By Billy Kaderli, RetireEarlyLifestyle.com

By Billy Kaderli, RetireEarlyLifestyle.com

Special to the Findependence Hub

First things first, what is inflation? Inflation is when too much money is competing for a finite number of goods. This causes a general increase in prices and a fall in the purchasing value of money.

The US Real-Estate market is a prime example, and we have all witnessed the rising home values. Translate this to food and energy, and this is the effect we are feeling today.

Current inflation numbers

Recent inflation numbers came in at 8.5% year-over-year. The producer price index (PPI) came in higher at 11.2% which means it is costing more for the producers to manufacture products.

These increases get passed on to you and me, the consumers, and we are going to be feeling these increases now and on into the future.

How can you protect yourselves in retirement?

Perhaps you are living on a fixed income such as Social Security. [or in Canada: CPP and Old Age Security.] Your annual Social Security adjustment doesn’t keep up with grocery and fuel costs; thus, you are slipping backwards.

This is not a good position to be in.

One answer is to own equities.

Stocks are the best inflation hedge out there. These companies are in business to stay in business and they are not going to absorb the cost increases and go broke. Instead, they pass it on to the consumer – which raises their prices and increases the company’s revenue. If the company is managed well, this increase in revenue will drop to their bottom line showing higher earnings.

These increases in earnings also translate into higher stock prices and you, being an owner of the stock, participate in the growth. Many companies will also raise their dividends which also creates a win-win for you.

Which stocks to buy?

So, all is not lost, but how do you know which stocks to own?

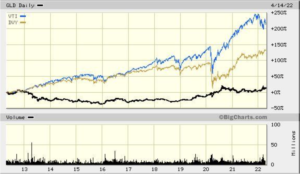

Our recommendation is to keep things simple and own VTI, Vanguard Total Market Index with a 1.34% yield, and DVY, IShares Select Dividend, yielding 2.90%. Both are ETFs (exchange traded funds) that increase in value over time, outpacing inflation. Full disclosure: We own them both.

Some people believe that gold is the better metal to keep up with inflation.

Below is a 10-year chart showing the returns of GLD, the largest gold ETF, and both VTI and DVY. As you can see there is no comparison. For the last ten years inflation has averaged roughly 2.53% per year before this recent rise. Where it is going to be in another ten years is anyone’s guess, but equities are your best assets to own to protect yourself and hedge against inflation.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available here or here. This post originally appeared on RetireEarlyLifestyle.com. Is is reposted with permission.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available here or here. This post originally appeared on RetireEarlyLifestyle.com. Is is reposted with permission.