with larger balances) who tend to have more conservative portfolios, the dollar-weighted asset allocation goes closer to 60/40. Our Capital Preservation portfolios are also pretty popular, and they really skew the data towards fixed income.

I think what we see here is more risk-appropriate models base on life situation. But we see those younger clients taking on that Balanced Growth model. Here’s my review of Justwealth: The Robo Advisor That Knows When To Get Personal.

Keep in mind that for all of the Robo Advisors (and with any proper advisor risk profiling) it’s a client-by client assessment; if you indicate that you have a lower tolerance for risk and/or a shorter time horizon you will be directed towards a lower risk portfolio.

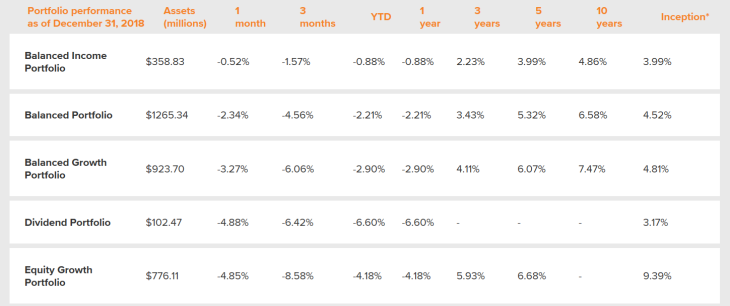

And if we check in with the ‘original’ Robo Tangerine Investments, we see that clients are in that Balanced Growth Sweet Spot. This is a more comprehensive and longer term look at Robo-advised asset allocation as Tangerine (formerly ING Direct) launched these portfolios in 2008 right before the recession. Originally they were called the Streetwise Funds. They are index-based mutual funds and of course are not represented in the ETF numbers. But they demonstrate how Canadians ‘get invested’ after completing online investor profiles. ‘Human’ advice is also available at Tangerine.

We can have a look at the assets by portfolio type. Collectively Tangerine Investment clients sit within that Balanced Growth model. This chart gives us a nice look at the breakdown of conservative investors vs down-the-middle and more aggressive investors. We see over half of the assets are in Balanced Growth or all-stock models.

That Dividend Portfolio is also all-stock.

Are ETF and index investors better prepared for the next correction?

I’d say yes. While indexing is the most superior form of investing it now more often comes attached to risk profiling. It also appears that the self-directed investor is more aware of risks. In the recent mini correction typical mutual fund investors were once again running for the hills. The ETF investors were adding monies as a group.

Better lower fee investments. Better investor behaviour.

Thanks for reading.

Spread the word (sharing is caring) kindly share this post on Twitter, LinkedIn and Facebook. You’ll find the follow Cut The Crap Investing button at the very bottom of this page.

Feel free to reach out with questions and ideas.

Dale cutthecrapinvesting@gmail.com

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Jan. 31, 2019 and is reproduced here with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Jan. 31, 2019 and is reproduced here with his permission.