By Bob Lai, Tawcan

When we started our financial independence journey back in 2011, we didn’t set a specific FI date or number. In our minds, we do not doubt whether we could become financially independent or not. We knew we’d become financially independent in the future. It was just a question of time. We simply needed to have patience and let our investments compound over time.

A few years into our FI journey, our FI plan started to evolve. Rather than having a specific liquid net worth and utilizing the 4% safe withdrawal rule, we decided to have enough dividend income to cover our expenses. Looking at the calendar, we randomly set a target of reaching this milestone by 2025 or earlier.

It’s funny how ten years seemed to have gone by in the blink of an eye. At the same time, a lot has happened in our lives…

- Getting engaged and married

- Having two kids

- Moving from an apartment in Vancouver to a house in the suburb

- Me having different job titles, going from engineering to project managing to product marketing to engineering

- Mrs. T starting her holistic doula practice

- Starting my photography business ( I’ve been on a bit of break the last few years)

- Starting this blog, writing articles, learning new things, and connecting with other like-minded people

One thing I’ve realized is that life is never static. It’s always dynamic. Although we can do as many projections and make as many plans as we possibly can, projections and plans do and will change. Therefore, with three years to go before 2025, I thought it would be a good time to re-examine our financial independence plans and see if we need to make any adjustments.

Our FI numbers

Since starting our FI journey, we have tracked our expenses meticulously. Here are our annual expenses since 2012:

| Total Necessities | Total Annual Spending | |

| 2012 | $26,210.52 | $44,603.76 |

| 2013 | $26,343.00 | $45,260.88 |

| 2014 | $29,058.96 | $47,391.96 |

| 2015 | $31,256.88 | $47,270.16 |

| 2016 | $29,831.40 | $47,566.96 |

| 2017 | $33,887.68 | $51,144.77 |

| 2018 | $31,840.75 | $57,231.99 |

| 2019 | $33,199.98 | $54,906.02 |

| 2020 | $35,511.60 | $48,908.74 |

| 2021 | $38,950.66 | $71,852.02 |

Necessities cover core expenses like food, insurance, housing, clothing, utilities, car, etc. Other expenses are considered as non-core expenses which include things like dining out, skiing, camping, travel, charitable donations, gifts, etc.

The last two years have been abnormal in terms of spending. Due to the pandemic, our spending was much lower than usual in 2020. Then last year we had unplanned expenses of around $16,500 on our cat and our house. If we take this amount out, it’d put our 2021 annual spending to around $55,000.

Based on our historical spending trend, I would estimate that we need somewhere between $50,000 to $60,000 in dividend income annually to cover our expenses. To be on the safe side, I’d use $60,000 annual spending for any FI plans because we need to have inherent built-in flexibility on variables outside of our control, like major purchases, emergencies, etc.

The $60k annual spending estimate, of course, assumes that we continue to live in Vancouver and do not have many significant changes in our spending habits.

One thing to keep in mind is our spending can drastically come down if we decide to geo-arbitrage by moving to a smaller Canadian town or somewhere in South East Asia with a lower cost of living than Vancouver. On the flip side, the spending number can increase if we move to Denmark and live there for a few years (I’m ignoring the tax consequences for now).

How much do we need in our dividend portfolio?

How much do we need in our dividend portfolio to generate $60,000 in dividend income? Let’s do a quick math exercise, shall we?

For $60,000 dividend income per year, at 3% dividend yield, we’d need a dividend portfolio worth $2 million; at 4% dividend yield, we’d need a dividend portfolio worth $1.5 million. In other words, we need a portfolio valued between $1.5 million to $2 million. That’s certainly not a small chunk of change.

Now, if we take a middle-of-the-road approach and use a portfolio dividend yield of 3.5%, that means a portfolio value of around $1.714 million.

One thing is clear – we need to continue to save and invest money in our dividend portfolio. We also need to find the right mix between high-yield low-dividend growth stocks and low-yield high-dividend growth stocks.

With three years remaining in our FI timeline, it might be tempting to start buying more very-high-yield dividend stocks to make sure we can reach our FI target. But it is very important to make sure our dividend income is safe and remains sustainable over time. We definitely don’t want to hit $60,000 in dividend income one year only to see that amount slashed by 20% or more the next year.

The stability of our dividend income is extremely vital.

We also want to make sure the portfolio value continues to appreciate over time. The rationale is simple – total returns matter. Having a stable and safe dividend income and a portfolio that increases value over time will give us more options.

