By Bob Lai, Tawcan

Special to Financial Independence Hub

It’s never too early to start looking forward. I’ve been doing this on my site for some time and doing a bunch of assumptions and simulations on what our financial independence retire early might look like.

- Our financial independence assumptions

- Our financial independence assumptions – what about taxes?

- Revisit our financial independence assumptions

I also have interviewed many Canadians who are financially independent and/or retired early in my FIRE Canada Interviews.

Having some plans on your hands is better than no plans at all. Furthermore, having some quantitative targets available will allow you to set up different financial milestones and goals each year. Doing so will help you to stay focused and work your way to achieve them.

If you aspire to retire or semi-retire earlier than most people, how much do you need to retire early at age 40, 45, 50 or 55? Thanks to my friends at Cashflows & Portfolios, I have that answer today.

‘Traditional’ retirement vs. the ‘new’ retirement

For those not familiar with Cashflows & Portfolios, it’s a site started by two long time Canadian bloggers, Mark and Joe. Mark runs My Own Advisor, which I started reading before I started this blog. Joe was the brain behind Million Dollar Journey, which I have been following for over a decade.

All three of us believe we need to retire the term: retirement. To be more specific, we believe it’s time to change the ‘traditional’ definition of retirement. It is also important to make sure you know what you’re retiring to.

Back in the day, when you turned 60 or 65, and once you had grown tired of working by already clocking decades of company time – trading those years in the workplace for your workplace pension to supplement income for your senior years.

Well, workplace pensions are dwindling and more and more, pursuing retirement in any traditional sense seems rather unhealthy today. A traditional retirement can be unhealthy physically, emotionally and financially.

On an emotional level, retirement for some could lead to social isolation. Potentially, you’ve identified and linked your self-worth to your organization, your co-workers and your manager.

Retirement means you’re leaving your workplace but the organization will undoubtedly continue to work without you being there. Unfortunately, life just works that way; it doesn’t stop for anyone. So, I believe it’s important to maintain a modest level of stimulation at any age, including retirement.

Not remaining socially engaged with other people in retirement could lead to mental health struggles.

Finally, retirement is not cheap, financially. Unless you have a workplace pension (and let’s face it, many Canadians don’t, me included!), you’ll need to rely on your disciplined, multi-decade savings rate to maximize your retirement income stream at age 40, 45, 50 or 55 – by giving up your regular paycheque.

Sure, while there are other retirement income streams to enjoy eventually, like Canada Pension Plan (CPP) and Old Age Security (OAS), many readers of this blog probably don’t want to wait until ages 60 or 65 to tap those income streams respectively.

Let’s get one point straight, it’s a privilege to be able to retire early at age 40, 45, 50 or 55. Early retirement isn’t for everyone and those who can “retire” early typically enjoy some sort of privileges in their lives. Such privileges need to be highlighted more within the FIRE community.

The reality is that you do need to have a certain level of income to build up enough assets by your 40s so your portfolio can withstand some drawdowns in the subsequent decades. A relatively high savings rate combined with a certain level of income will help and is in my opinion crucial.

Should FIRE just RIP?

I’ve written about this many times, but it’s worth mentioning again in the context of these case studies today – to see how much you need to retire early at age 40, 45, 50 or 55.

To summarize the previous section… I think FIRE should just RIP (Rest In Peace).

What I mean is, unless you are like Jacob Fisker, at times just living off $7,000 per year (not a typo!) in an RV, in dorms, not many of us are going to retire early through extreme ways – nor do we want to!

Here is an actual quote from Jacob’s site:

“Keep in mind I’ve spent between $5-7k/year for more than a decade while living in several different situations: being single and married, living in three different countries, in dorms, apartments and house rentals, in an RV and as a homeowner. There are many different solutions at this spending level. For more examples, look through the forum journals.”

