By Ian Riach, Portfolio Manager,

Franklin Templeton Investment Solutions

(Sponsor Content)

It’s been a volatile first half of the year for the world’s capital markets. In many countries, both equities and fixed income have declined, which has led to the second-worst performance for balanced portfolios in 30 years. Typically, bonds outperform stocks in down markets, but not this time. In fact, this has been the worst start to the year for fixed income in the past 40 years, thanks to higher inflation and the resultant rise in interest rates.

Supply-side inflation harder to tame

Central banks use rate hikes as a tool to curb demand for goods and services; but the current inflation is being driven more by supply-side issues stemming largely from the COVID-19 pandemic and exacerbated by the Russia/Ukraine war. Unfortunately, central banks have little influence over supply. All they can do is try to dampen demand with an aggressive interest-rate adjustment process, but they must be careful not to overshoot. Raising rates too quickly runs the risk of tipping weak economies over the edge into recession territory.

Canada’s most recent inflation imprint, released in June, showed an increase to 7.7% year-over-year. One negative consequence is that real incomes are being squeezed as inflation continues to accelerate.

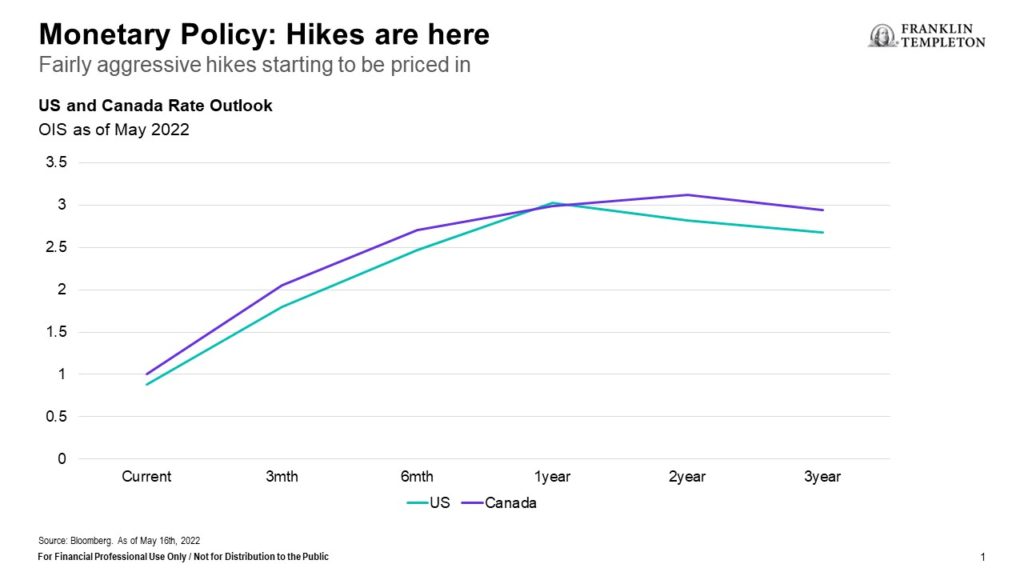

Rates are rising quickly

Both the U.S. Federal Reserve (Fed) and Bank of Canada (BoC) have increased their overnight lending rates from essentially 0% prior to March of this year to 1.5%-plus in June. The Canadian futures market had priced another 75-basis point (bp) increase at BoC meeting in July, which ended up an even higher 100-bps with indications of more to come in September.

Rising interest rates are hurting several sectors of Canada’s economy, notably real estate — especially risky for the economy as housing and renovations have been leading Gross Domestic Product (GDP) growth for the past few years. A significant correction in that sector could lead to a recession.

If there is any silver lining in the current situation, it may be in the Canadian dollar versus its U.S. counterpart. Short-term rates in Canada have moved higher than in the United States. This differential, along with the direction of oil prices, affects the value of the Canadian dollar against the U.S. dollar. If the differential widens and stays higher in Canada, the loonie will likely benefit.

Recession risks are growing

The likelihood of recession is hotly debated within our investment team. Recession in North America is not our base case, but a soft landing will be very difficult. We are currently in a stagflationary environment and recession risks are increasing daily. Europe may already be in recession.

The stock market is a good leading economic indicator, and its recent decline indicates the risk of recession is rising. In addition, the yield curve is very flat, which typically portends an economic slowdown. These market signals have somewhat altered our team’s thinking. Given the current environment, we are reducing risk in our portfolios. In fact, we recently went slightly underweight equities.