By 2025, both Mrs. T and I will be in our early 40s. With decades ahead of us, we need to ensure our dividend income can grow organically over time and inflation doesn’t eat into our dividend income’s buying power. It will be necessary to have some low-yield high-dividend growth stocks in our portfolio to allow for organic dividend growth.

The plan of living off dividends

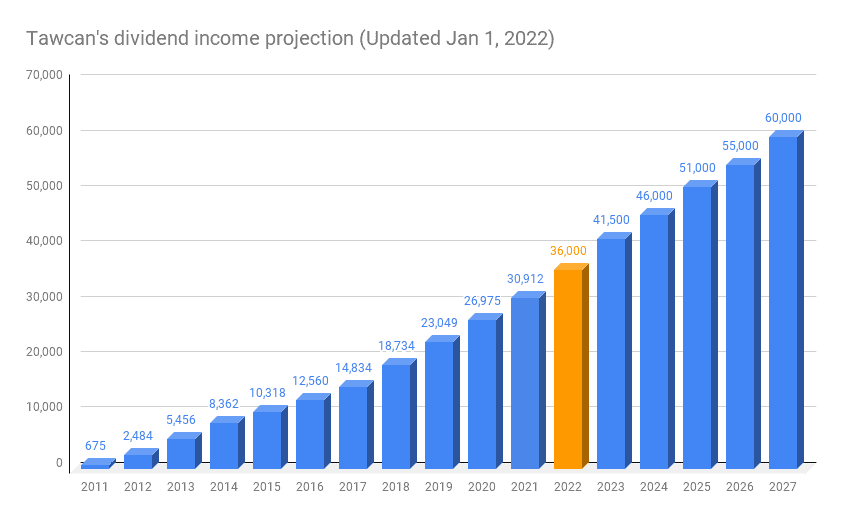

Living off dividends is an amazing idea. Based on my dividend income projection, we should receive $51,000 in dividend income in 2025. However, when we compare that number with the $60,000 annual spending target, it doesn’t take a rocket scientist to realize that we are short by several thousand dollars.

Furthermore, the projection below is based on us continuing to grow dividend income post-2025. If we start living off dividends and not adding new capital, the dividend income will not grow as fast as the projections in the chart. And depending on the rate of spending compared to the rate of growth, the actual dividend income could potentially fall.

Does that mean we need to abandon our FI by 2025 plan?

Not necessarily.

First of all, we will most likely to receive more than $36,000 dividend income in 2022, which will shift the projection timeline forward slightly. If the Canadian banks, Canadian insurers, and other companies continue with impressive dividend payout increases, our dividend income could continue to grow at a higher than expected rate. However, there are simply too many unknowns to conclude that these impressive dividend payout increases will continue to happen and build that into our dividend income projection.

One important thing to keep in mind is that we are facing the law of the big numbers. It will get harder and harder to grow dividend income at a high rate year over year.

Where does that leave us? In case our dividend income comes short of $60,000 by 2025, we need to have a few different options.

The different options

Here are a few options that I have in mind in case our dividend income comes short of $60,000 by 2025.

#1 Shift FI date by a few years

At this point, we are not really set to become financially independent by the year 2025. We can give ourselves some flexibility by shifting our FI date out by a few years. For example, if we target 2030 rather than 2025, that’d give us 8 years from now or 5 additional years than our 2025 target to build up our dividend portfolio.

It would mean we’d live off dividends in our late 40s. The original date of 2025 was fairly arbitrarily selected. It was simply mid-decade and seemed to be a convenient point of demarcation. However, when you think about it reasonably and logically, there really is not that big a difference living off our dividends in our late 40s compared to the 2025-mandated early 40s.

#2 Work part time

Long time readers will know that when it comes to Financial Independence Retire Early (FIRE) we have been focusing on the FI part rather than the RE part. To me, early retirement doesn’t mean sipping drinks on the beach all day. The relaxed leisure life is nice but I can’t do that for the rest of my life.

In our FI plans, we have never planned for early retirement in the traditional sense. We have always planned to continue working in some form. The key is that we want to work on something that we truly enjoy rather than having a job because of the good salary.

When we become financially independent, work will take on a completely different meaning. Because we’re no longer relying on the paycheque every two weeks, we have the power to decide what to do and what kind of work we want to do.

In other words, having the freedom to walk away from work if we don’t enjoy doing it. We can do something that we enjoy without having to worry about money.

If our dividend income is short of our target by 2025, we can work part time and use that income to supplement our dividend income. For example, Mrs. T will most likely continue to do her doula work because she enjoys helping expecting moms. I can either work part time at my current job (although I’m not convinced that working part time in high tech is doable) or I can put more emphasis on my photography business and this blog and earn more income than what I currently do.

