While it’s well known that the longer you wait to start receiving CPP benefits, the higher the payout, a series of papers debuting today from the National Institute on Ageing (NIA) highlights the fact that:

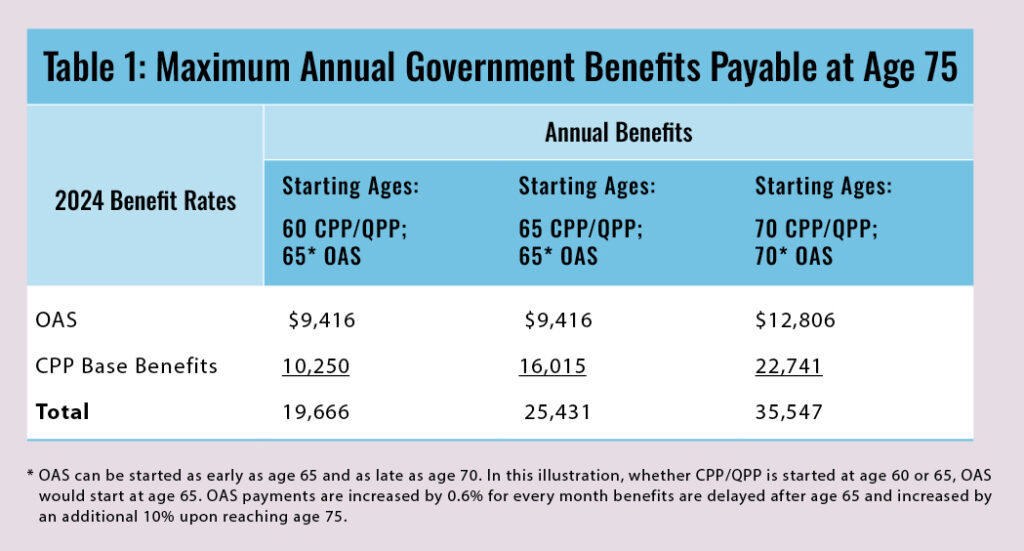

a) Many Canadians don’t realize that CPP benefits taken at age 70 are a whopping 2.2 times what they are if taken at the earliest possible age of 60. Indeed, a 2018 Government of Canada poll found an amazing two thirds of us didn’t understand that the longer you wait, the higher the CPP payout will be.

b) Despite this fact and despite being often mentioned in media personal finance articles, most Canadians nevertheless take CPP long before age 70.

You can see at a glance in the chart shown at the top the dramatic rise in free government money that can be obtained by waiting till 70.

The paper’s lead author is Bonnie-Jeanne MacDonald, PhD, FCIA, FSA, Director of Financial Security Research for the National Institute on Ageing at Toronto Metropolitan University.

Addressed chiefly to Canadian baby boomers, MacDonald and three contributors say upfront that deciding when to start taking CPP (or the Quebec Pension Plan) is “one of the most important retirement financial decisions they will make.”

Not only are benefits begun at age 70 2.2 times higher than they would be if taken at age 60, but “these higher payments last for life and are also indexed to inflation.”

So it’s a baffling that 90% choose to start CPP at the traditional mid-way point between these extremes: age 65.

Starting with the paper being released today, the NIA will publish seven papers in total aimed at educating consumers about these decisions.