Jacob’s case is definitely on the extreme side and very few people would be able to pull that off for an extended period of time. To me, you probably won’t enjoy your life all that much when living on such an extreme budget.

Where I am going with this is, many FIRE (Financial Independence, Retire Early) stories tend to sensationalize early retirement. Many of these articles tend to focus on just the upside of early retirement in some misleading ways. It seems either very relaxed and/or quite luxurious for some – travelling around the world, leaving the 9-5 rat race, saying FU to the employers, and sipping piña coladas on the beach.

But this is not true!

Because no matter where you go, you will always bring yourself. What I mean is, if you’re not in a happy, well, and fulfilled place while pursuing FIRE, then you’re probably not going to find happiness once you reach it.

In other words, FIRE shouldn’t be seen as a finish line and crossing this finish line will magically make you happy. Life doesn’t work that way and it shouldn’t. We should see FIRE as a journey and we should evolve as individuals throughout this life long journey.

Furthermore, more to my point, many of these articles also fail to acknowledge that some of these early retirees are not really “retired” in the traditional sense. They still make money in retirement, just different in the traditional sense of a 9-5 job.

Many of these early retirees are still earning money through their side-hustles or even part-time jobs. The difference is that they choose to work because they enjoy it, not because they have to. Often, some of these money-earning potentials come from hobbies that they enjoy doing and eventually lead to some small amount of income (i.e. Mr. Money Mustache makes money via carpentry because he enjoys doing that).

You also need to carefully differentiate between those who retired early because they have enough in their portfolio and those who are “retired early” but are trying to sell you courses and eBooks to “help” you achieve financial retirement.

Are they actually retired? Or are they using you to help them achieve/sustain early retirement?

I’ve tinkered with the concept of a mini-retirement and if not that, definitely some form of semi-retirement as I work part-time. I believe it’s important to retire “to” something vs. run away from something.

You need a purpose in life, which doesn’t have an age-expiry date.

So, like my friends Mark and Joe at Cashflows & Portfolios do, if you’re considering any form of retirement or semi-retirement in a few years, then start practicing and thinking early and often about how you might spend your time, over time.

It’s a great start to have a financial roadmap that’s designed around your needs, your goals and your objectives with your family. But let’s not forget that your financial future is also a lot more about what you do with your time. You need to consider the need to be physically, mentally and socially engaged as well.

How much do you need to retire early at age 40, 45, 50 or 55?

In thinking about my readership and the questions I often get on this site, I asked Mark and Joe to consider a series of mini-case studies below related to retirement savings by age – to retire early at age 40, 45, 50 or 55.

In this series, I share a couple’s plan to retire earlier without pursuing homeownership and by staying out of debt.

Before we get to that analysis, a reminder for all of us that retirement projections and some form of planning is a never-ending process. Retirement planning has a start, but it doesn’t really have an end… like I said before, having a plan is better than having no plans at all.

To have a comfortable, secure-and-fun-retirement or semi-retirement, you need to define what that means for you and revisit any assumptions routinely. A good retirement plan with your family, partner, or just for you alone, while it starts with goals and dreams, it also looks at revisiting these things usually every year as you get older to see if any of those things have changed.

The new retirement

The traditional/old norms of retirement meant working to age 60 or 65 (again, for many there was no choice) and then maybe, hopefully, you had another ‘good’ 10-20 years to live.

I think the “new” retirement should be and really is, completely different. People are retiring or semi-retiring earlier and living longer, so it’s possible some form of semi-retirement for many people could be 30, 40 or more years!

To figure out how much you might need to retire early at age 40, 45, 50 or 55, Mark and Joe worked with me to finalize some assumptions and inputs for each age.

While I will leave it to you to figure out how you want to spend a bit more of your time, what keeps you motivated, highlighting your favourite hobbies and activities for retirement or semi-retirement, we figured it would be great to demonstrate what it would take to retire early.

Let’s look at those case studies now!

