The following is an edited transcript of an interview with Michael Kovacs, CEO of Harvest ETFs, conducted by Financial Independence Hub CFO Jonathan Chevreau.

Jon Chevreau (JC)

Thanks for taking the time today, Michael. We all know that 2022 was a pretty bad year as markets were impacted by higher interest rates. That turbulence bled into much of 2023, although the last few weeks have seemed much rosier.

How do you respond to unitholders of funds who are currently down year over year? Does your covered call writing protect retirees?

Michael Kovacs (MK)

Thanks for having me, Jon. It is important to remember that we offer equity income funds. That means that you have to look at the total return of the product, which includes the price of the ETF and its accumulating distributions.

Yes, there has been turbulence in 2022 and through much of 2023. However, over that period, products like the Harvest Healthcare Leaders Income Fund (HHL) have paid consistent distributions.

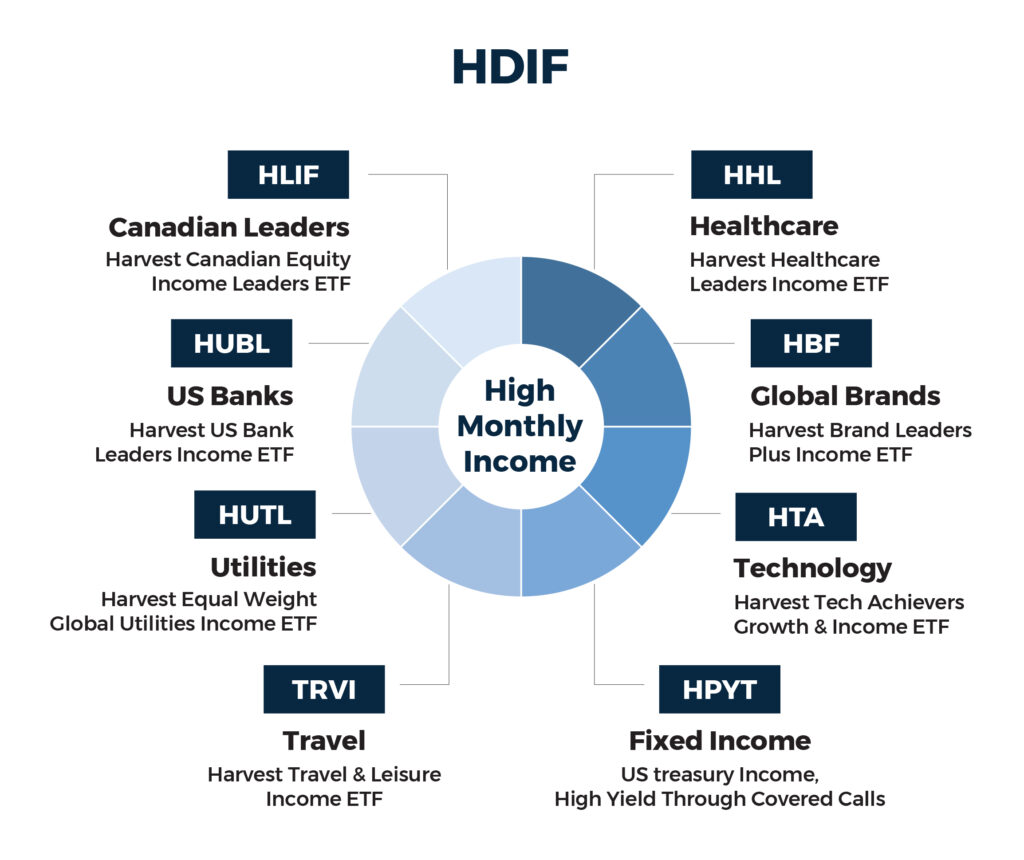

Let’s look at the Harvest Diversified Monthly Income ETF (HDIF). In terms of actual returns, this ETF is down nearly double-digit percentage-wise in the year-over-year period (as of early November). But, when you look at the distributions paid over that same period, HDIF has delivered positive cashflow for its unitholders, which reduces the decline by more than half.

JC

Are you saying that between the covered calls, the distribution and the leverage plus the underlying equity income, that a retiree could expect annual yields as high as 10% or 12% or higher?

MK

Yes. Yields are anywhere from 1.5% to 3%, depending on the equity category. Then you have option writing. We can go right up to 33% on any of those portfolios, which generates additional yield. So, to be able to generate 9-10% is very achievable. And we’ve been able to do that consistently for a quite a few years now.

JC

What is your view on the current interest rate climate? Have we reached a top? If so, when will they start to come down?