Technically this isn’t financially independent since our portfolio is not enough to sustain our spending and we needed the supplement of part time income.

#3 Make small withdrawals

Instead of relying on living off dividends completely and not touching our portfolio at all, we can supplement our dividend income with small withdrawals each year. If we’re short by $5,000 a year, we can withdraw that amount from our non-registered accounts and split the amount equally between Mrs. T and me to reduce income tax.

Based on the retirement projections from Cashflows and Portfolios, it’s comforting to know that we are on track to hit the $60k after-tax annual spending target if we rely on small withdrawals each year.

Option 1 means delaying our FI date which is OK since both Mrs. T and I are enjoying our lines of work. Option 3 will require selling assets which if we’re living off dividends, is not something we’re comfortable with, at least for the first 3 or 5 years.

As expected, option 2 is somewhere in the middle between the other two options. As mentioned, technically we wouldn’t be financially independent with option 2 and will be shifting our FI date by a few years, although probably not as much as option 1.

Which option we take will depend on several factors, such as how much shortfall between our dividend income and how much our portfolio is at the end of 2024 and the $60,000 dividend income target.

I suspect if we are short of our target, we may end up doing a mix of all three options.

Furthermore, given that we do invest in high-growth stocks like Amazon, Google, Tesla, etc, another option would be selling some of these high-growth stocks and using the profits to supplement the dividend income shortfall. Another potential option is to look into generating income via options.

The bucket approach

Many bloggers have talked about their bucket approach. For example, Tanja has written about their sequencing withdrawal plans. Fellow Canadian blogger Mark has referred to his 3 budget approach many times.

On a very high level, our bucket approach looks something like this…

- Bucket #1 – Have roughly $50k worth of cash in a high-savings account. Cash in this bucket can be seen as our buffers in case the market tanks and our dividends get cut as a result. Having some cash sitting on the side will give us some margin of safety and allow us not to constantly worry about where our money is coming from. As we move closer to 2025, we plan to start building up the cash pile in this bucket.

- Bucket #2 – Dividend income from taxable accounts. We are counting on dividend income from our taxable accounts to be our prime source of income because Canadian dividends are very tax efficient. Dividend income generated from our taxable accounts will be used for day-to-day expenses. If needed, we can also sell assets but we plan to avoid that if we have to, especially early on.

- Bucket #3 – Dividend income from RRSPs. Since withdrawals from RRSPs count as working income and are taxed at our marginal tax rates, we also plan to make small withdrawals each year. In addition, we may collapse our RRSPs before the age of 71 or only have a small balance before having to convert to RRIF.

- Bucket #4 – Dividend income from TFSA. We will avoid touching our TFSAs for as long as possible to allow for everything to be compounded tax free inside.

- Bucket #5 – income from any part time work. As mentioned, we don’t plan to retire in the traditional sense and will be earning income in some form or another. Income from any part time work will provide some flexibility. It may also allow us to donate more money to charities.

This five-bucket approach is simply a plan and not set in stone. It is very possible that we may change this approach.

Focus on the bigger things in life

Being able to live off dividends by 2025 is nice but there are always more important things to prioritize and we need to get these things into alignment.

For example, Mrs. T and I need to be completely on board with our financial independence plans. That is why we discuss our plans frequently. We need to understand what each of us wants in life and align our needs and goals accordingly. It is just as important to get both kids involved, when they have the requisite maturity and understanding. At this point, Mrs T. and I must constantly have them at the forefront of any and all planning that we do. We need to focus on having happy and good family dynamics.

It does us no good if we plan to travel around the world for a year but someone in the family doesn’t want to do that. It also does us no good if we’re constantly bickering, arguing, and not having a good time.

Summary

Taking a closer look at our financial independence plans allows us to re-evaluate and determine if we’re on track or not. It also gives us the opportunity to make adjustments. Since projections and plans can – and do – change, as we get closer to 2025, we will be re-examining our plan, probably on an annual or semi-annual basis.

Plans are useful and important but we must have flexibility built into these plans. Because circumstances, both good and bad, will come along and we have no way of predicting them when you set out your plans.

For now, we will continue with our plan to live off dividends by 2025 and our five bucket approach. I think if we continue saving and investing, it is very possible to achieve our ultimate aim of living off dividends by 2025.

Dear readers, what do you think about our FI plans? Any suggestions?

This blog originally appeared on the Tawcan site on Sept. 5, 2022 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.

This blog originally appeared on the Tawcan site on Sept. 5, 2022 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.