Special to the Financial Independence Hub

The mere thought of a stock market crash gets many investors riled up.

Maybe it shouldn’t, but don’t blame yourself or others. That’s simply our lizard or caveman brains hard at work. The reality is, we’re naturally wired to be bad investors.

This is because the same area of our brain (the amygdala) that responds to fight or flight for the last 100,000 years sees financial losses as the same way as a big, mean, nasty grizzly bear running after us. So, whether this big bear (a big financial bear at that) is real or just perceived as being real, our brains do not discriminate. Our hearts will race, our palms will get sweaty and we’re apt to click the keyboard and sell a stock or a bond or anything in between based on our fight or flight response.

Watching what goes up go down, way down

Watching your investment portfolio crash can and would likely be, devastating. So, with our amygdala fully engaged, we’ll have higher levels of cortisol running through our bodies to fight the stress.

Our risk appetite will sink and during higher periods of market calamity, that means we’ll probably act in the opposite ways we should:

We’ll sell low instead of buying low or holding the line.

Needless to say, I think market volatility and watching your portfolio go down can have detrimental affects on the portfolio you’ve worked so hard to build. If you’re an investor who might panic and react, when your investments drop in value, you might incur major long-term consequences.

Thanks to a reader question of late (adapted slightly below), I thought I’d highlight some things to consider (and what I think about and do) to prepare for a market meltdown.

Hi Mark,

With all the news of late, I’m really not sure how to prepare my portfolio for a market correction exactly.

Most of my stocks (I don’t have bonds or GICs or fixed-income-oriented ETFs) have unrealized gains.

My TFSA is full of Canadian bank stocks and Enbridge. My RRSP has some utilities.

Within my non-registered account, I have a mix of banks, insurance, utilities, CNR (Canadian National Railway), and telecom stocks, ALL with gains. I know if I sell anything in my non-registered account, I will pay tax on my capital gains. If I buy back some of the same stocks when the market dips during or after a correction, I will have a revised adjusted cost base (that I need to calculate).

I do have a cash wedge to use, to buy some stocks when the market corrects, but otherwise everything is tied up. So, what can I do to help prepare for any correction? What are you doing?

Great questions! Boy, lots to unpack there.

In no particular order, here are some key things I would consider (and what I’m doing) to prepare yourself for any market meltdown.

1.) Review your risk tolerance

Will you make a portfolio change, including selling stocks and buying more bonds, when the equity market drops 10%? 20%? 30%?

I think knowing this answer or these answers is key.

The best time to put any plan in place is before you need it. Financially or otherwise…

That means when it comes to investing, think about your risk tolerance today and identify what you might do in those situations above. If you think you’ll sell assets when the market is down 10% or maybe 20% (or more!), you probably have too many equities as a % in your portfolio. And that’s OK! It simply means you need a more balanced stock-to-bond mix and/or you might need a more global, well-diversified portfolio that you could ride out.

Consider some of these low-cost, highly diversified ETFs to build your portfolio with.

What I am doing?

I’ve reviewed my financial plan a few times over in recent years and I’m rather confident I will not sell any of my Canadian dividend-paying stocks or my U.S. ETFs (disclosure: I own U.S. dividend ETF VYM) when they are down 20% or even down 30% in price.

I have a plan to live off dividends – to some degree.

Doing so helps me stick to an investing approach I thoroughly believe in. Besides that belief, I would be absolutely shocked if some of these companies stopped paying all their dividends, in a prolonged market downturn, all at the same time.

Image courtesy of iShares. FYI: A boring buy and hold strategy with XIU would have earned you ~ 7% over the last decade. Basically, your money doubled in those last ten years.