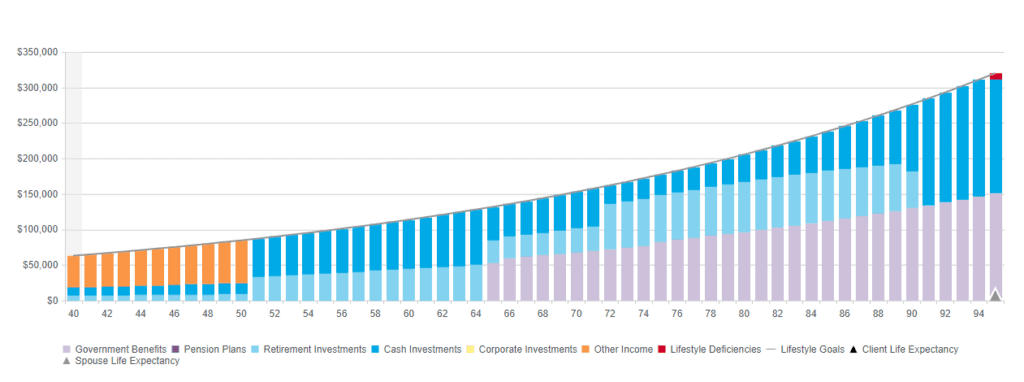

How much do you need to retire early at age 40?

For our first data point, we’ll look at how much you need to retire early at age 40.

Here are our assumptions for our couple:

- Assume they have maxed out both TFSAs = $125k each / $250k total.

- Assume they have no company pensions.

- Assume they have maxed out both RRSPs, now worth $300k each / $600k total. Mind you, this assumes a very high savings rate sustained over time. Remember, FIRE is not for lower-income individuals unless you are ruthless with your spending. This assumes a couple is saving over $1,500 per month, for 15 years, and 7% returns. We used RBC’s RRSP calculator.

- $300k joint non-reg account.

Total portfolio Value: $1.15M

- They will get 30% max CPP at age 65, since they have not been working full-time that long at the maximum contribution rate.

- They will get 100% max OAS at age 65, since they will have lived in Canada most of their lives at this point.

- They will work part-time at hobbies or side-hustles, earning $2k per month each from ages 40-50 /$4k total per month, not indexed to inflation. Remember, this couple is a good example of a partnership that wants to retire “to” something.

- They keep a small emergency fund of $10k which is NOT part of their drawdown plan. They also anticipate spending $5k per month, on average, increasing with inflation at age 40.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

The cashflow results for this couple who wants to retire early by age 40, given some meaningful part-time work is essential to sustain their spending needs at a younger “retirement” age:

Max Spend: $63k/year or $5,250/month (in today’s dollars and until age 95)

The punchline: with a $1.15M portfolio, a couple can absolutely retire at age 40 but they still have to work and hustle a bit for a few years to avoid running out of money 55 years later.

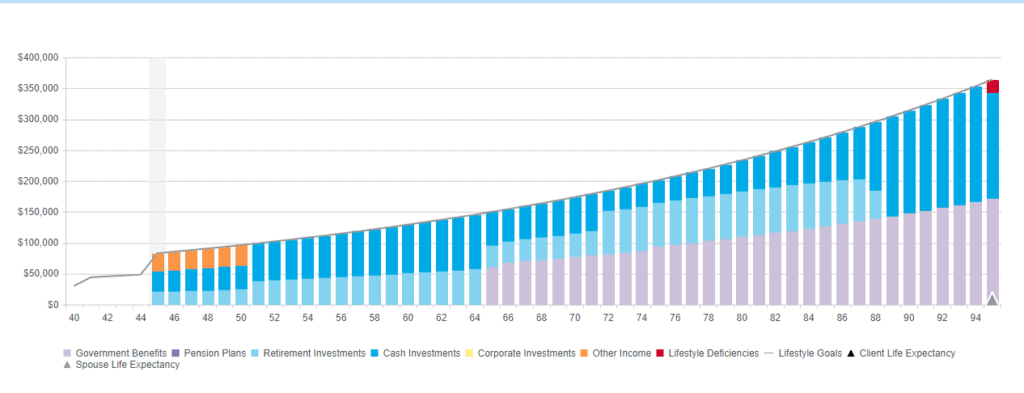

How much do you need to retire early at age 45?

