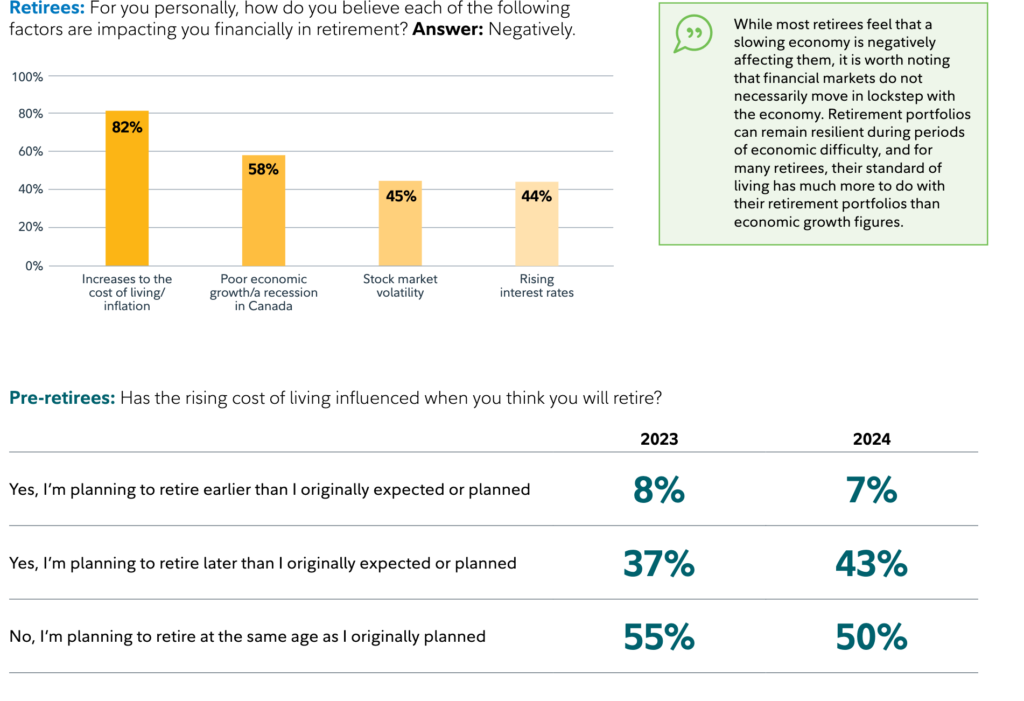

More than four in five (82%) Canadian retirees say inflation is having a negative financial impact on them in retirement, according to a just-released report from Fidelity Investments Canada ULC.

The 2024 Fidelity Retirement Report also found that 43% of pre-retirees say the rising cost of living is delaying when they think they will retire. In addition, 59% of retirees report helping their non-student adult children in retirement: both with day-to-day expenses as well as big-ticket items like home purchases, weddings and even education savings for their grandchildren.

“It comes as no surprise that retirees are feeling the bite of inflation. Other macroeconomic issues such as a slowing economy, rising rates and volatile markets are also common factors that have negatively affected retirees financially,” says the report, “Pre-retirees are also feeling the pinch. We find that compared with last year, a larger share of pre-retirees are considering delaying their retirement in response to the rising cost of living.”

As you can see from the graphic below, the percentage of pre-retirees who plan to retire later than originally expected rose from 37% in the 2023 survey to 47% in the new 2024 edition.