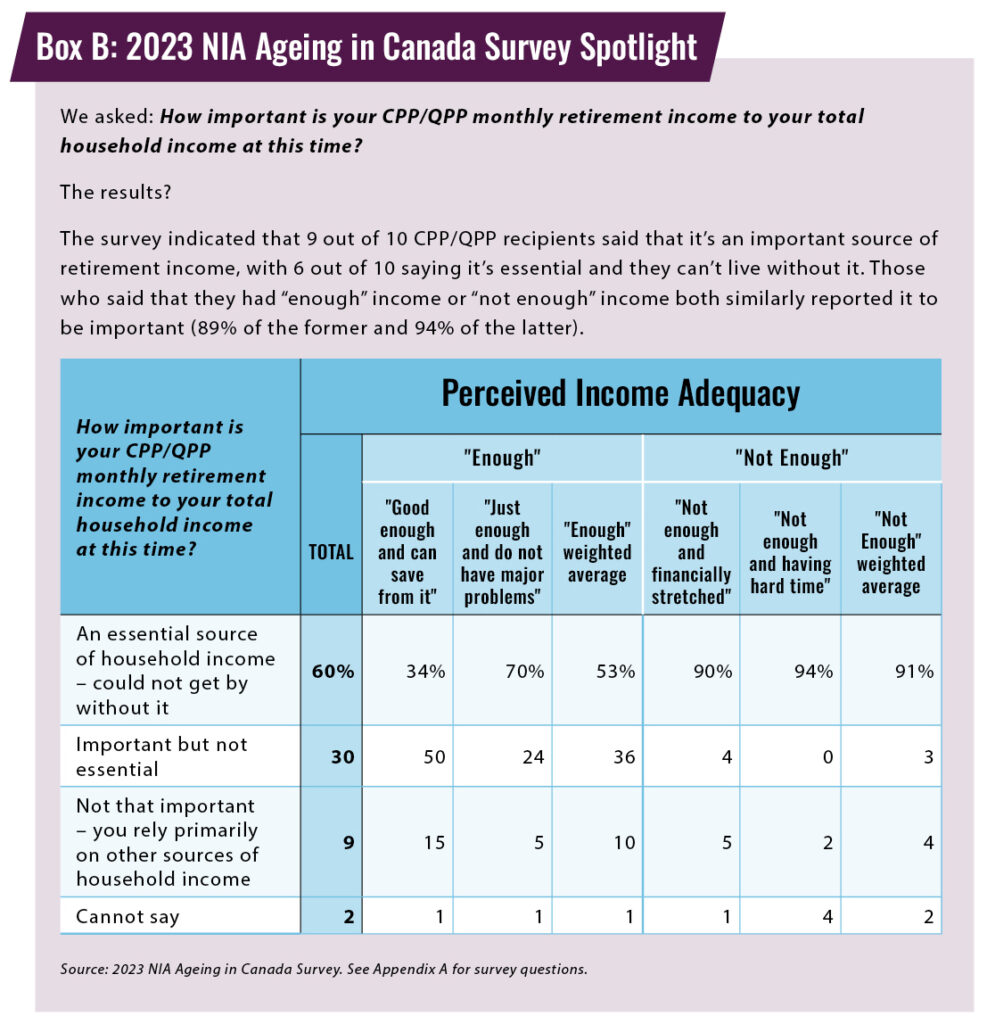

It’s not as if most Canadians don’t already realize how important CPP will be to their income. Indeed, with traditional Employer-Sponsored Defined Benefit pension plans becoming increasingly rare outside the public sector, for many the CPP, together with Old Age Security, will be the closest many retirees will come to having a guaranteed-for-life inflation-indexed pension. According to a 2023 NIA survey on Ageing in Canada, 9 out of 10 recipients say their CPP/QPP pension is an important source of their retirement income, with 6 out of 10 saying it’s essential and they can’t live without it.

The chart below illustrates this:

The initial paper being released today observes that similar dynamics are at work in the United States with its Social Security system. Academic literature there finds that “delaying claiming is almost always the optimal decision from an economic perspective.”

CPP offsets the 2 big bogeymen of Inflation and Running out of Money

A larger CPP income obtained by waiting till 70, or at least past 65, helps new retirees address two of their biggest fears, the NIA says: Inflation and running out of money before you run out of life. It finds that 37% fret about inflation and 22% worry about running out of money in old age.

The paper’s authors are sympathetic to the fact humans are “naturally short-sighted when it comes to retirement financial planning, impulsively reacting to short-term self-interest rather than carefully working toward the combined self-interest of their present and future selves.”

Even financial professionals sometimes fail to point this out

One finding I found surprising is that even financial professionals sometimes don’t emphasize the long-term benefits of deferring CPP sufficiently:

Financial services and retirement planning professionals may be swayed by the ease and simplicity of giving short-sighted guidance that brings in the retiree’s money sooner rather than attending to the potential consequences of a reduced pension that may manifest later in a retiree’s life.

The remaining papers in the series will present what the NIA describes as “a paradigm shift in thinking about the timing of claiming CPP/QPP benefits in particular and retirement financial planning more generally. They provide solutions to help change how Canadians are influenced by their own biases and provide insights for stakeholders who want to improve their retirement outcomes.”

Some of those papers will look at related topics, notably deferral of Old Age Security (OAS), purchase of annuities and election of lump-sum commuted value settlements from defined benefit (DB) pension plans.

All in all, a must read for those nearing Retirement or already in it still trying to decide when to take CPP and/or OAS.

It’s not all free government money.

We pay for CPP either with employer, or as self employed.

OAS come from government revenues and can be clawed back.

Both CPP and OAS are taxable at our marginal tax rates.

Right now all I recieve is $255.00 for CPP. IM 62 I WAS TOKD ID GET A PAID BCOF A SOWIG TO ME MONTHS AGO. GOT NOTHING. IVE WORKED FULLTIME FOR 45 YEARS ALSO RAN A ROOFING COMPANY WHEN MARRIED. THEY OWE ME MORE THEN THIS. THEY OWE ME PAY BACK .A ACCOUNTANT THEY WERE SAYING, YES YOUR GETTING RIPPED OFF. I SHOULD BE GETTING CLOSE TO $400 – $ 420 A MONTH. HOW DO I FIX THIS. IM BARELY SURVIVING. CARRIE CHALMERS. carriechalmers35@gmail.com

Are you also getting OAS, and perhaps the Guaranteed Income Supplement? Or in Ontario, GAINS?

(1.072^5)(1.084^5)- 2.1189481891. How’d she get 2.2?

“Should you wait to start collecting CPP

Your age affects your pension amount:

If you start before age 65, payments will decrease by 0.6% each month (or by 7.2% per year), up to a maximum reduction of 36% if you start at age 60

If you start after age 65, payments will increase by 0.7% each month (or by 8.4% per year), up to a maximum increase of 42% if you start at age 70 (or after).”

From the Canadian govt website.

Consider $1000 at age 60=> $1000 x 1.36= $1360 at age 65 and $1360 x 1.42= $1931,20. This is an increase of 1.931 times, not 2.2. What am I doing wrong here?

I get it. The 36% reduction is not the same as a 36% increase! One actually gets an extra 9.336 percent per year increase per year from 60 to 65. 1.5625 x 1.42=2.21875 which equals the 22741/10250