By Jennifer McCracken, BDO

Special to Financial Independence Hub

The cost of living has spiked significantly in the past year and Canadians across the country are feeling the pinch. Younger Canadians between the ages of 18 and 34 are particularly affected, having not had the chance to build up as much savings as older generations.

BDO’s newest Affordability Index shows that 45% of young Canadians say their debt load is overwhelming and they’re unsure how to tackle the problem. That’s higher than those between the ages of 35 to 54, where 39% say they’re in that situation and significantly larger than the 13% of Canadians between the ages of 55+ who feel the same.

Credit-card debt appears to be the main reason younger Millennials and Gen Z are falling behind, with 37% of 18-34 year olds saying this form of debt causes them the most stress. Mortgage debt and student debt were the next closest reasons, with 22% for the former and 21% the latter.

What are Canadians doing to cope with inflation and rising debt?

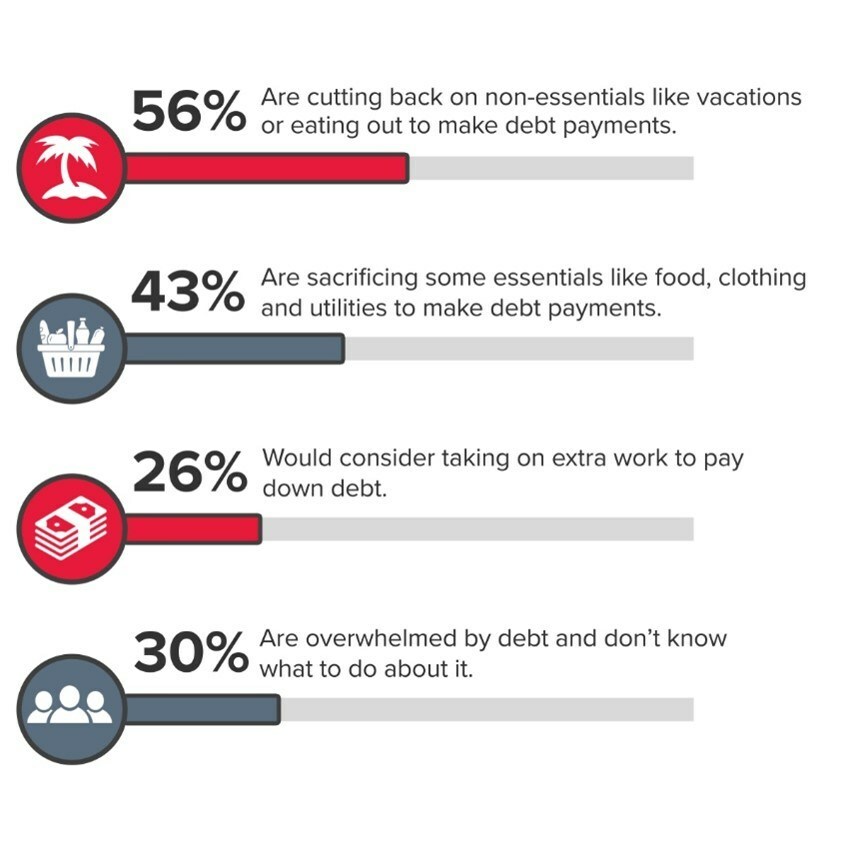

It’s not surprising then that 49% of younger Canadians say they’re reducing their living expenses to cope with inflation and the high cost of living, while 32% say they’re lowering how much they contribute to savings as well.

While younger Canadians may be struggling more than their older counterparts, they’re also more open minded when it comes to finding solutions.

The Affordability Index indicates that younger generations are much more willing to look for new streams of revenue compared to older ones. Some 24% say they are adding part-time work to keep up with inflation, compared to just 13% of 35-54-year-olds and only 5% of those 55 or older.

Young Millennials and Gen Z would also find side hustles and gig work to increase their income. Of those doing this, 35% said it was to help them pay for essentials and 27% say it’s to help them pay down debt.

It’s not just part-time and gig work that younger Canadians are using to fight inflation, they’re also looking for higher paying jobs. A total of 13% say they’ve recently found a new full-time job in response to the affordability crisis. That’s compared to just 7% of those aged between 35-54 and only 1% of those 55 and older.

However, while younger generations are keen to seek out new ways to increase their income, they’re very unfamiliar with many of the most common debt relief options available.

A lot of people just don’t know what their debt relief options are …

Only 19% of them said they were familiar with the idea of bankruptcy, 11% said they know what a debt management plan is and 9% with a debt consolidation loan.

These findings mean that the vast majority have no idea what a consumer proposal is. Despite it being one of the most recommended debt relief strategies by Licensed Insolvency Trustees, only 9% said they were aware of it.

They are, however, much more open than other generations to talking about their financial issues openly with those they know. Of those aged 18-34, as many as 25% say their first course of action when looking to manage debt is to talk to friends and family, far higher than the 13% of 35-54-year-olds who would take that course of action and substantially far more than the only 9% of those 55 and older.

So, while they may be struggling with debt at this point in their lives and be unaware of some of the strategies that are used by professionals, they are open to looking for new forms of income and talking about money in ways that older generations simply weren’t.

If you’re looking for someone to talk to about debt, reach out to a Licensed Insolvency Trustee like myself.

Are you looking for someone to talk to about your debt? Visit bdodebt.ca. And for some fast financial tips, give me a follow on Instagram and TikTok.

Jennifer McCracken is a Partner and a Senior Vice President at BDO’s Vancouver office. She is a licensed Insolvency Trustee (LIT), a Chartered Insolvency and Restructuring Professional (CIRP), and a Qualified BIA Insolvency Counsellor.

Jennifer McCracken is a Partner and a Senior Vice President at BDO’s Vancouver office. She is a licensed Insolvency Trustee (LIT), a Chartered Insolvency and Restructuring Professional (CIRP), and a Qualified BIA Insolvency Counsellor.

Since 2000, she has worked on corporate and consumer insolvency and restructuring engagements. Her breadth of financial recovery experience includes privately and court-appointed receiverships, bankruptcies, and proposals to credit