MK

Many of us remember the high interest rates of the 1980s, especially some of your readers who were trying to obtain their first mortgages. We have experienced a big jump in interest rates over the past two years. However, we believe that we have probably seen the top for rates for now. Or, if we haven’t, we are very close to the top. That means there are going to be some great opportunities in fixed-income markets. The next move for interest rates may be down by mid-to-late 2024.

That said, there are still great opportunities that will benefit equities and bonds in the current climate. Our first launch in the Bond area is the Harvest Premium Yield Treasury ETF (HPYT). We’ve launched with a high current yield. We are targeting long treasury bonds in this fund. This is about generating a high level of income while owning a very good credit-worthy security like a U.S. Treasury. So, if rates start declining next year, it is a great time to be holding fixed income.

JC

Findependence Hub readers tend to be retirees who want steady cash flow. What is Harvest’s view of cash flow for retirees?

MK

I think cash flow for retirees is essential. Once your employment income has gone, you must depend on your investments, your pensions, your CPP, and so on. The recent increases in interest rates have been good for retirees in the short term. Higher rates allow retirees to keep shorter-term cash and generate a safe yield of 5% or more.

Our longer-term equity products aim to have that heavy bias toward equities. For example, the Harvest Healthcare Leaders Income ETF (HHL) is typically written at about 25-28% average, with the other 70% or so fully exposed to health care stocks. The covered call option writing strategy allows us to generate a high level of income.

Cash flow is the basis behind our name: Harvest. People have spent decades building up capital, sowing the seeds. Our products allow them to harvest the fruits of their life-long labour.

We believe our equity-income and fixed-income products are a fantastic way to do that. If we can help you preserve capital and generate consistent income, we are doing our job.

JC

There is also interest among investors in asset allocation ETFs. Is HDIF essentially your answer to that demand?

MK

You’re correct. Some people prefer to allocate to specific funds, but the idea behind HDIF is to allocate to the best of Harvest’s top products that generate cash flow. In the case of HDIF, you do have a leverage component. You are increasing the yield but at the same time, you do increase your risk as well.

HDIF has run into some turbulence in 2022 and through 2023. Funds that allocated to U.S. banks and global utilities, for example, were hit hard. However, as those sectors turn around, you’re going to get the same effect in reverse by having that little bit of leverage. The income will continue to be consistent at an attractive level because of the covered call option writing on the value of the underlying portfolios. HDIF is a fund of funds. We recently added some HPYT to HDIF, a high-yield Treasury portfolio.

HDIF has run into some turbulence in 2022 and through 2023. Funds that allocated to U.S. banks and global utilities, for example, were hit hard. However, as those sectors turn around, you’re going to get the same effect in reverse by having that little bit of leverage. The income will continue to be consistent at an attractive level because of the covered call option writing on the value of the underlying portfolios. HDIF is a fund of funds. We recently added some HPYT to HDIF, a high-yield Treasury portfolio.

JC

Do you see HDIF being held in RRIFs or non-registered portfolios?

MK

I think HDIF is more well-suited for RRIFs and RRSPs. It’s about how much income to generate and consistently draw from the RRIF portfolio.

Of course, our portfolios also work well for non-registered programs. One of the benefits of running covered call options is that your income is treated as capital gains or return of capital. So, that’s a real benefit for non-RRSP or non-RRIF investors. Historically we have seen roughly 70% of our clients investing through registered plans. However, there is still a fair amount of money that looks for non-registered as well.

JC

Thank you for your time, Michael.

MK

You’re quite welcome, Jon. It was a pleasure.

Michael Kovacs is the President & Chief Executive Officer of Harvest ETFs. He founded Harvest Portfolios Group Inc. in 2009 and is a 35-year veteran of the Investment management business. Michael began his career as an Investment Advisor and for seven years managed money for individual investors before moving into senior management roles within the Investment Management Industry. He is a strong believer in providing individuals with Investment products that are equity based, have long term growth prospects and transparent portfolios. Michael has been featured in the Globe & Mail, National Post and BNN-Bloomberg. Michael is also the Chairman of the Board for Harvest.

Michael Kovacs is the President & Chief Executive Officer of Harvest ETFs. He founded Harvest Portfolios Group Inc. in 2009 and is a 35-year veteran of the Investment management business. Michael began his career as an Investment Advisor and for seven years managed money for individual investors before moving into senior management roles within the Investment Management Industry. He is a strong believer in providing individuals with Investment products that are equity based, have long term growth prospects and transparent portfolios. Michael has been featured in the Globe & Mail, National Post and BNN-Bloomberg. Michael is also the Chairman of the Board for Harvest.