By Sa’ad Rana, Senior Associate – ETF Online Distribution, BMO ETFs

(Sponsor Blog)

Sector ETFs provide exposure to a specific industry or market sector and have grown in popularity amongst “Do It Yourself” investors who are looking to add strategic or tactical opportunities to their investment portfolios.

Why ETFs for Sector Exposures?

Sector ETFs have many benefits that ETFs provide in general: diversity, transparency, liquidity, and cost efficiency. Using a sector ETF, investors can tactically add exposure to an entire sector within a single trade. A sector ETF generally holds anywhere from 10 to over 100 different securities providing instant diversification, which minimizes single-stock risk and maximizes exposure to the entire sector. This diversification also helps to lower overall portfolio volatility.

Sector ETFs in Canada

Canada has over 1100 ETFs and 150 of these are categorized as sector ETFs. BMO ETFs has 20 different sector ETFs and was one of the first to list sector ETFs on the TSX in 2009.

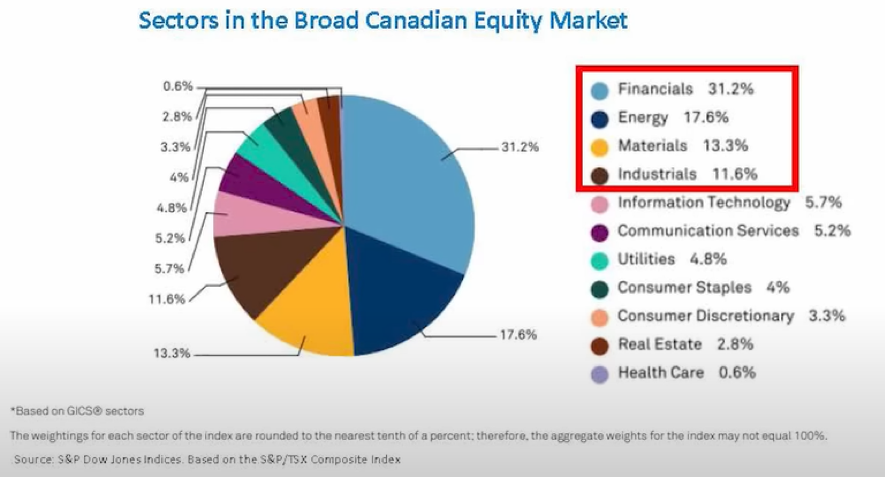

The Canadian market is very concentrated in several different sectors: Financials, Energy, Industrials and Materials. For investors using a broad-market Canadian ETF they may be underexposed to other areas of the market. For example, the Health Care and Info Tech sectors in Canada are extremely small relative to the global economy. Therefore, Canadian investors may consider U.S. and global sectors for a more diversified portfolio. This completion trade makes sector ETFs in Canada very popular.

Investors may also use sector ETFs because they like certain characteristics that some sectors exhibit. For example, Canadian investors who are more defensive may prefer areas that are more stable, paying income or dividends. So, sectors like Financials, Real Estate, and Utilities tend to resonate with them.

Equal Weight vs. Market Capitalization Weighted

There are typically two ways in which sector ETFs can be constructed: Market cap weighted and Equal weighted. Market cap weights all the stocks in the ETF’s portfolio based on the market size of the company, so a larger company will have a larger overall position in the portfolio. This weighting method provides more single-stock exposure to the companies with the largest market caps. A consideration here is that this method can be concentrated in certain securities which have outsized market caps vs their peers.

Equal Weighed weights all the companies equally in a portfolio. This approach is an effective strategy for reducing single-stock risk. It can help mitigate individual security concentration and provide better overall diversification to sector exposures. Because the largest companies are given the same weight as smaller companies, this method also tilts the portfolio slightly more to mid- and small-cap exposures.

Sectors & the Market Cycle

A popular way that sector ETFs are used by investors is to employ a sector rotation strategy based on the economic cycle. Fluctuations within an economic cycle consists of contraction (recession) and expansion (growth). Within a market cycle defensive sectors (Utilities, Consumer Staples) tend to perform well during recession and economic troughs and cyclical sectors (Financials, Industrials, and Information Tech) tend to do well when the economy is expanding. Therefore, using sector ETFs to rotate into relevant sectors helps some investors play the economic cycle.

Today’s Market Environment and its Impact on Sectors

Investors have been faced with a drastic market rotation out of growth stocks and into value over the past 12 months. We are also seeing inflation and interest rates rising quickly. This environment has impacted each sector differently:

- Tech Sector: Rising rates put pressure on growth sectors like tech stocks, which are priced based on future earnings. Higher rates discount these earnings more aggressively, which causes current valuations to drop.

- Energy: Energy was the top performing sector in 2021 and has been the top performing sector so far in 2022. Energy tends to be more insulated against interest rates and rising inflation and has benefitted from the increase in the price of oil this year.

- Banks: Banks benefit from a rising rate environment because they can make wider spreads on loans.

- Utilities: Utility stocks are more defensive and have higher dividend yields than other sectors.

For more information on this topic, please visit our YouTube channel – ETF Market Insights to watch our Spring into ETF Investing Episode on Sectors (episode 4): here.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.