By Matthew J. Moberg, CPA

Franklin Equity Group (Sponsor Content)

Innovation is where wealth creation occurs. Innovation is a powerful growth engine across the global economy, and it is accelerating, in part because of the COVID-19 pandemic.

Yet innovative companies are often misunderstood and, as a result, their stocks are often mispriced. For example, Amazon.com Inc. is a prominent company that is covered widely (and held by Franklin Innovation Fund), and its stock has long been considered very expensive. Even though it is consistently viewed as expensive, Amazon’s stock has been among the best performers for investors for years, indicating to us a general misunderstanding of valuation by the market, which may seem counterintuitive for a company so well known.

Innovative companies are commonly mispriced as market participants often underestimate the duration of growth these companies can provide. Rather than seeing profits competed away in short order, many of these companies grow and generate excess profits for seven, 10 and 15 years, some even longer. Their pace of growth may also be underestimated, which affects valuations as well.

The Franklin Innovation strategy invests in growth, but the portfolio team thinks like value investors as they look for companies they believe are misunderstood and undervalued – which can lead to outperformance. Our new Franklin Innovation Fund and Franklin Innovation Active ETF (TSX: FINO) are driven by a time-tested philosophy that innovation can be found everywhere, and that innovation ultimately drives the creation of wealth over the long term.

Key platforms of innovation

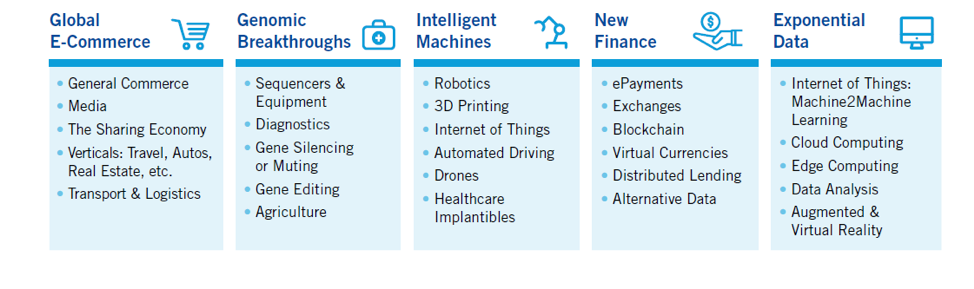

Our Franklin innovation strategy has been investing in innovation for more than 50 years, and over that time we have seen myriad technological and other advances. Our team is constantly reading and researching about what the future might hold and how these advances might develop. As we look at our strategy today, we have identified five major platforms where innovation is creating investment opportunities across sectors, industries, markets and geographies:

Key Innovation Platforms

One of the major trends of the COVID-19 economy has been consumers shifting to e-commerce, accelerating a migration away from brick-and-mortar retailers that was already established. Estimates show that global sales in e-commerce stood at 14% in the summer of 2019;1 by May of 2020, this number had risen to somewhere between 22% and 25%.2 We also see significant opportunities in industries such as fashion, automobiles, travel, ride sharing and restaurant delivery. Other firms to consider are digital payment companies and software developers that will enable brick-and-mortar companies to have an online presence.

Genomic Breakthroughs

The amazing progress in the field of genetics is probably less well known. The cost of gene sequencing — or mapping DNA for diagnostic and curative purposes — has fallen significantly in recent years, which opens the door for further development of diagnostics and therapeutics. We are particularly interested in companies that are focused on diagnostics, gene editing and gene silencing, but opportunities with genetics may extend into agriculture and even artificial intelligence.

Intelligent Machines

Once considered the domain of science fiction, artificial intelligence and machine learning now permeate every layer of product development. The future of production will include products designed specifically for the needs of the individual customer, where efficiencies created in the design and manufacturing process, employing massive amounts of data, will enable that level customization.

New Finance

We believe access to capital is one of the fundamental differences between developed and developing countries. There are three vectors that drive access to capital: what constitutes money, efficient pricing, and methods of exchange. Bitcoin is the latest addition to what constitutes money, while data is increasingly being used to price risk, allowing for a more efficient allocation of capital. Methods of exchange are also evolving through mobile payments and digital wallets.

