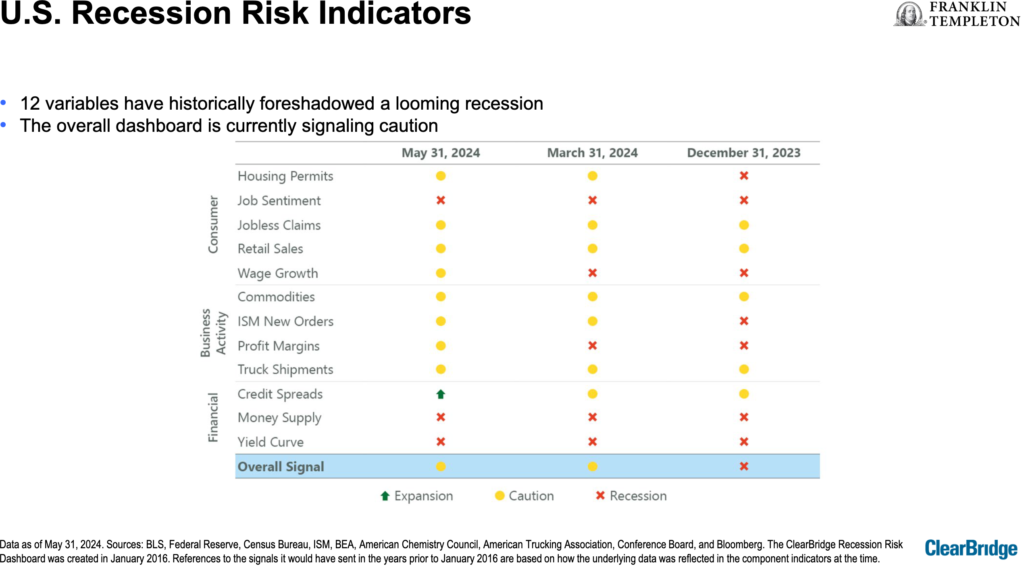

The 12 variables used to forecast Recessions are currently “signalling caution,” says Jeffrey Schulze, CFA.

Speaking Wednesday in Toronto at Franklin Templeton’s mid-year outlook, Schulze — Managing Director, Head of Economic and Market Strategy for Clearbridge Investments — told financial advisors and media that as of May 2024, the 12 variables he tracks have “historically foreshadowed a looming recession … the overall dashboard [shown below] is currently signalling caution.”

Three indicators — Job Sentiment, Money Supply and Yield Curve — have been flashing red since the end of 2023 and continue to be, as you can see in the above chart taken from a presentation made available to attendees. The only green light is Credit Spreads, while the other eight — which include Housing Permits, Jobless Claims and Profit Margins — are all a cautionary yellow.

