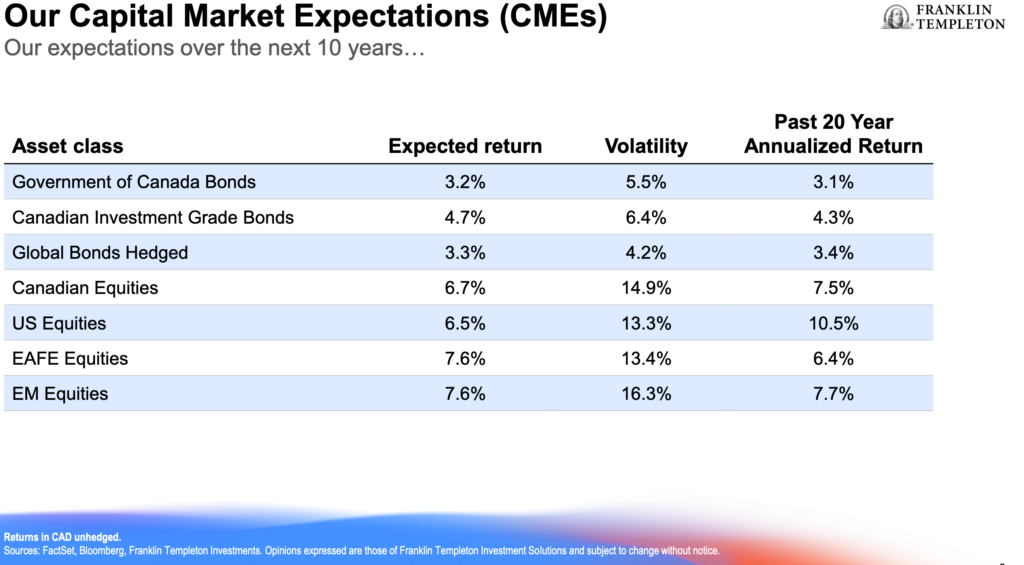

Stocks are expected to outperform bonds over the next 10 years but EAFE and Emerging Markets will probably do a little better than U.S. and Canadian equities, portfolio managers for Franklin Templeton Investment Solutions told advisors and the media in its 2025 Outlook session held Thursday in Toronto. The twice-annual economic outlook marks the 70th year that Franklin Templeton has operated in Canada: Sir John Templeton’s famous Templeton Growth Fund was launched in Canada in 1954. It has been in the U.S. more than 75 years.

Senior Vice President and Portfolio Manager Ian Riach [pictured left] said in a presentation distributed to attendees that “expected returns for fixed income have become slightly less attractive as yields have moved lower over the past year. EAFE and Emerging market equities [are] expected to outperform U.S and Canadian equities.” The most likely path to stable returns will be through “a diversified and dynamic approach,” he said.

Senior Vice President and Portfolio Manager Ian Riach [pictured left] said in a presentation distributed to attendees that “expected returns for fixed income have become slightly less attractive as yields have moved lower over the past year. EAFE and Emerging market equities [are] expected to outperform U.S and Canadian equities.” The most likely path to stable returns will be through “a diversified and dynamic approach,” he said.

Shorter-term Macro themes

Addressing major shorter-term themes, Riach said the United States continues to lead in Growth, while Canada is improving and the rest of the world is “challenged.” Inflation continues to trend down but some areas are faster than others. Fiscal policy “remains supportive” while “central banks remain data dependent.”

Addressing major shorter-term themes, Riach said the United States continues to lead in Growth, while Canada is improving and the rest of the world is “challenged.” Inflation continues to trend down but some areas are faster than others. Fiscal policy “remains supportive” while “central banks remain data dependent.”

Addressing Canadian economic growth, Riach said Canada’s inflation backdrop “continues to surprise to the downside” and is now at target levels as leading indicators continue to improve from weak levels. Thus far, Canadians holding mortgages have not yet been impacted by higher interest rates, based on the cumulative share of mortgages outstanding in February 2022 that have been subject to a payment increase.

Economic Growth in Europe and Asia.