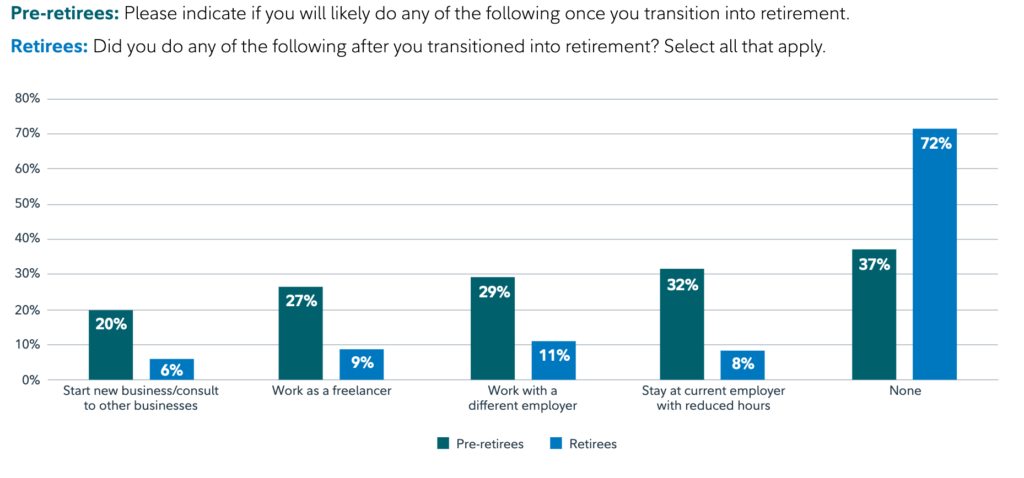

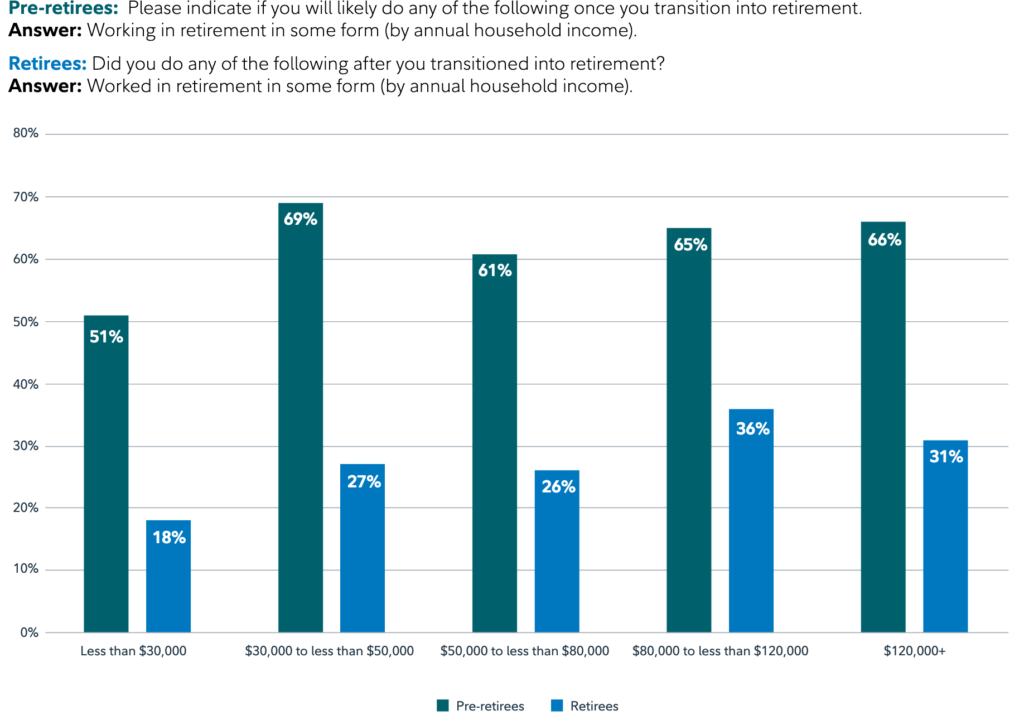

While less than a third of those already in retirement have worked in some capacity once they have left full-time work, most pre-retirees anticipate that they will work at least part-time once they’re retired, according to the report.

While Fidelity cites rising inflation as one reason for this trend, it also says “most pre-retirees would like extra money for recreational purposes.” Further, the report says, “We also find that there isn’t a clear relationship between those working in retirement and their level of household income, suggesting that in general, many Canadians may be working or anticipating working to maintain a higher material standard of living, rather than just to keep up with the rising cost of essentials.”

Financial plans help manifest Retirement dreams

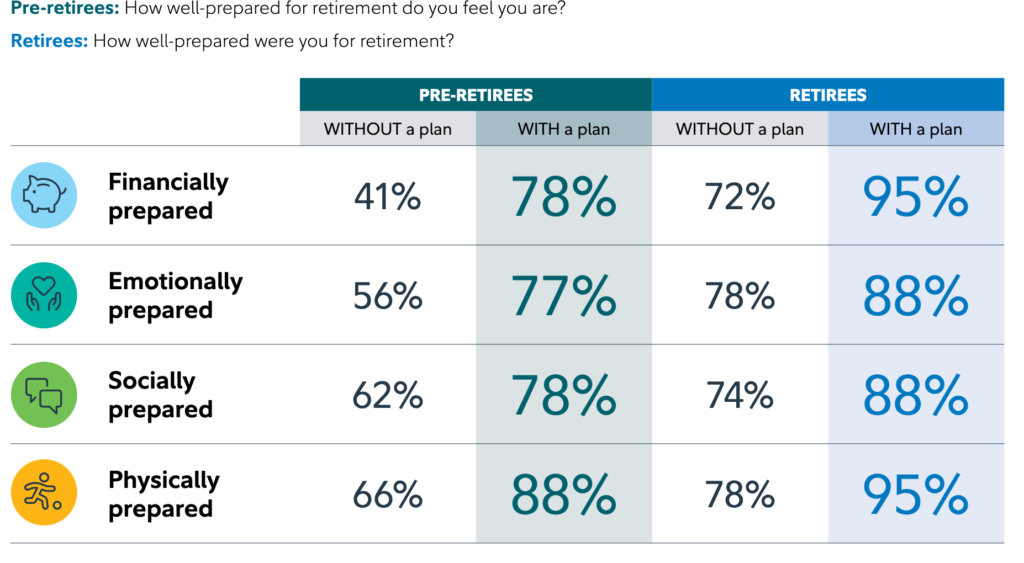

As you’d expect, Fidelity argues that a strong financial plan can help in achieving retirement dreams. “Despite uncertain economic times, working with a financial advisor, developing a written financial plan, sticking to that plan, and especially staying invested can help Canadians live the retirement they envision,” said Fidelity Vice President, Tax and Retirement Research Peter Bowen [pictured, right] , in a press release.

Given a background of economic headwinds and a rising cost of living, more Canadians are opting to change their retirement plans, often with an advisor. Many Canadians “remain resilient and optimistic about retirement,” Fidelity says. Again, odds favour those with a financial plan: Fidelity finds that 88% of Canadians with a written financial plan feel financially prepared for retirement compared to only 56% of those who lack such a plan.

Even so, only 27% of Canadians have a written financial plan; of those that have one, 85% worked with a financial advisor to create it.

Regional differences

The report also found some regional differences. Those based in Quebec are most likely to have a written financial plan that specifically deals with their retirement compared to the rest of Canada (34% vs. 26% average). Those living in the prairies (50%) and BC (49%) are more likely to work in some capacity in their retirement compared to Canadians residing elsewhere (average of 41%).

There are also gender differences: Fidelity found a written financial plan can significantly contribute to improved retirement expectations: 87% of women with a written financial plan felt positive about their outlook on retirement (vs 60% of those without).

For more information, visit fidelity.ca/retirement.