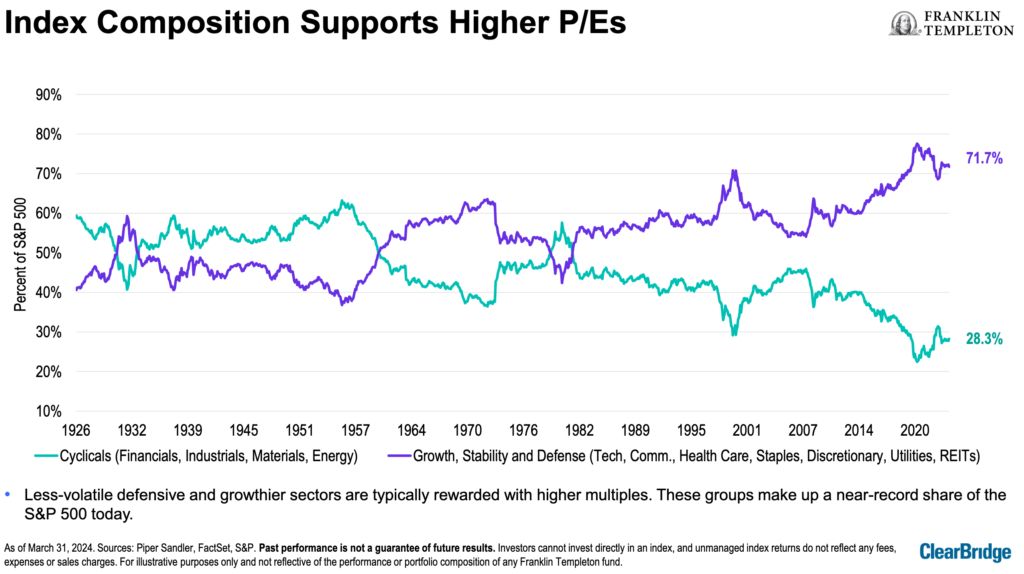

However, stock valuations do not appear to be too stretched at present. The composition of major stock indexes, such as the S&P500, support higher P/E ratios, Schulze said. “Less-volatile defensive and growthier sectors are typically rewarded with higher multiples. These groups make up a near-record share of the S&P 500 today.” As you can see in the chart below and in the higher purple line of the graph, these Defensive stocks include Tech, Consumer Staples, Utilities, and Health Care.

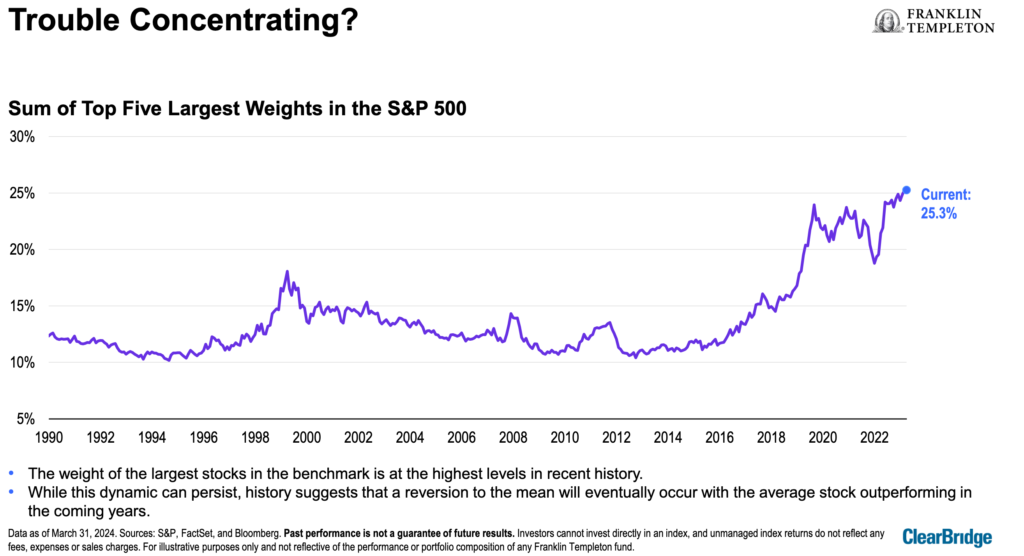

However, Schulze did note a “troubling” record-high concentration of the largest S&P500 names by market weight. As you can see in the chart below, the five largest-cap components now account for more than a quarter (25.3%) of the index, which is “the highest levels in recent history … While this dynamic can persist, history suggests that a reversion to the mean will eventually occur with the average stock outperforming in the coming years.”

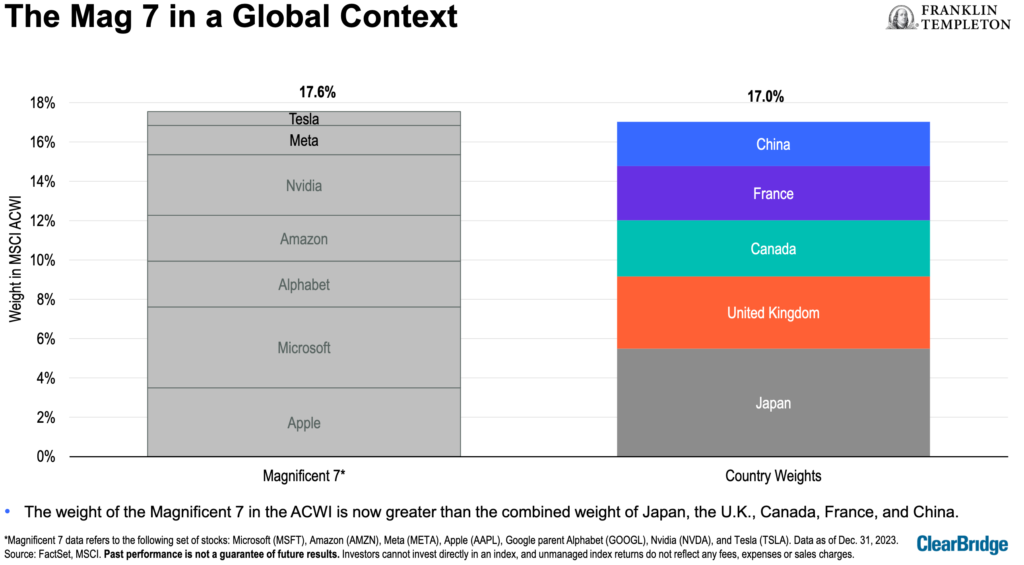

In fact, the combined weight of the so-called Magnificent 7 tech stocks now exceeds the combined market weight of the stock markets of Japan, the U.K., Canada, France, and China!

