Despite Tuesday’s 3% plunge in US stock markets, Franklin Templeton money managers are optimistic most major asset classes will deliver positive if muted returns in 2019.

Despite Tuesday’s 3% plunge in US stock markets, Franklin Templeton money managers are optimistic most major asset classes will deliver positive if muted returns in 2019.

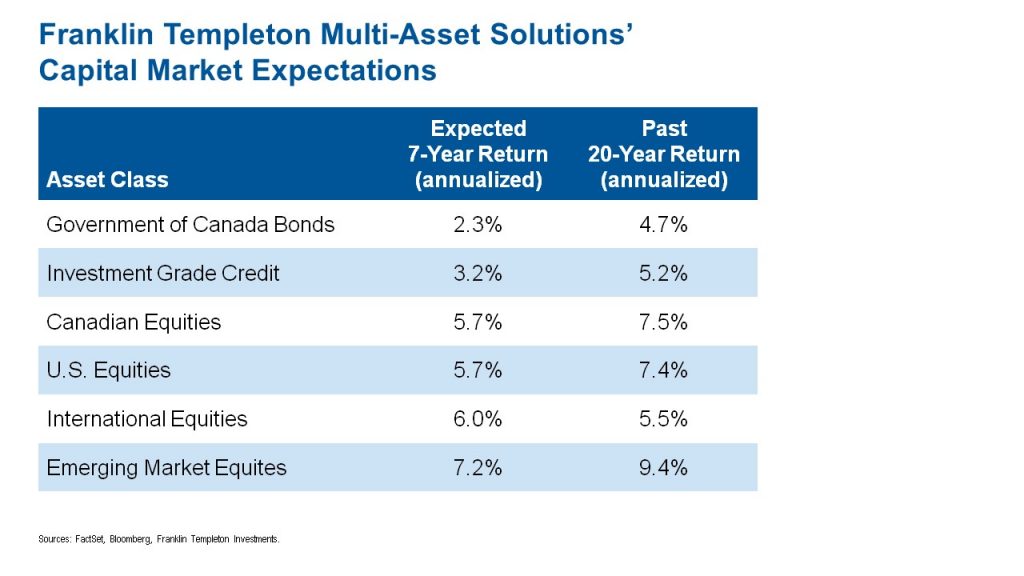

At the 2019 Global Market Outlook event in Toronto, William Yun, New York-based executive vice president for Franklin Templeton Multi-Asset Solutions, projected 7-year annualized returns for Canadian equities of 5.7%, compared to a 7.5% average the last 20 years [as shown in above chart]; 5.7% for U.S. equities (versus 7.4% historically), 6% for international equities (versus 5.5%), and 7.2 versus 9.4% for Emerging Markets. On the fixed income side, he is projecting 2.3% annualized 7-year returns for Government of Canada bonds (versus 4.7% historically the last 20 years), and 3.2% for investment grade corporate bonds (versus 5.2%).

All this is in an environment of continued desyncronized global growth (of 3%) and moderate inflation expectations. Long term, Yun is particularly optimistic about the long term growth of Emerging Markets equities, which at 5% is two-and-a-half times the 2% growth expectation for developed market equities. This optimism is based on positive population growth and labor productivity in Emerging Markets. Globally, inflation “remains muted” and “we don’t see many excesses in the global economy generally.” There are however, some excesses in the U.S. labor market.

More normalized interest rate environment

Capital spending growth patterns are supportive and trending upwards since the 2016 US election, with the transition from very low interest rates post the financial crisis to a “more normalized interest rate environment.” The opportunity is to reinvest capital to more productive assets, as opposed to allocating to corporate share buybacks.

With respect to central bank balance sheets, markets are normalizing around the world, transitioning from excessive Quantitative Easing to Quantitative Tightening and shrinking balance sheets. Assets quadrupled at the Fed between US$1 trillion in 2008 to $4 trillion today as the Fed committed to buying bonds, with liquidity tapering off. He has similar expectations for the ECB, which has announced the ending of its QE programs, and it’s the same with Japan and China. “Central bankers are pulling back on Quantitative Easing.” There is a “restart of normalization in interest rate policy.”

