When central and southern Alberta experienced catastrophic flooding in June 2013 there were 32 states of emergency declared and over 100,000 people displaced throughout the region. Reports of price gouging at various retailers surfaced on social media; one story in particular claimed that an unscrupulous Calgary retailer was selling individual bags of ice for $20.

- Move on to the next retailer and hope to find an honest owner

- Go home with no ice and wait for the situation to return to normal

- Suck it up and buy the ice, grumbling the entire way home about how you got ripped off

- Hope for some kind of government intervention to protect you and other consumers from price gouging

- Borrow ice from a friend or neighbour who has plenty to spare

Priced out of Vancouver and Toronto?

Many prospective home buyers in cities like Vancouver and Toronto act like a $20 bag of ice is a good deal; as if they don’t buy that over-inflated bag of ice now they risk having to pay even more for a bag of ice in a few years, or worse, not being able to find a bag of ice again in the future.

It’s understandable. Ice is better than no ice. And buying expensive ice today is certainly more tempting than the prospect of buying more expensive ice (or no ice) tomorrow. But here’s why a first time home buyer is crazy to get into the Vancouver or Toronto real estate market today.

The Real Estate Board of Greater Vancouver said the price of a condominium apartment in April 2016 reached $475,000 – up over 20% from the same time last year. Meanwhile a townhouse in the greater Vancouver area will set you back $608,600 – up 22% from last April.

Related: Why Vancouver’s real estate prices are so crazy

Just as frothy in the GTA, the Toronto Real Estate Board reports that the price of a condo-apartment went for $409,631 in April while a townhouse cost $537,934.

When we look at housing affordability, recent Statistics Canada data suggests that the price-to-income ratio in Vancouver is an eyebrow-raising 11.2 while Toronto’s is 8.2.

Median household income in both Toronto and Vancouver comes in around $76,000 – surprisingly below the national median of $80,000 (and a knock to those who say the best-paying jobs are in Canada’s two largest cities).

Let’s bring out our first-time home buyers; a couple we’ll call Jon and Dany, who live in the fictional Canadian city of Vanronto.

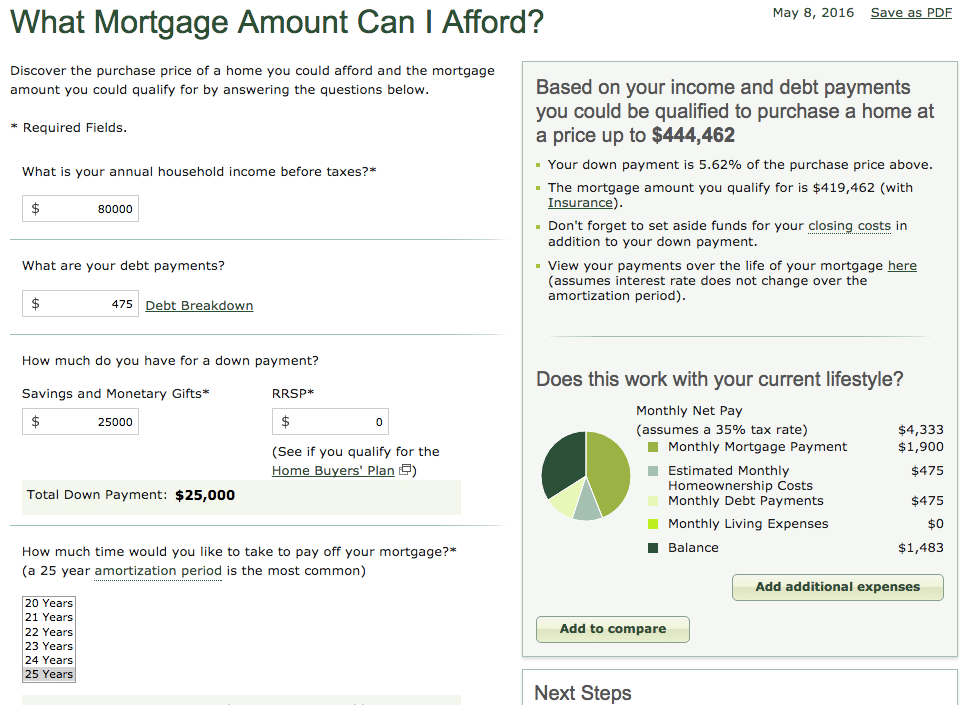

Jon got his foot in the door at a start-up and makes $30,000 annually. Dany is a designer with a software company and brings in $50,000 per year. Together they have scraped together $25,000 for a down payment. They’re tired of paying rent to a landlord they never see while all of their friends move into brand new apartments and townhouses that they bought on the outskirts of downtown.

Dany’s parents insist that renting is a waste of money. “Why pay someone else’s mortgage?,” her mom says.

Both Jon and Dany are still paying the last of their student loans. Jon also has a small credit-card balance of $2,500, while Dany pays $250 per month on her leased Honda Civic. The couple decides to head down to the bank to see what they can afford.

The good news is that Jon and Dany can get in on the ground-floor (literally) of a lower-end condo-apartment. It’s not in the heart of Vanronto like where some of their friends ended up, but the neighbourhood is up-and-coming with lots of potential, and the subway is close by.

The bad news is that while they can afford to buy a $445,000 condo, they haven’t considered their other monthly living expenses – important ones like groceries, or gas for their slightly longer commute. The leftover $1,483 might stretch them thin.

Related: How much home can I afford?

And what about saving? This couple worked hard to squirrel away $25,000 over the last few years. Will they still be able to set aside money for emergencies, travel, or a new car? What about retirement? Dany’s employer offers a generous matching program for their group RRSP plan that she has yet to take advantage of.

There’s a lot to consider beyond the bank’s affordability calculator when buying a home. Does it pass the real life ratio test?

Put together by Rob Carrick of The Globe and Mail, the real life ratio uses take-home pay instead of the less useful gross income used by the banks. It encourages you to use other expenses such as insurance, daycare, as well as a percentage for home maintenance and upkeep.

“Use the Real Life Ratio and you’ll know what you’re getting into before you buy a house. You may decide you need to save a bigger down payment, buy a smaller house, live in a cheaper location or not buy at all.”

Jon and Dany pore over the numbers and find their real life ratio is at 88.74, and according to the guidelines, any number over 86 shows a financial stress overload. In short, it means this couple has less than 12% of their take-home pay left over each month to pay for food, clothing, transportation, entertainment, travel, and insurance premiums.

Admitting defeat, Jon and Dany head back to their rented apartment to mull their options. The most reasonable solutions seem to be staying put and continuing to rent, or leaving Vanronto for good and moving to a more affordable city in Canada.

Final thoughts

Wannabe home buyers in Vancouver and Toronto can easily get caught up in the euphoria of an overheated market. Sure, maybe their parents made a killing on the houses they bought 30 years ago, but maybe their colleagues overextended themselves to buy homes closer to downtown, and maybe some of their friends received gifted down payments from their relatives to get into the market.

(Some 100 people even camped out for two weeks just for the chance to buy a $500,000 condo).

Much like price gouging during an emergency, as long as you’re prepared you still have the option not to pay the over-inflated price and wait it out, or move to a more reasonable and affordable location.

Know a bad deal when you see one. Overextending yourself just to get a piece of the real estate action in Vancouver or Toronto is not just a bad deal, it could spell your financial doom.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on May 8th and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on May 8th and is republished here with his permission.