For our second data point, we will look at how much you need to retire early at age 45.

For this new scenario, Cashflows & Portfolios used the age 40 inputs in the previous scenario as the baseline. The same baseline is used for the 50 & 55 scenarios later on as well.

Here are our updated assumptions for this couple:

- To retire at age 45, this couple is saving a bundle (and they need to) since they desire a higher spend of $6k per month given they don’t want to hustle too much more, although they still do it a bit to meet their needs.

- They max out TFSA annually increasing with inflation.

- After TFSAs are maxed, they save $10k/year each (i.e., x2) inside the RRSPs – another reminder to readers that higher income can offer higher savings potential, early retirement and FIRE is rarely about being ruthless with cutting all costs!

- They also save $10k/year in a joint non-reg account.

- TFSA balance @ 45: $215k each.

- RRSP balance @ 45: $465k each.

- Non-reg balance @ 45: $440k total.

Total portfolio value: $1.8M

- They will get 40% max CPP at age 65.

- They will get 100% max OAS at age 65.

- They will work part-time at hobbies, $1k per month each from ages 45-50 (5 years), $2k total per month, not indexed to inflation.

- They keep a small emergency fund of $10k which is NOT part of their drawdown plan.

- A reminder they anticipate spending $6k per month, on average, increasing with inflation.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

The cashflow results for this couple who wants to retire early by age 45:

The punchline: any couple approaching an impressive $1.8M portfolio, at such an early age, can absolutely “retire” assuming they have moderate spending needs and they can continue to have some part-time / hobby income beyond their portfolio value (just in case).

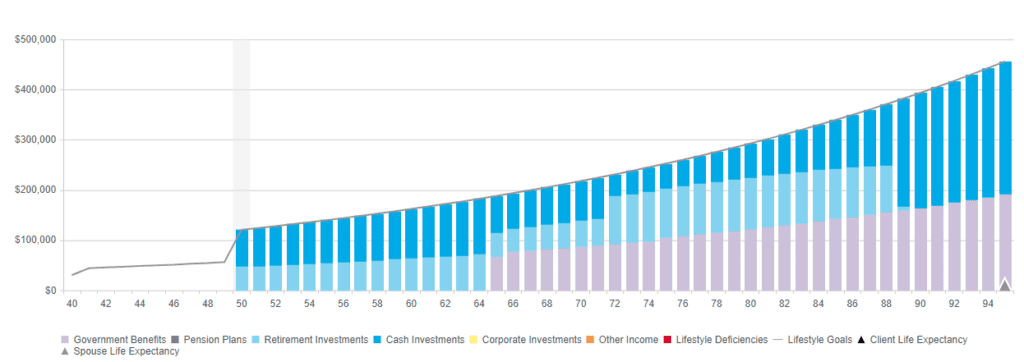

How much do you need to retire early at age 50?

In our third data point, we’ll look at how much you need to retire early at age 50.

Here are their account values and some other assumptions to retire at age 50:

- TFSA balance @ 50: $332k each.

- RRSP balance @ 50: $685k each.

- Non-reg balance @ 50: $620k.

Total portfolio value: $2.654M

- They will get 50% max CPP at age 65.

- They will get 100% max OAS at age 65.

- They keep a small emergency fund of $10k which is NOT part of their drawdown plan.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

- No part-time work.