Regionally, we are reducing the Europe weighting as that region is more exposed to the negative headwinds associated with war. We are slightly overweight the U.S. but acknowledge that valuations are subject to disappointment with declining earnings growth. We are overweight Canada, which continues to benefit from rising resource prices.

Though we expect the weakness to persist for some time, we’re watching for signs of a turn. When it happens, we will gradually increase risk again.

The fixed-income side is somewhat complicated, as the skewed return relationship for bonds could become even more acute. What does this mean? If bond yields increase (and prices drop), the loss for holding that bond is negligible compared to the gain if interest rates decline even slightly from current levels. With that in mind, we are adding to bonds at the margin in the event there has been an overshoot in interest rates, but are also holding more cash than usual to dampen volatility.

Separating the signal from the noise

We believe it’s important to try to separate the signal from the noise. Our team works with long-established market indicators to anticipate the direction of markets. We are not market timers; we alter portfolios dynamically and gradually make adjustments in measured moves, permitting deviation to capture opportunities.

The Quotential Program has been helping investors meet their financial goals for 20 years. We believe the key to the program’s longevity has been its ability to evolve and adapt. Today’s Quotential looks quite different from 20 years ago. The basic principles have remained, but we now have a larger toolbox of internally managed funds and specialist investment managers that has been augmented by improved technology and an expanded investment team. We have refined our asset allocation process to take full advantage of Franklin Templeton’s global resources, but it’s all brought back to the Canadian portfolio management team to make it relevant for our market.

Launched 20 years ago this year, the Quotential Program makes investing simple. All Quotential Portfolios are globally diversified within their asset classes and across countries and regions. Speak with your financial advisor to find out which Quotential portfolio is right for you.

The investment team also manages the Franklin Multi-Asset EFT Portfolios. Launched in 2019, each of the three mutual funds offers a simple, cost-effective way of investing in a diversified portfolio of ETFs. You don’t have to worry about researching ETFs, making asset-allocation decisions, monitoring the investments, or trading: we do all of that for you.

The information is not a complete analysis of every aspect of any market, country, industry, security or portfolio. Statements of fact are from sources considered to be reliable, but no representation or warranty is made as to their completeness or accuracy. Because market and economic conditions are subject to rapid change, opinions provided are valid only as of the date indicated. The views expressed may not be relied upon as investment advice and are not share class specific.

Ian Riach, CFA, is Senior Vice President, Portfolio Manager Franklin Templeton Investment Solutions, Franklin Templeton Investments Toronto, Ontario, Canada. Ian joined Franklin Templeton in 1999 and is a senior vice president and portfolio manager for Franklin Templeton Investment Solutions (FTIS) and is a member of the FTIS Investment Strategy & Research Committee. He has portfolio management responsibilities for all Canadian-based multi-asset products including the Franklin Quotential Portfolios, Private Wealth Pools, and Franklin LifeSmart Portfolios. He is also responsible for Institutional Balanced Portfolio Management. As the Chief Investment Officer of Fiduciary Trust Canada (part of Franklin Templeton Investments), Mr. Riach also oversees the investment management of Franklin Templeton’s private wealth business.

Ian Riach, CFA, is Senior Vice President, Portfolio Manager Franklin Templeton Investment Solutions, Franklin Templeton Investments Toronto, Ontario, Canada. Ian joined Franklin Templeton in 1999 and is a senior vice president and portfolio manager for Franklin Templeton Investment Solutions (FTIS) and is a member of the FTIS Investment Strategy & Research Committee. He has portfolio management responsibilities for all Canadian-based multi-asset products including the Franklin Quotential Portfolios, Private Wealth Pools, and Franklin LifeSmart Portfolios. He is also responsible for Institutional Balanced Portfolio Management. As the Chief Investment Officer of Fiduciary Trust Canada (part of Franklin Templeton Investments), Mr. Riach also oversees the investment management of Franklin Templeton’s private wealth business.

With over 30 years in the investment industry, Mr. Riach holds a bachelor of commerce degree from the University of Calgary and is a Chartered Financial Analyst (CFA) Charterholder.

Important Legal Information This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user. All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special ri sks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Equity and Fixed Income prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Franklin Multi-Asset Solutions, part of Franklin Templeton Canada. Franklin Templeton Canada is a business name used by Franklin Templeton Corp.