European sentiment is improving but remains at weak levels while Asian manufacturing “has started to fall,” he said. Economic growth in China remains weak: “Consumer sentiment has yet to recover from deteriorating property sector and labor market imbalances.”

European sentiment is improving but remains at weak levels while Asian manufacturing “has started to fall,” he said. Economic growth in China remains weak: “Consumer sentiment has yet to recover from deteriorating property sector and labor market imbalances.”

Addressing Emerging Markets ex China, Riach said weakening leading manufacturing indicators will “challenge upside potential of cyclical regions broadly.”

In the United States, AI-related stocks (Artificial Intelligence) continue to power U.S. earnings growth expectations. However, Riach said, “this has been broadening to the ‘forgotten 493’ somewhat.” (i.e. away from the Mag 7.)

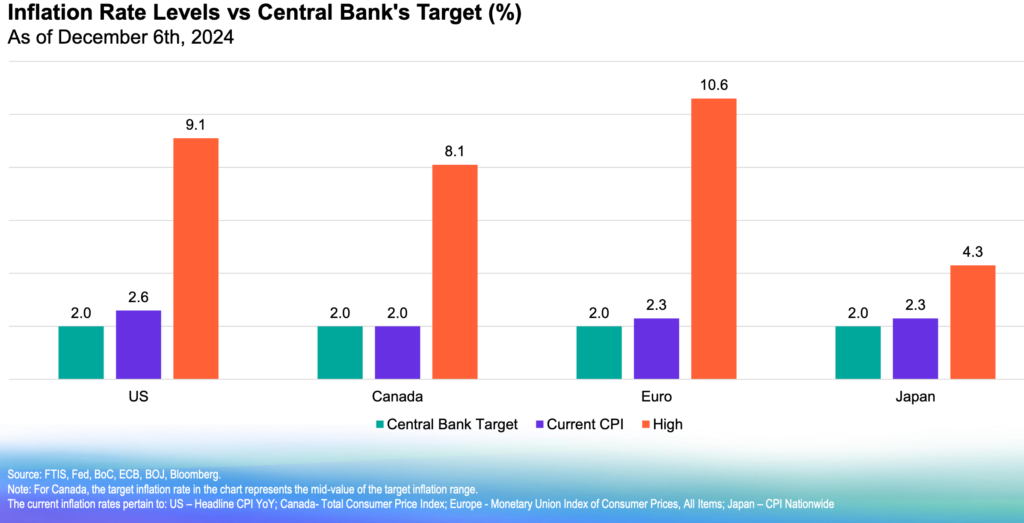

Inflation much improved

Worldwide, inflation is much improved and is now below Central Bank targets, Riach said.

Asset Allocation

Moving to recommended portfolio positioning, Franklin Templeton is overweight equities, underweight bonds and neutral on Cash. Within stocks, it is overweight Canadian and U.S. equities, Underweight EAFE (Europe Australasia and Far East) and Neutral on Emerging Markets.

