By Myron Genyk, Evermore Capital

By Myron Genyk, Evermore Capital

Special to Financial Independence Hub

You see lots of people on business channels and investing blogs talking about the types of things to invest in when inflation is high – energy stocks, material stocks, value stocks, dividend growth stocks, floating rate bonds, inflation bonds, oil, copper, gold, silver, crypto, etc. OH MY! – and what types of investments you should avoid. On the surface, it’s pretty reasonable advice.

“Of course!! I should be invested in something that does well when inflation is high! Inflation is high now! And everyone says it’s going to continue like this for a long time! And I want my investments to grow!” But before we go leaping and investing in whatever it is that’s great during inflationary times, let’s explore the soundness of the argument itself.

The Tautology of it all

I’m always a little amused when people say things like:

“When market variable X is high (or low), that will cause thing Y to happen, which will cause thing Z to occur, which will cause some asset A to go up (or down). And so when market variable X is high/low/whatever, then buy (or sell) asset A. Easy peasy!”

There’s a lot happening there, but at its core, it’s just a chain of events: X leads to Y leads to Z leads to A going up (or down). At each step, there are assumptions baked in, assumptions that aren’t exactly baked into the fabric of the universe, but let’s leave that for now. Because what is more interesting here is that the expression above can be simplified as follows:

“When asset A is going to go up, you should buy asset A.”

This is much cleaner. It removes all the unnecessary hand-waving (but, perhaps the hand-waving IS necessary … but by whom? And for what purpose?) and lays bare what is actually being said:

“Buy things before they go up in value.”

Let’s pause here for a quick definition. A tautology is an expression that is obviously true by logical necessity. A classic example is “it is what it is”; of course it is! Another tautology is claiming that “tautologies are tautological in nature”. And perhaps saying that “’tautologies are tautological in nature’ is a tautology” is excessively tautological. You either get the idea or you don’t. (Fine, that was my last one, I swear.)

One classic investing tautology is “buy low; sell high.” Again, thanks Captain Obvious, great advice. But if you think about it, isn’t that last expression logically consistent with the longer expression we started with?

Leading Indicators

Alright, fine, perhaps I’m being a little unfair. There are things in this world called leading indicators, which are like the instigator in an economic “cause and effect” phenomenon. And there are plenty of things happening economically or geopolitically all the time that can cause the price of different things to move up or down in the future. Examples:

- Lots of people suddenly re-employed? Consumer spending will increase!

- There’s a strike at an American oil refinery? Gas prices will go up!

- A pandemic shut down 90% of flights and nobody’s driving anywhere? Gas prices will go down!

- Did interest rates go up? Housing prices will go down!

ANECDOTE TIME!

In a previous job at one of Canada’s big banks, I used to trade all sorts of asset classes, mostly commodity futures. I remember at 3:14 pm Eastern in around 2014 when some international energy agency tweeted that Saudi Arabia’s largest oil export terminal had exploded. Within seconds, the price of oil rose about $5 per barrel! For 15 long minutes, oil traders at ALL the banks and trading houses and commodity houses in the WORLD were trying to make sense of the new order of the world – other markets were affected, too … after all, the explosion may not have been accidental … – when suddenly, some website (I think it was ZeroHedge) revealed the tweet to be a hoax and the Twitter account to be fake. The price of oil dropped back down by about $5 per barrel, to where it was 15 minutes before, and everyone went back to calmly winding down their day.

That really exciting story has a point: market prices reflect all publicly available information.

What about Stocks and Bonds?

In the long run, both stocks and bonds have experienced positive returns, even after adjusting for inflation. That means, if held for long enough, buying a diversified portfolio of stocks or bonds, or stocks AND bonds together, would have eventually been worth more in real dollars.

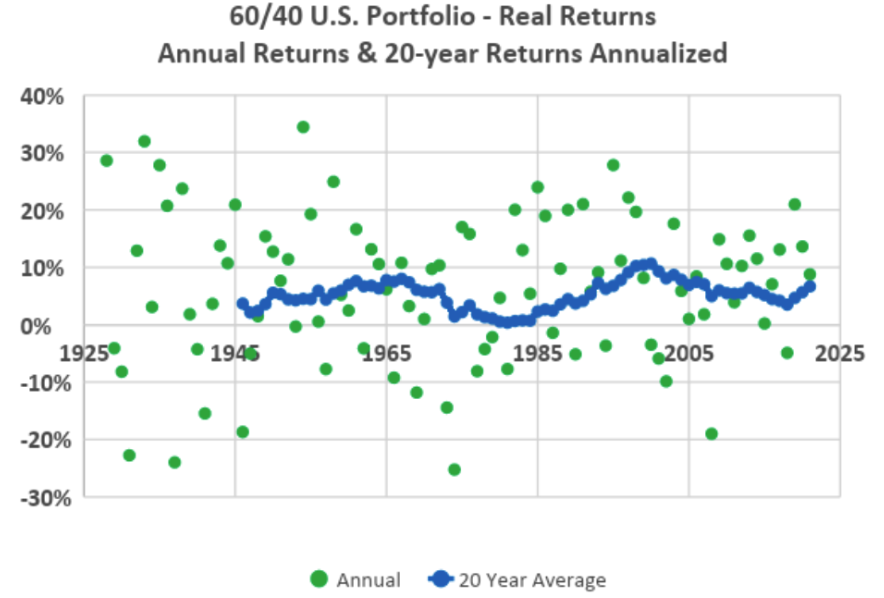

Fine, you ask, but what does the data say? Well, over the past 94 years (going back to just before the Great Depression), if you look over any 20-year period …

