Special to the Financial Independence Hub

Changes are coming. Small business owners and professionals can feel it like a frosty winter breeze that lets you know winter is here. It’s time to get your winter tires on and prepare for longer hours commuting and shorter daylight hours. It’s time to understand and strategize for some cold Liberal government small business tax changes that may have a significant impact on your retirement plan through the changes to the income splitting and passive investment tax rules that will take effect in 2019.

You’ve worked extremely hard growing your business, for you, your family, and your employees. You’ve taken risks and sunk a lot of money and sweat equity into your company, and in your opinion, there should be a nice reward for taking this entrepreneurial path. And you may be right; but with rising costs, interest rates and tax rule changes, it’s getting harder to remember why you got in the business in the first place.

Maybe you don’t know how the tax changes will affect you and your family. Strategies for your business that have been implemented and worked in the past, may no longer work for you. To help you avoid being left out in the cold, let’s take a quick look at one relatively underutilized strategy that still exists for small business owners and professionals: it’s called an Individual Pension Plan (IPP).

It’s all about a level playing field

You are an incorporated small business owner, top executive, doctor, lawyer, veterinarian, or dentist, over the age of 40, consistently making over $200,000 gross/year and have been paying yourself T4 salary for a few years now. You likely know about the recent passive investment tax rule changes that make it even less enticing to save money within your corporation for retirement and you wish there was somewhere else you could save. You may be taking a T4 salaried income from your corporation instead of dividends to reduce your corporation’s gross taxable income. In turn you will lean on making RRSP contributions to reduce your annual personal tax bill.

The strategy discussed below can put you on the same playing field as a person with a Defined Benefit pension. If you were an employee of a company or government agency and qualified for a Defined Benefit pension program, you would be in a relatively rare and advantageous position. The IPP has different rules, but it is playing the same game.

A supersized RRSP

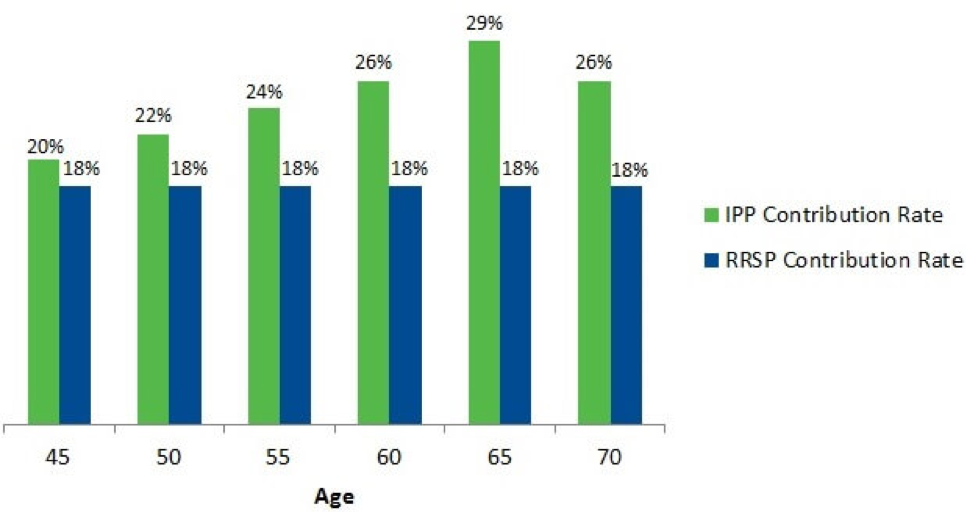

The IPP is often referred to as a “Supersized RRSP,” as in the IPP allows for you to contribute more annually than an RRSP. The extra contributions will allow you to save for their retirement like a Defined Benefit pension set up for one person. Establishing an IPP can provide you with greatly enhanced retirement benefits when compared to your regular RRSP contributions. The company is responsible for making the contributions and is a deductible expense.

What’s in it for you and your business

It is all about how much you can save, tax deferred, for your retirement and how much tax you can save in deductions for your company today.

What are the benefits?

- Higher contributions than RRSPs, the older you are the higher the contribution limit.

- Tax deductible contributions for the company.

- Contributions made by the company.

- If your portfolio doesn’t grow as expected, your company can contribute more to make up the difference.

- Contributions grow tax deferred until withdrawn.

- Costs of set up and administration are all tax deductible.

- Potentially more value for your estate than a typical unprotected Defined Benefit pension.

Some of the negatives include:

- Complicated calculation that requires help from an actuary.

- An initial minimum contribution from your current RRSP holdings.

- Requirement of T4 salaried income.

- Extra costs, administration, set up time and an actuarial valuation every 3 years.

- The end value is not guaranteed.

- You control the portfolio’s investment which means you bare the investment risks.

- Uses up your RRSP room, except for $600/year.

- Subject to pension legislation resulting in more restrictive withdrawals in retirement than RRSPs.

- Minimum contribution requirements for the company.

Let’s look at a quick example:

*From Westcoast Actuaries Inc. via image source: https://www.westcoast-actuaries.com/individual-pension-plans/

In summary

Your personal situation will dictate whether this strategy makes sense for you, your family and your business.

With all the uncertainty coming in 2019 and the impact of the Federal Government tax changes, this is a perfect time to reflect on your long-term savings plan, your business and your retirement goals to ensure you are properly prepared.

If you’d like to know more and understand how it can benefit your personal situation, please connect with RT Mosaic today where we provide discretionary portfolio management in conjunction with comprehensive financial Planning.

David Miller 403-457-3285 david.miller@rtmosaic.com

David Miller, BFS, CFP®, R.F.P., CIM®, is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. Along with an honors degree from Mount Royal University’s Bachelor of Financial Services Applied program in 2005, David is a Certified Financial Planner® Professional (2007), Chartered Investment Manager® (2014) and Registered Financial Planner (2017). David has been providing advice to high net worth and affluent individuals and families for over 10 years. He left a major bank in 2016 to help fulfill his drive to provide client centered advice. David prides himself on providing Canadians with the ability to make informed financial decisions with increased financial literacy and support.

David Miller, BFS, CFP®, R.F.P., CIM®, is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. Along with an honors degree from Mount Royal University’s Bachelor of Financial Services Applied program in 2005, David is a Certified Financial Planner® Professional (2007), Chartered Investment Manager® (2014) and Registered Financial Planner (2017). David has been providing advice to high net worth and affluent individuals and families for over 10 years. He left a major bank in 2016 to help fulfill his drive to provide client centered advice. David prides himself on providing Canadians with the ability to make informed financial decisions with increased financial literacy and support.

Disclaimer This post should not be construed or interpreted to be investment advice or direct financial planning advice.Any data, information and content on this blog is for information purposes only and should not be construed as an offer of advisory services. Related information is presented ‘as is’ and does not make any express or implied warranties, representations or endorsements whatsoever with regard to any products or service. It is solely your responsibility to evaluate the accuracy, completeness and usefulness of all opinions and information provided. This post does not warrant and makes no representations about the accuracy, reliability, completeness or timeliness of the content, be error-free or that defects in the information will be corrected. The law is constantly changing, and your situation should always be consulted with the proper professional. All links and images have been cited and are owned by those individuals under their individual sites.