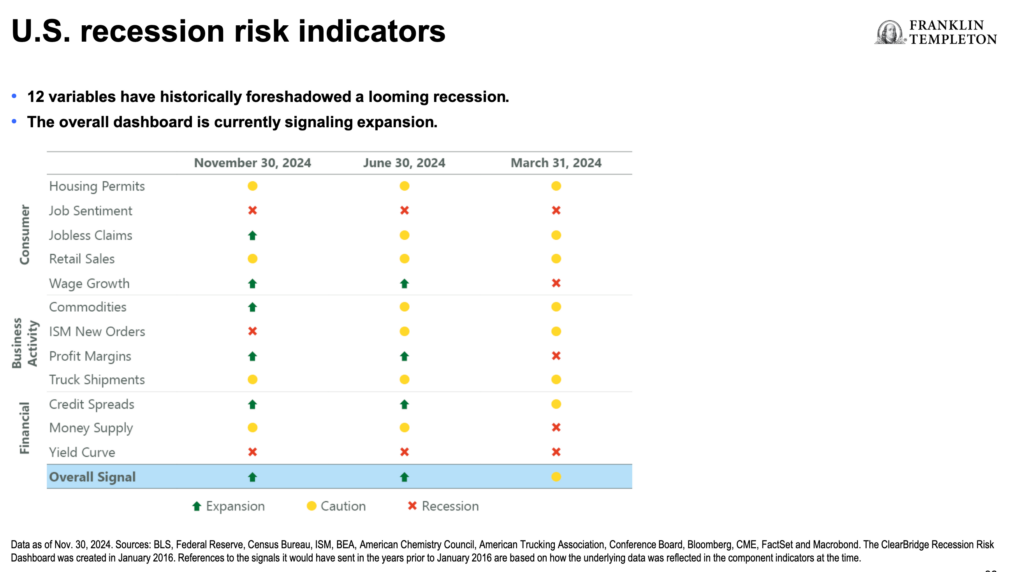

The second major presentation was delivered by Jeff Schulze, Head of Economic and Market Strategy for Franklin Templeton’s ClearBridge Investments. Schulze [pictured on right] is known for his “Anatomy of a Recession” analytical work, which assesses 12 variables that historically foreshadow recession.

The second major presentation was delivered by Jeff Schulze, Head of Economic and Market Strategy for Franklin Templeton’s ClearBridge Investments. Schulze [pictured on right] is known for his “Anatomy of a Recession” analytical work, which assesses 12 variables that historically foreshadow recession.

However, as the chart below shows, the recession dashboard is currently signalling expansion rather than recession:

Addressing employment, Schulze said that while the pace of job creation has slowed substantially over the past few years, “it has settled in line with the pace experienced during the previous economic expansion.” As a result, U.S. consumer spending is robust.

“The top 20% of earners make up a disproportionate share of consumer spending, accounting for just as much as the three lowest quintiles combined (bottom 60%). While lower income consumers are facing headwinds,” his presentation says, “The top 20% of earners make up a disproportionate share of consumer spending, accounting for just as much as the three lowest quintiles combined (bottom 60%). While lower income consumers are facing headwinds, strength from other cohorts could offset this potential income.”

The consumer deleveraging (paying down debt) that began after the Great Financial Crisis is now “done”, Schulze said. “With household net worth up by $46.6T since 2020, the U.S. consumer is in position to sustain their spending even as the economy normalizes.” American consumers have become less interest-rate sensitive since the financial crisis: “While the current 30-year fixed rate mortgage is nearly 7%, the average rate Americans are paying is just 3.9%.”

On the corporate side, “Profits don’t look recessionary,” Schulze said, “With profits on the rise, the recent trajectory bears little resemblance to these past periods suggesting less of a need to cut costs and lay off workers.”

Productivity is back

Another plus, aided by technology and A.I. in particular, is that corporate productivity is on the rise: “Productivity dropped well below the historical average in the aftermath of the GFC but has rebounded more recently and is now back in-line with the long-term average. While the benefits from AI have not yet arrived, this technology could unleash a sustained productivity wave similar to the internet revolution.”