Max spend = $89.7k/year or $7,475/month (in today’s dollars and until age 95)

The punchline: any couple that can sustain a high savings rate, and possess invested assets in their portfolio worth north of $2M around age 50 should have no retirement income concerns whatsoever I believe. Being debt-free is essential to help save more and then spend more in retirement.

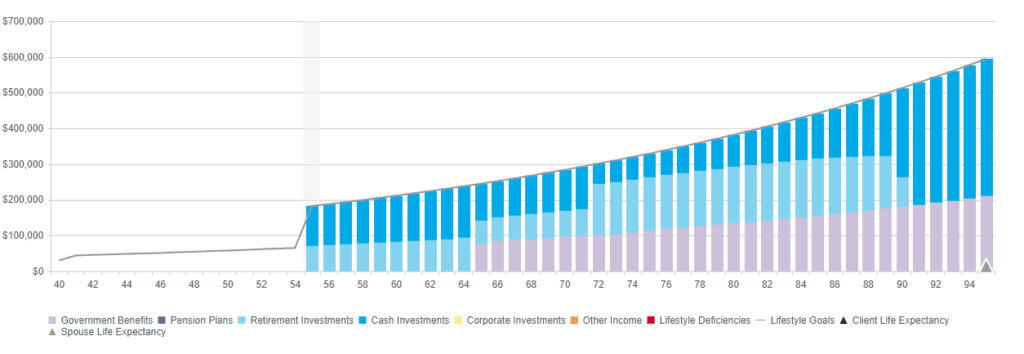

How much do you need to retire early at age 55?

In our fourth and final data point, we’ll look at how much you need to retire early at age 55.

Here are their account values and some other assumptions to retire at age 55:

- TFSA balance @ 55: $500k each.

- RRSP balance @ 55: $1M each.

- Non-reg balance @ 55: $877k.

- They will get 60% max CPP at age 65.

- They will get 100% max OAS at age 65.

- They will have no part-time hobbies; they desire full-retirement for travel at this age.

- They keep a small emergency fund of $10k which is NOT part of their drawdown plan.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

- No part-time work.

The cashflow results for this couple who wants to retire early by age 55, are now very sizeable thanks to years with a high savings rate and invested assets worth well over $3M combined:

The punchline: any couple with a prolonged high savings rate, through maxing out their TFSAs and contributing high sums of money to their RRSPs, really have no retirement worries whatsoever and will likely have a tax-problem to navigate in retirement. That’s a great problem to have overall!

Summary – How much do you need to retire early at age 40, 45, 50 or 55?

I hope readers have found all four scenarios useful. In particular, the portfolio value in the respective scenario should give readers some ideas on how much you need to achieve early retirement at the different ages, including some reliance on government benefits.

Of course, if your annual spending amount is lower, then you can most likely achieve early retirement with a much smaller portfolio value.

For us, we are aiming to live off dividends sometime in 2025 (both of us are in our early 40s). We estimate that our dividend income will need to generate about $60k for us to achieve that. At a 4% dividend yield, that means our portfolio will be $1.5M by 2025. This roughly aligns with the numbers from the retire at age 45 scenario above.

Since we don’t plan to stop working completely, most likely we will continue working part time and generate income somehow. We estimate that we’d bring in about $20,000 in part time/side hustle income a year. Without considering tax implications, this equals to $80,000 in annual income for us.

Tax efficiency will be very important when we are not working full time anymore. But most of our dividend income is generated inside of our TFSAs and registered accounts, which should be quite tax efficient. For dividend income from RRSPs, we will need to develop tax efficient early RRSP withdrawal strategies.

With income splitting planned (for our dividend income), we should hopefully be in the lowest tax bracket when we are not working full time anymore.

Of course, this is just the plan right now. Plans can change and we will have to re-evaluate regularly and adjust our plan accordingly.

