Investors can expect strong positive single-digit returns for the ten years between 2024 and 2034, portfolio managers for Franklin Templeton Investments told advisors on Thursday.

Investors can expect strong positive single-digit returns for the ten years between 2024 and 2034, portfolio managers for Franklin Templeton Investments told advisors on Thursday.

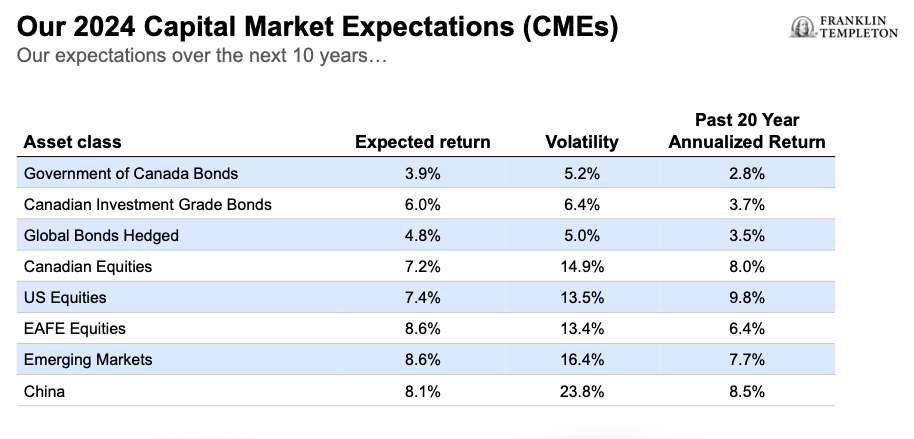

Speaking at the 2024 Global Investment Outlook in Toronto, portfolio manager Ian Riach said Canadian equities will have expected returns in C$ of 7.2%, a tad below the 7.4% of U.S. equities and 8.6% for both EAFE and Emerging Markets and 8.1% for China. Riach is Senior Vice President and Portfolio Manager for Franklin Templeton Investment Solutions and CIO of Fiduciary Trust Canada.

Fixed-income returns are expected to be in the low single digits: 3.9% for Government of Canada bonds, 6% for investment-grade Canadian bonds and 4.8% for hedged global bonds, again all in C$. See above chart for the Volatility of each of these asset classes, as well as the past 20-year annualized returns for each. From my read of the chart, expected returns of North American equities the next decade are slightly below past 20-year annualized returns but EAFE and Emerging Markets expected returns are slightly higher, with the exception of China.

Fixed-income investors who were dismayed by bond returns in 2022 will no doubt be relieved to see expected future returns of Canadian bonds and global bonds are higher than in the past 20 years. “Expected returns for fixed income have become more attractive; recent volatility [is] expected to subside,” Riach said in the presentation provided to attendees.

Capital markets expectations (CME) are used to set Strategic Asset Allocation, which forms the basis of Franklin Templeton’s long-term strategic mix for portfolios and funds, the document explains: “Portfolio managers then tactically adjust.”

“This year CMEs are generally higher than last year. Primarily due to higher cash and bond yields as a starting point,” the document says.

Global equity returns are expected to revert to longer- term averages and outperform bonds, EAFE equities “look attractive,” and Emerging market equities are expected to outperform developed market equities, albeit with more volatility.

Central banks may have to tolerate higher inflation, but are determined to at least get it closer to target in the short-run. The Bank of Canada does have some room to tolerate a higher rate as its target is more flexible at 1%-3%. This compares to the Fed’s hard-wired 2%. Thus, rates in the US may stay higher for longer to bring inflation down to target

Risks of Recession

Riach described three major broad portfolio themes. The first is that Recession risks are moderating but “reasons for caution remain.” The second is that on interest rates, central banks have reached “Peak policy, but expect higher rates for longer.” The third is that “Among the risks, opportunities exist.” Addressing the narrow market of the top ten stocks in the S&P500 (the Magnificent 7 Big Tech stocks plus United Health, Berkshire Hathaway and ExxonMobi), market breadth should broaden to the rest of the market.

For portfolio positioning, Riach suggested selectively adding to Equities, overweighting U.S. and Emerging markets equities, underweighting Canada and Europe equities, and for Fixed Income,”trimming duration and prefer higher quality corporates.” In short, “a diversified and dynamic approach [is] the most likely path to stable returns.”