However, “after behaving fairly monolithically in 2023, the performance of the Mag 7 members have diverged substantially so far in 2024,” Schulze said. A slide of the “Divergent 7” showed Tesla down 28.3% and Apple flat, while the others were higher, led by the 121.4% surge in the price of Nvidia this year.

A key driver of the Mag 7 outperformance has been superior earnings growth, Schulze said, but “this advantage is expected to dissipate in the coming year, which could be the catalyst for a sustained leadership rotation.”

Companies that grow their dividends are overdue to start outperforming. “Over the past year, dividend growers have trailed the broader market to a degree rarely seen over the past three decades … Past instances of similar underperformance have been followed with a strong bounce-back for dividend growers.”

A positive for markets is the “copious” amount of cash sitting on the sidelines and being readied to deploy on buying stocks. After the October 2022 lows, investors flocked into money market funds with a net increase of US$1.5 trillion, or 32%, Schulze said: “Should the Fed embark upon its widely anticipated cutting cycle later this year, investors may reallocate. This represents a potential source of upside for equities.”

Cash and large-cap growth stocks have historically performed best following the beginning of a new rate cutting cycle. “Rate cuts that preceded soft landings have historically given way to substantial equity outperformance compared with cash.”

New Secular Bull? Don’t be afraid of all-time highs

While some investors may fear deploying cash as stocks keep hitting new all-time highs, Schulze said they shouldn’t be afraid of new highs: “Surprisingly, putting money to work at all-time highs has historically outperformed deploying capital when the benchmark is below peak, on average.”

Speaker sees Biden having edge over Trump in U.S. election

In the final presentation of the day, a presidential campaign advisor to Hillary Clinton and Joe Biden described geopolitical dynamics and implications for investors, and sees the odds slightly favouring Joe Biden in the November U.S. presidential election. Charles Myers, CEO of Signum Global Advisors, has been travelling the world in the last two months to express his views.

The two takeaways he got from his audiences is that the world is “absolutely watching this election more closely than previous ones” and that “if Trump wins, there will be some big changes: some positive, and some of concern.”

In his travels, he found that almost everywhere there is a high-conviction consensus that Trump will win in November. He on the other hand is on the other side, with a “base case for a Biden win and divided Government. The Republicans will take the Senate and the Democrats will take the house.”

He said the election will come down to five swing states, not seven: Wisconsin, Michigan, Pennsylvania, Georgia and Arizona, which Trump won in 2016 and Biden won in 2020. Trumps legal issues and recent new status as a convicted felon are not disqualifying. “People find this remarkable but there is nothing in the constitution that prevents it … in the late 1700s the founding fathers never could envision a candidate who was indicted, let alone convicted.”

However, Myers’ base case of Biden winning depends on him actually making it to November 5th. Based on his age and health there’s a 30% chance he won’t make it actuarially till the end of a second term. So the real issue is that Biden 2.0 could become Harris 1.0, referring to vice president Kamala Harris. And “she’d be fine by the way.”

If there is a Trump 2.0, “he will hire good people.” While he may try to remove current Fed chairman Jerome Powell, “he can’t fire him. He will stay on the board.”

Trump 2.0 domestic and international policy

Domestically, Trump 2.0 will be like Trump 1.0: deregulation of energy and financial services, pro-business. Canada would see one or two pipelines revived. Internationally he is running on 10% tariffs but that would be inflationary: he expects that instead the U.S. would target the EU and be more punitive. Trump would likely end the war in Ukraine sooner than Biden: “not in 24 hours but in two or three months.”

The Ukraine endgame is all but decided, Myers said: “At the end there will be a free and independent Ukraine and second, it will be [20%] smaller.” If Biden wins, the war would end late next year when Ukraine is exhausted.”