To summarize, there are a few important themes in this post:

- You need modest assets to retire/semi-retire at age 40 and 45 to begin with. Unless you are ruthless with cutting costs and sustaining frugal ways for decades, you’re going to require a high savings rate and need to divert lots of cash from high-paying jobs to FIRE. So, although I believe in the principles of FIRE, don’t let all the FIRE marketing fool you! I would anticipate most couples in their 40s who FIRE, still work, they just have side-hustles.

- You can retire and have a very comfortable retirement starting in your 50s if you max out contributions to your TFSA(s), annually, and you make sizable, annual RRSP contributions for decades on end. The math just works out for you assuming you invest wisely and earn at least 6% annualized over time. Therefore, it’s important to try to max out TFSA and RRSP each year to take advantage of these retirement saving vehicles that the Canadian government created. Focusing on these accounts, even without non-registered investing, will deliver financial wonders.

- Although some investors are very suspicious about Canada Pension Plan (CPP) longevity, don’t be. CPP is sustainable for at least 75 more years. As such, if you are in your 40s and 50s and planning for semi-retirement or retirement like I am, make sure you consider how much and when to take your CPP benefit since it has a huge impact on your retirement spending plan, longevity risk, and more.

- Similar to CPP, count on OAS income in your 60s if you have lived and worked in Canada for many decades. Although deciding when to take OAS may not be as important as CPP, due to the fact that delaying CPP vs.OAS offers a higher inflation-protected income boost, receiving some OAS income is an additional retirement income stream that must be accounted for including taxation considerations and when to drawdown your personal assets. And don’t put too much time worrying about OAS clawback. If you have to figure out how to reduce your income in retirement to avoid OAS clawback, that means you’ve done very well financially. You should congratulate yourself.

- These projections have some linear thinking involved, purposely, to simplify this post and mini-case studies. As such, they might suggest you need more money than you really do. Again, personal finance is personal. A good example of that is inflation sustained to 3% over time. All examples above do not account for passive retirement years or slower-go years in your 70s or 80s and beyond. As such you might not need nearly this much saved up if you anticipate your spending will decline more as you age, and it very well could. Most studies suggest they do. That decline in spending is highly variable and personal. This is a very important consideration when you do your own financial projections and estimates, and speaks to the point why you want to do projections every year or so to see if you can spend more over time to avoid a large estate value.

- Like Mark and Joe, I think you should be optimistic about your financial future but at the same time, be a bit pessimistic on the assumptions side. What we mean by this is to target modest rates of return for your portfolio (we used 6% annualized for a 100% equity portfolio over time) and be suspicious about inflation rates, so a bit higher is better (we used 3% sustained inflation). You could earn more than 6% returns over the coming decades and inflation could eventually settle down a bit and normalize but it is critical you make some reasonable assumptions about the future and revisit them periodically to keep testing them over time.

- You’ll notice we took a total return approach, not a “live off dividends” approach or otherwise. If you live off dividends, in perpetuity throughout retirement, you could be leaving lots of portfolio value and spending on the table. Even more so than what these charts show.

- These projections are to age 95, for both individuals. That’s fine for longevity risk but many Canadians won’t live that long, statistically. Something to consider, in that this couple could likely spend much more during retirement than the above. We don’t live life in a spreadsheet or PDF report.

- Lack of homeownership may or may not be in the cards for you. This couple decided to rent over their lifespan, so a decent portion of their retirement income will need to fund rent. If you decide to own a home, and retire at some point, then being debt-free is likely the way to go for early retirement anyhow. Otherwise, servicing debt long-term is making other people wealthy.

- On that note above, being debt-free is quite liberating. When you don’t have any mortgage debt, you can save quite a bit of money without that obligation. It is definitely beneficial to be mortgage free when you retire. If you can be mortgage free before retirement, kudos to you. This can be an important key to your financial journey and boost savings rate and portfolio value over time.

I want to thank Mark and Joe from Cashflows & Portfolios for their work with me and I encourage you to check out their low-cost services on their site here:

In addition to the retirement projections service, Mark and Joe are writing about and providing more free content on their site about asset preservation and portfolio decumulation, since these subjects are not discussed nearly enough, even for the FIRE community.