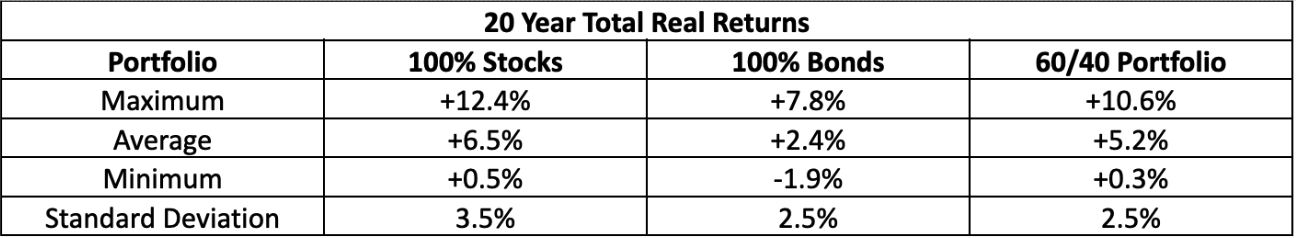

Stocks: The S&P 500 (an index of the largest 500 publicly traded American companies, more or less) had an average total (i.e including dividends) real (i.e. inflation-adjusted) return of 6.5% per year. The best 20-year period was 1942-1961 (post-WWII boom) when it realized total real annualized returns of 12.4%, and the worst 20-year period was 1928-1947 (Great Depression, WWII) when it realized total real annualized returns of 0.5% … still positive! Here’s a chart showing annual and 20-year annualized real total returns for stocks:

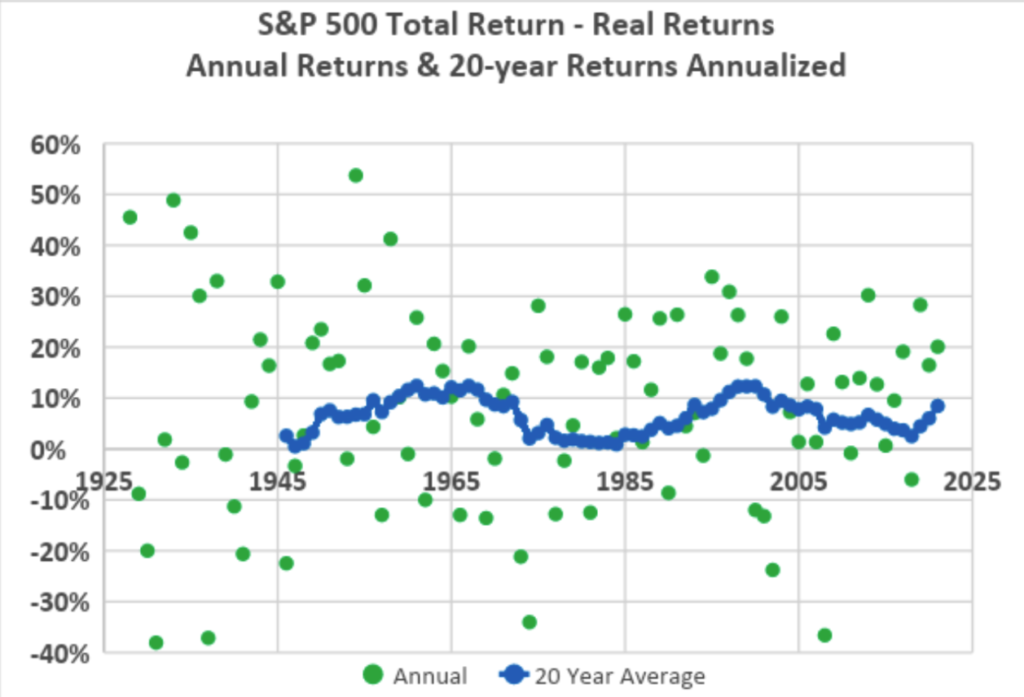

Bonds: If we look at a 50/50 mix of 10-year U.S. government bonds, and investment grade U.S. corporate bonds, again over any 20-year period going back to 1927, the average total real return was 2.4%! “They say” bonds are the worst during inflation, and maybe they aren’t super, but in the long-run, they usually beat inflation! Their best 20 years was the period ending in 2000, with an average real return of 7.8% per year, and their worst was the 20 years ending in 1981, when they realized an average real return of -1.9% per year. So, bonds performed less great than stocks, but it’s the classic risk-return trade-off: stocks have higher expected long-term returns, and the price you pay for that outperformance is greater short-term volatility. Here’s a chart showing annual and 20-year annualized real total returns for bonds:

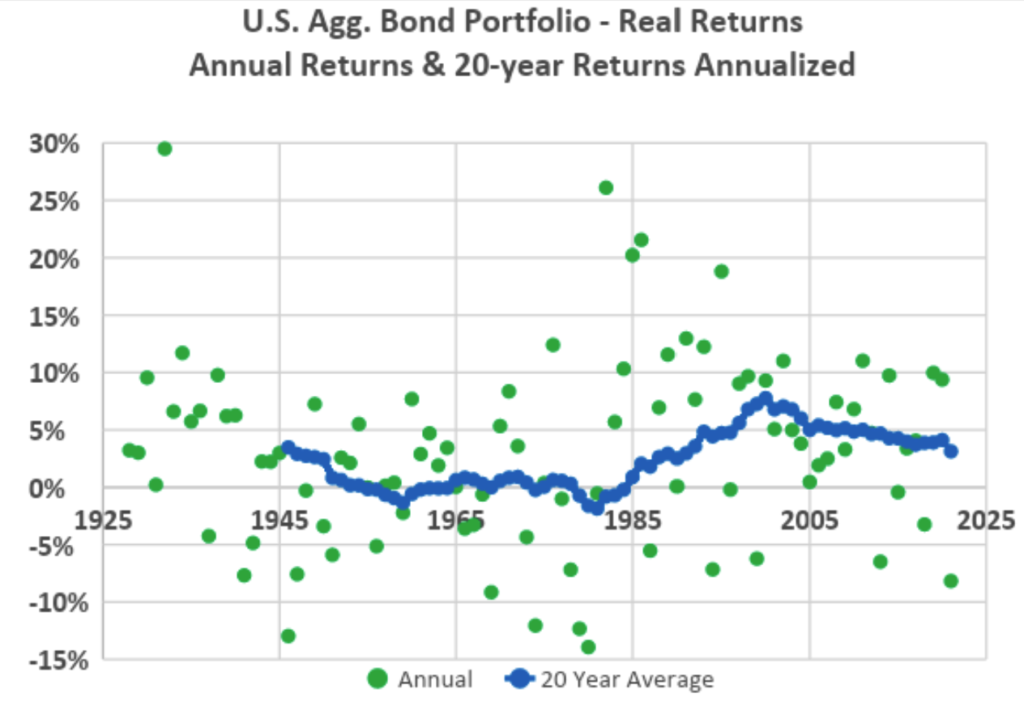

The Classic 60/40 Portfolio: Let’s take a balanced approach, and consider how 60% in the stocks described above and 40% in the bonds would have done. Using the same methods as before, the average real return was 5.2% per year, with the best 20-year period ending in 2000 at 10.6%, and the worst 20-year period ending in 1981 at +0.3%. (Yes, still positive, after inflation.) And here’s the chart:

And here’s a summary of the numbers I talked about above:

My Point Is …

Inflation has gone up a lot in the past year, and most people expect it to remain here for a while. If you’re investing in stuff *now* because inflation went up *months ago,” I hate to tell you, but you probably missed the boat. Inflation has already been priced in. (Remember my story about the imagined oil refinery explosion?) If you don’t believe me, consider how much stocks and bonds have fallen this year.

Any differential between things like value stocks versus growth stocks, for example, has already been priced in. What do I mean? Well, there are some big-name stocks that were growth stocks just last year, and have been punished so hard that they’re now value stocks.

So, what do you do with the money you want to invest? Despite advances in mattress technology, keeping your cash stuffed under a premium box spring hasn’t been this bad an idea since video killed the radio star. And picking winning sectors or styles or commodities or whatever is extremely difficult, and by the time you hear about an idea, it’s probably too late.

Consider investing in all the markets. Consider a diversified portfolio of low-fee index-based ETFs. If you’re looking to invest for your retirement, consider investing in a target date fund, like an Evermore Retirement ETF, each one a diversified portfolio of low-fee index-based ETFs. Because when you can’t (or don’t want to try to) pick winners and losers or time the markets, sometimes the best thing is just to own a little bit of everything. Especially when it’s never been easier to do so. After all, it is what it is.

Myron Genyk is the Co-Founder and CEO of Evermore Capital, a Canadian asset management company that issued Canada’s first and only target date ETF series aimed at retirement, Evermore Retirement ETFs. With over 15 years of Bay Street experience, Myron is now focused on making retirement investing easy and accessible to all Canadians.

Myron Genyk is the Co-Founder and CEO of Evermore Capital, a Canadian asset management company that issued Canada’s first and only target date ETF series aimed at retirement, Evermore Retirement ETFs. With over 15 years of Bay Street experience, Myron is now focused on making retirement investing easy and accessible to all Canadians.

Disclaimer: The information herein represents the author’s opinion and should not be taken as investment advice. Exchange traded funds (“ETFs”) come with fees and expenses (including trading commissions). ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the prospectus before investing.