2.) Embrace (and learn from) market history

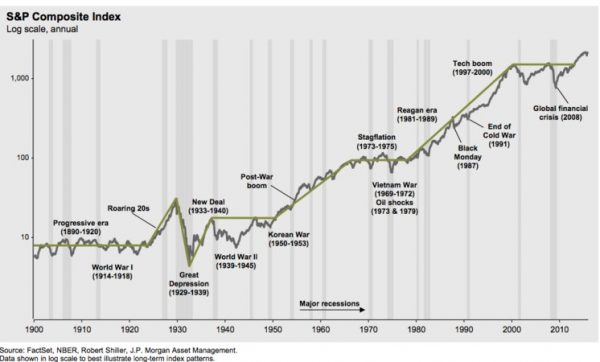

Rather than trying to time the market, beat the market, outsmart the market – the list goes on – I think it’s very helpful to remember that crashes have happened and consequently, they will happen again.

This was a great tweet I found recently – something to remind yourself about when it comes to market history:

Long-term, stocks should go up in price. They always have.

This means having a long-term, multi-year, well thought out investment strategy (including knowledge of market history and how it usually repeats) will help you with your investing reasoning and decision-making.

What I am doing?

Since starting My Own Advisor, I’ve absorbed a good dose of market history. I use it as one tool in my investing toolbox to avoid making snap financial decisions.

3.) Keep some cash – aligned to your investing approach and timeline needs

Based on my readings and experiences with #1 and #2 above, I’ve learned market corrections tend to have the biggest impact on those that need the money in the near future (more than others).

That only makes sense.

You certainly don’t want the equity portion of your portfolio to vapourize when you’re expecting to use that money sooner than later…

This means as investors move closer to retirement time, or at least when they need money for expenses, they should consider owning some more fixed-income assets and/or more cash inside their portfolio. You can do this by selling some of your profitable assets today, when the market is frothy OR keeping more cash across your portfolio, starting now.

In some cases, as the reader pointed out, selling assets might incur a capital gain. Unfortunately this is part of the trade-off that comes with successful taxable investing. Look at it the other way. A capital gain means your investments made money. That’s a good thing…

I wrote about taxable investing including tax efficient taxable investing here.

At the end of the day, only you can decide how much fear or anxiety the stock market might be causing you. If you’re worried about the future, if you have some profits on your table that could be opportunity to make some portfolio changes before you really have to.

Further still, keeping some cash on the sidelines now, for an unknown future, is generally smart planning. If you don’t sell any assets now, consider squirreling away a few extra dollars into a savings account via automatic contributions as another way to hedge the market bears. At least this way, you don’t have capital gains to incur and you have more cash on hand when $hit hits the fan!

What I am doing?

Over many years of running this blog, although I didn’t always have one, I’ve embraced the merits that come with owning a modest emergency fund. We try to never touch these funds unless we absolutely have to. It’s cash, sitting in a savings account, collecting interest – liquidity if and when we need it.

Sure, there are opportunity costs with keeping cash but it’s nice to know I don’t have to go into debt to use money in an emergency.

Longer term, as we march towards semi-retirement, I’m thinking we’ll keep much more cash on had as part of our modified cash wedge. I’m anticipating keeping one year worth of expenses in cash.

Thoughts on that? Retirees who do the same and keep a cash wedge on hand?

This is our upcoming cash wedge approach here – once we open the investment taps.

Summary

No one has a crystal ball when it comes to the stock market. Those that think they do, including any financial experts, are only kidding themselves. Hopefully you’re not fooled by any of them.

Our lizard brains often remind us that feeling any loss, including a financial one, typically brings twice as much pain as any joy we might get from an equivalent gain.

While our caveman instincts have helped us tremendously over the years; to gather food, fight bears in the wild, these same attributes work against when it comes to money management. Now you know!

Hopefully by following a combination of these three tips you can be better prepared for any market meltdown with me.

I want to hear from you. How do you prepare for any market meltdown? How did you survive the last great recession 10+ years ago? What did you do and what insights might you offer others including a younger generation of investors?

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Aug. 19, 2019 and is republished on the Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Aug. 19, 2019 and is republished on the Hub with his permission.