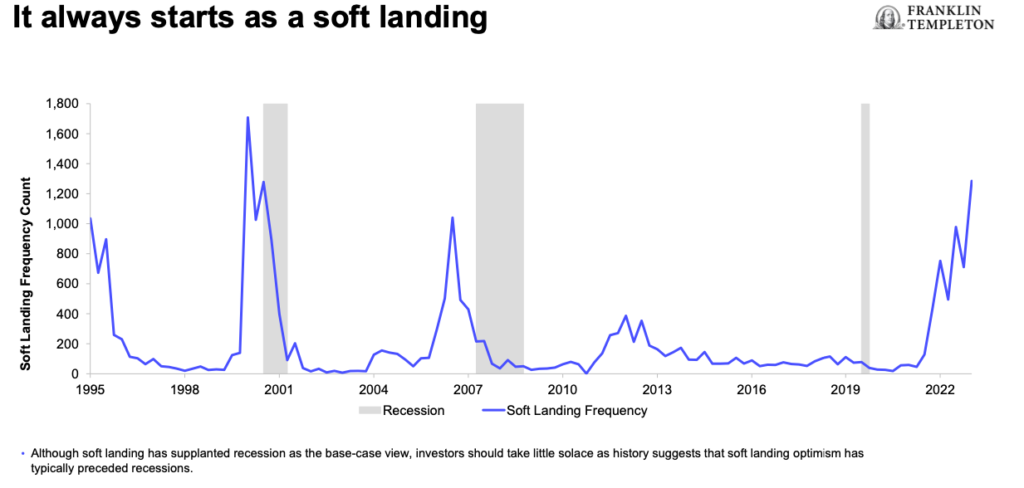

Jeff Schulze, Head of Economic and Market Strategy, ClearBridge Investments (part of Franklin Templeton) gave a presentation titled “Anatomy of a Recession.” A recession always starts as a “soft landing,” as the slide below illustrates. “We’re not out of danger. Leading indicators point to Recession,” he said, “The base case is Recession.” While the S&P500 consensus is for earnings growth, the U.S. GDP is expected to worsen.

He described himself not as a permabear but a permabull, at least until a year ago. If as he expects there’s a “soft landing” with stocks possibly correcting by 15 to 20% in 2024 Schulze would view that as an opportunity to add to U.S. equities in preparation for the next secular bull market.

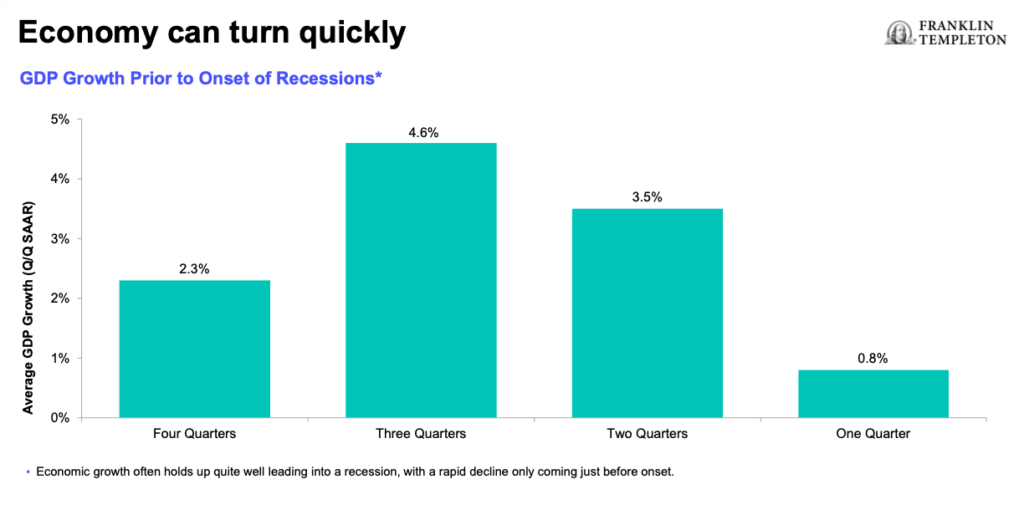

One of the catalysts will be A.I., not just for the Magnificent 7 but also for the S&P500 laggards. As the chart below illustrates, economic growth often holds up well leading into a recession, with a rapid decline coming only just before the onset of a recession.

During an audience Q&A with financial advisors, Riach pushed back on the notion the traditional 60/40 balanced portfolio has died. “Over the long run it’s really stood the test of time and served investors well.”

During an audience Q&A with financial advisors, Riach pushed back on the notion the traditional 60/40 balanced portfolio has died. “Over the long run it’s really stood the test of time and served investors well.”

Geopolitics: Ukraine & American politics

The day ended with keynote speaker Jon Huntsman Jr., former U.S. Ambassador to Russia and China. On the Russian invasion of Ukraine, Huntsman expects a protracted stalemate but said Vladimir Putin probably views that as a relative victory, given that he now has 20% of Ukraine territory, including a key corridor to Crimea. “He will bet on outlasting us.” But Huntsman does not view modern Russia as a superpower like the U.S. or Japan, citing the fact its economy is roughly the size of Texas. While no one knows who will succeed him, he suggested it would likely be another ex KGB person with a background similar to that of Putin himself. His power over the Russian people mostly comes from his huge nuclear arsenal.

As for American politics, he was underwhelmed by Wednesday’s GOP debate, which featured the last four alternatives to Donald Trump. Huntsman expects Trump will get the nomination and suggests political observers should keep a close eye on who he picks as his running mate.