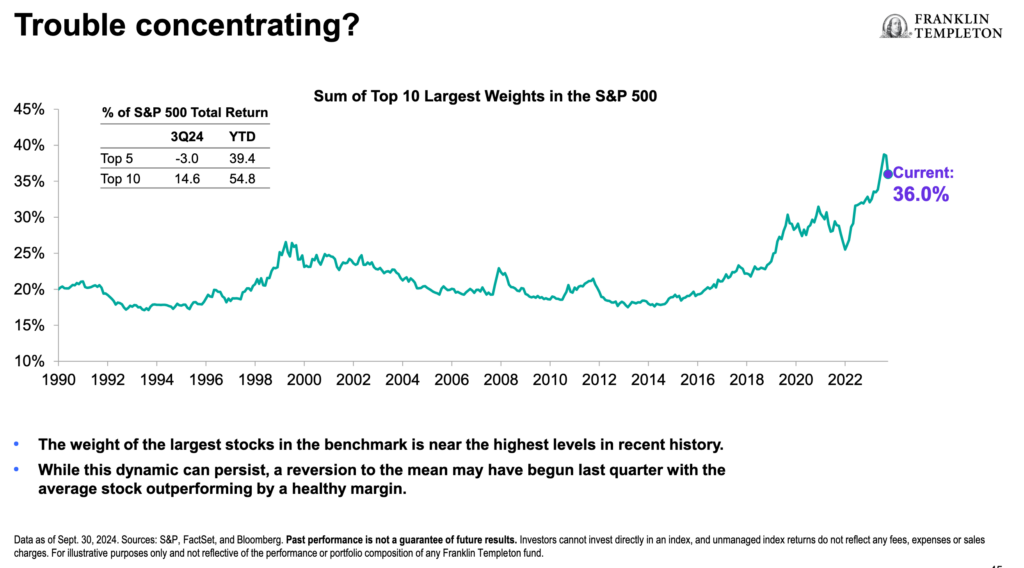

Mag 7 Concentration still a concern

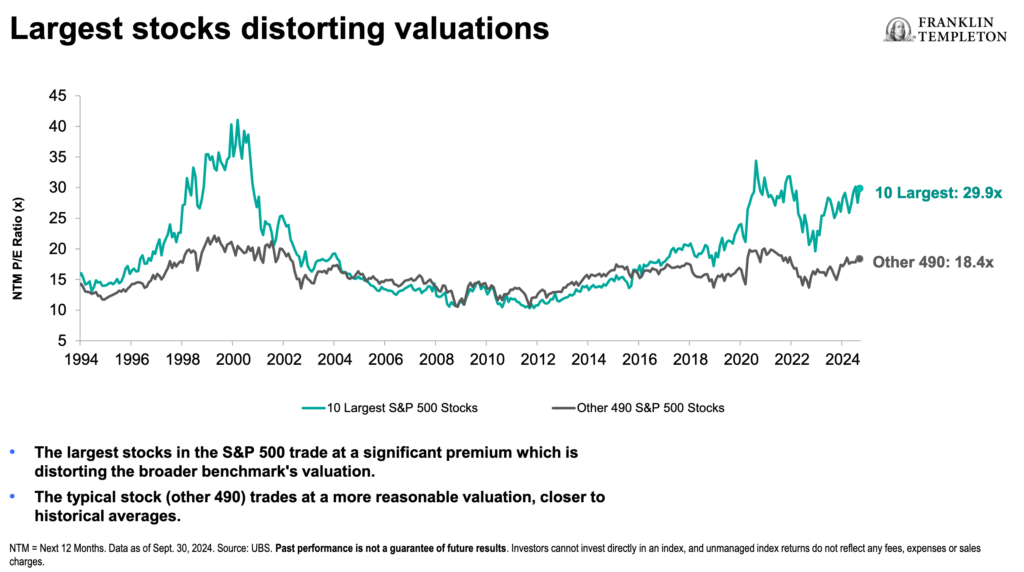

Still, Schulze is troubled by the rising levels of concentration in the largest stocks in the S&P500, including the so-called Magnificent Seven.

The Mag 7 Advantage is dissipating, Schulze said: “A key driver of the Mag 7 outperformance has been superior earnings growth. Bottom-up consensus expects this advantage to narrow in the coming year, which could help drive broader equity market leaders.”

As a result, the rotation has begun as of July 2024: More of the S&P493, more small-caps, more equal-weighted indexes vs market cap indexes and Growth to Value. While Value has been “down,” it is not out, he added: “Value has historically recovered following periods of sizeable (-25%) underperformance vs. Growth. This threshold was triggered during 3Q24.”

Don’t be afraid of all-time highs

Finally, Schulze counselled investors not to be afraid of repeated all-time highs in the market. Interest rate cuts near all-time highs are generally a good omen, he said: “Surprisingly, putting money to work at All-Time Highs has historically outperformed deploying capital when the benchmark is below peak, on average.”

In the 12 months following an All-Time High, stocks have historically been up 8.3% on average with positive returns 70% of the time, he said, suggesting we have been in a secular bull market since 2010, one which may well last for the balance of this decade.