Exponential Data

Data underpins virtually all our investment themes.

The economy of the future will require massive amounts of data centers, fiber-optic cable, and cell towers, among other supporting infrastructure. The creation, cleaning, storage and delivery of data will also be crucial to the development of augmented and virtual reality, artificial intelligence, and machine learning, as well as the sharing economy. There are many investment opportunities in companies along this value chain, leading some market observers to posit that data is becoming as valuable as oil and gold were to previous generations.

These five platforms for growth reach right across the global economy, touching all sectors. The pace of change illustrates that we have entered a fourth industrial revolution, with themes including data analysis, gene sequencing and intelligent machines driving innovation.

As active managers, we constantly research and meet with different companies to understand their innovations. This proactive approach governs the investment strategy of the two Franklin Innovation funds in Canada to ensure that we remain at the forefront of the innovative economy.

The long-dated opportunity of innovation

Given the equity valuations of certain growth stocks, some investors may wonder if they missed the best opportunity to invest in innovation back in 2020. The better question is, as you look out to the next 5, 10 or 15 years, do you believe these platforms of innovation are going to be a much greater part of the economy? We believe these platforms offer a compelling opportunity to create significant value in the global economy and generate long-term wealth.

In fact, innovation is broadening out through other areas of the world which makes the investment universe even richer in nature. Franklin Innovation Fund and Franklin Innovation Active ETF invest across these five platforms of innovation through a diversified portfolio of companies that we believe can capitalize on these trends in the coming years. Our aim is to invest at the intersection where new ideas can make great long-term investments.

Matthew Moberg is a senior vice president, portfolio manager and research analyst with Franklin Equity Group and the lead portfolio manager of Franklin Innovation Fund and Franklin Innovation Active ETF (FINO) in Canada. The funds invest primarily in companies that we believe are leaders in innovation, that pioneer new technologies, new products, new ideas, new methodologies or benefit from new industry conditions in the dynamically changing global economy. The funds have a broadly diversified growth portfolio that focuses on global e-commerce, genetic breakthroughs, intelligent machines, new finance and exponential data. Both funds mirror the successful strategy of Franklin DynaTech Fund, a ***** Morningstar rated fund in the United States.

- Source: Lipsman, A., “Global Ecommerce 2019: Ecommerce Continues Strong Gains Amid Global Economic Uncertainty,” eMarketer, June 2019.

- Source: Moffett Nathanson,”Payments: From Tidal Wave to Tsunami—Our Proprietary eCommerce Forecast, Updated for COVID-19,” as at 22 May 2020.

Morningstar®. For each mutual fund and exchange traded fund with at least a 3-year history, Morningstar calculates a Morningstar Rating based on how a fund ranks on a Morningstar Risk-Adjusted Return measure against other funds in the same category. This measure takes into account variations in a fund's monthly performance,and does not take into account the effects of sales charges and loads, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The weights are: 100% 3-year rating for 36-59 months of total returns, 60% 5-year rating/40% 3-year rating for 60-119 months of total returns, and 50% 10-year rating/30% 5-year rating/20% 3-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent 3-year period actually has the greatest impact because it is included in all three rating periods. Morningstar Rating is for the named share class only; other classes may have different performance characteristics. This commentary is for informational purposes only and reflects the analysis and opinions of Franklin Templeton as of February 10, 2021. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges, or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Commissions, management fees and expenses may all be associated with investments in ETFs. Investors should carefully consider an ETF’s investment objectives and strategies, risks, fees and expenses before investing. The prospectus and ETF facts contain this and other information. Please read the prospectus and ETF facts carefully before investing. ETFs trade like stocks, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. Performance of an ETF may vary significantly from the performance of an index, as a result of transaction costs, expenses and other factors. The indicated rates of return are the historical annual compounded total returns including changes in share or unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Franklin Templeton Canada, part of Franklin Templeton Investments Corp.