I really believe that Mark and Joe provide a lot of benefits with their retirement projections. The retirement projections that they did for us a few years ago was quite an eye opening to Mrs. T and me. To be able to see all the charts visually and the different withdrawal strategies and their implication for the portfolio value was really awesome. Such visuals and financial projections might be hard to model when you’re only relying on spreadsheets.

Unfortunately, many people gravitate to safe withdrawal rates (like the 4% rule) and other generalizations when it comes to retirement planning, and because of that, they don’t take the necessary time to look at all the combinations of what is possible for any retirement drawdown plan. Mark and Joe are here to help to do just that.

If you ever want to see your personal drawdown strategy, or what your net worth, estate value or taxation might be in a key retirement scenario – subscribe to the Cashflows & Portfolios free newsletter and contact Mark and Joe about their services. They post regular content on their site and if you become a member they even have a forum to interact with other clients.

When it comes to my plan, I’ve been thinking more about semi-retirement since five or so years ago. I have come to the realization that full retirement just isn’t for me. I want to keep myself busy and engaged in different activities. It’s important to be able to choose and pick what I want to do in early retirement.

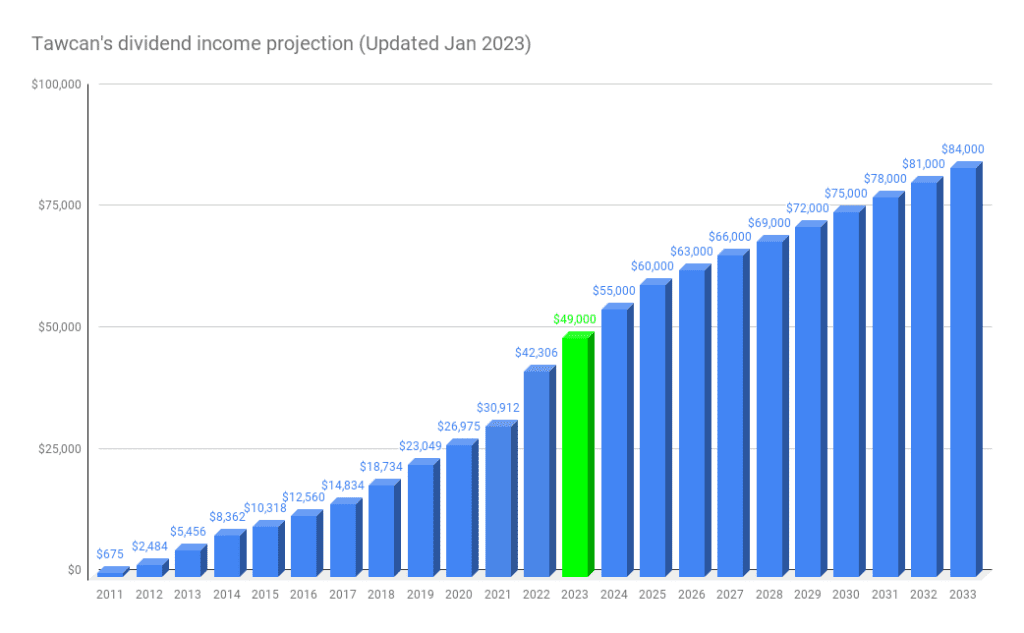

For now, we still aspire to reach financial independence in 2025. That’s two years from now, so we have done a lot of planning and simulations to make sure we’re on track. Per my latest dividend income projection, I think we can reach $60,000 in dividend income in 2025, but it will require a lot of savings in the next couple of years.

Now, if this fun factor ever disappears, then I may have to re-examine my full time work plan…

One minor thing I need to figure out is if I do move from working full time in high tech to working part time, what kind of part time job I would want to do. Luckily I have lots of time to figure that out.