Rising volatility

Even as the Dow Jones Industrial Average was in the process of tanking almost 800 points Tuesday, Yun predicted rising volatility after a period of relative calm. In that environment, “investing passively [in index products] has been the way to go but we anticipate volatility returning.” With higher interest rates and more volatility, it may be a time for active management, Yun said, acknowledging his own firm’s expertise in active security management.

Emerging Markets gross domestic product (GDP) continues to rise relative to the rest of the world, from 40% in 1990 to 60% in 2017, and Yun expects that percentage to move higher still. The trend is driven by rising consumption growth for the middle class, which benefits industries like consumer staples and consumer discretionary stocks, technology and even investment management.

Emerging Markets are showing reduced reliance on developed markets, which are slowing. Whereas in 2007 eight of the top trade markets were with the United States, in 2017-2018 China has supplanted the US, with 8 of the top 14 destinations.

In short, Yun sees a supportive global market for risk assets but lower returns: positive growth and moderate inflation, with increased volatility.

Ian Riach, Chief Investment Officer for Fiduciary Trust Canada and a senior vice president of Franklin Templeton Multi-Asset Solutions, says it makes sense in this environment to make some “dynamic” (i.e. tactical) shifts to long-term Strategic Asset Allocation. Currently, the firm is underweight Canadian equities and Canadian bonds, because the loonie has been getting weaker and Canada is facing a number of challenges ranging from trade to energy to a shrinking manufacturing base, all of which “affects growth going forward.” In the short term, Riach expects short-term interest rates in the United States will be higher than in Canada, “given that they are growing more quickly than us.”

Flat yield curve

Even after the recent rate back-up, “we think Government of Canada bonds are expensive, especially at the long end of the curve.” The yield curve is flat, meaning there is very little difference in return between short-term and longer-term bonds. As a result, the firm is keeping the average term to maturity short and is underweight Canadian government bonds and overweight corporate credit, while neutral on global bonds.

Riach has been underweight Canadian equities for some time, due to Canada’s highly concentrated market, which continues to be dominated by financial and resources (energy/materials). “Reducing that home country bias has taken time; today some feel foreign markets are riskier than Canada but there are diversification benefits beyond the home country.” While the manufacturing purchasing manager index shows the economy is still growing, there has been “notable deceleration the last months.” The energy sector is presenting challenges and high consumer debt levels are a concern. “We are cautious on Canada now, largely because of the growth side.” Even so, Riach says valuations for Canadian equities are more attractive than other areas and “more attractive than long-term averages.” This he finds encouraging, but “we are waiting for more transparency on Canadian growth before we take advantage of valuations and raise our commitment to our own country.”

He is slightly underweight U.S. equities, which it has been since earlier this year. Instead, he is overweight international equities, but favoring developed international stocks over Emerging Markets. “It’s no secret” that interest rates are also rising in the U.S. but “the yield curve is very flat. Less than 20 basis points separates 2-year from 10-year US bonds, which are at historical lows.” That doesn’t portend well for Growth. As in Canada, “we are seeing leading indicators roll over.” He expects equity returns the next 18 months will be lower than the long-term average.” That implies defensive stocks will outperform cyclical stocks.

Leaning to US stocks that are raising their dividends

Valuations in the US are “not overly demanding or excessive but they’re not cheap either by historical standards. They are slightly at or above fair value so we’re a bit cautious.” Once the firm sees a reset in valuations or gets more confident it will get back to a neutral weighting for US equities. For now it is “slightly underweight and we are leaning to more defensive-oriented names that can pay and growth their dividends.”

Debt fuelling China

European stocks “could surprize on the upside. We look at pessimism as a contra indicator” so he continues to be overweight Europe. He is below weight in Emerging Markets, although “long term we are very constructive on Emerging Markets, where Growth will be significantly above North America.” It will eventually come back to market weight but Emerging Markets is inextricably linked to China and his “short term view of China is that we are less than enthusiastic.” Any growth in China has to come from Government stimulus. “There’s no doubt China can do this but the government is cracking down on the explosive growth in debt which has fuelled the Chinse economy.”

In this lower-return environment with higher volatility, alternative asset classes are gaining interest, including private equity, infrastructure, real estate and other asset classes with low correlation to the traditional asset classes of stocks and bonds.