Writing and thinking about FIRE regularly has made me realize one crucial thing – life is fluid and things can change. We need to remain flexible with our FIRE plans and different backup plans.

Mark and Joe are kind enough to offer all Tawcan.com readers a 10% discount on their Cashflow & Portfolios Retirement Projections services until May 31, 2023.

To get the discount, all you have to do is to mention Tawcan, or Tawcan.com in the “How Did You Hear About Us” part of the form.

After this date, their services will be back to the regular pricing which is still an amazing deal.

In the coming weeks, I have a new dividend income update to share with you so I can try to semi-retire myself and I have more great blog ideas to post as well.

Thanks for reading.

Dear readers, what is your path to semi-retirement or retirement? Do you intend to FIRE or not? What income do you intend to spend for your retirement?

Postscript from Mark Seed

Thanks for sharing the work with Bob, Jon!

I would like to stress by this comment here that Bob was seeking some early retirement information at these ages, assuming said couple in this case would continue working…padding an already very healthy portfolio value. The reality is, these numbers are not required for the majority of Canadians – only those who aspire to have trememdous retirement income (and tax issues) to manage.

Meaning, when Bob wanted the numbers, he was looking for the age-45 couple in particular to earn $1k per month each from ages 45-50 (5 years), $2k total per month, not indexed to inflation but still padding an already very impressive portfolio.

The facts are, any couple in their 40s, or even early 50s, that has saved anything over $1M portfolio already is doing very, very well. Likely a big understatement. Any couple that continues to work, save, etc. beyond that in their 50s (as this excercise should demonstrate) is likely to end up with massive set of taxation or estate issues to navigate.

Hardly any couple or individual needs a whopping $3M to retire early – that’s the lifestyle(s) of the rich and famous.

Just wanted to share some very important context!

Have a great long weekend…

Mark

This blog originally appeared on the Tawcan site on April 24, 2023 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.

This blog originally appeared on the Tawcan site on April 24, 2023 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.

Thanks for sharing the work with Bob, Jon!

I would like to stress by this comment here that Bob was seeking some early retirement information at these ages, assuming said couple in this case would continue working…padding an already very healthy portfolio value. The reality is, these numbers are not required for the majority of Canadians – only those who aspire to have trememdous retirement income (and tax issues) to manage.

Meaning, when Bob wanted the numbers, he was looking for the age-45 couple in particular to earn $1k per month each from ages 45-50 (5 years), $2k total per month, not indexed to inflation but still padding an already very impressive portfolio.

The facts are, any couple in their 40s, or even early 50s, that has saved anything over $1M portfolio already is doing very, very well. Likely a big understatement. Any couple that continues to work, save, etc. beyond that in their 50s (as this excercise should demonstrate) is likely to end up with massive set of taxation or estate issues to navigate.

Hardly any couple or individual needs a whopping $3M to retire early – that’s the lifestyle(s) of the rich and famous.

Just wanted to share some very important context!

Have a great long weekend…

Mark

Great article.

I tried to retire at 55 but I was too bored. I went back to the workforce. Now I work full time as a photographer and a salsa teacher, my retirement money continues growing. I taken any money out since I went back to the workforce.

Stopped working at age 45 with 1.5M…that was 8 years ago and net worth keeps increasing.

Think early retirement works well for people that have bunch of things they like to do with friends/family outside of work. Lots of people ask if I get bored, but there are so many ways to stay busy and social. Personally it’s ok to not always be busy and live a more sustainable healthy lifestyle.

Working longer after financial independence is good for people that enjoy their work more than what they do outside of work. Think many people need to keep working for their mental health due to maybe greed, ego or addiction to consumption…metal health is complicated.

Personally I choose to use a more conservative Total Returns 2% higher than Inflation for my projections.

Started my FIRE journey twenty years ago. This article was extremely informative and have returned a few times rereading sections. Well done.