By Fritz Gilbert, TheRetirementManifesto

Special to the Financial Independence Hub

The 4% safe withdrawal rule is a well-known “rule of thumb” for those planning for retirement.

One thing it has going for it is that it’s simple to apply.

If you have $1 Million, the 4% safe withdrawal rule says you can spend $40,000 (4% of $1M) in year one of retirement, increase your spending by the rate of inflation each year, and you’ll never run out of money.

Simple, indeed.

But, I’d argue that simplicity comes at a potentially very serious cost. Like, potentially running out of money in retirement.

Today, I’ll present my argument against the 4% safe withdrawal rule given our current economic situation, and propose 3 modifications I’d recommend as you determine how much you can safely spend in retirement.

Rethinking the 4% Safe Withdrawal Rule

I read a lot of information on retirement planning, and lately, I’ve been seeing more content challenging the 4% safe withdrawal rule. I agree with those concerns and felt a post outlining my position was warranted.

As a brief background, the 4% Safe Withdrawal Rule is based on the “Trinity Study,” which appeared in this original article by William Bergen in the February 1998 issue of the Journal of the American Association of Individual Investors. For further background, here’s an article that Wade Pfau published on the study. I’ll save you the details, you can study them for yourself at the links provided.

The conclusion, based on the study, is summarized below:

“Assuming a minimum requirement of 30 years of

portfolio longevity, a first-year withdrawal of 4 percent,

followed by inflation-adjusted withdrawals in

subsequent years, should be safe.”

My Concerns With The 4% Safe Withdrawal Rule

In short, some key factors about the study are relevant, especially as we “Rethink The 4% Safe Withdrawal Rule”

- It’s based on historical market performance from 1926 – 1992.

My Concern: Relying on past performance to predict future returns can mislead the investor, especially given the unique valuations in today’s markets (more on that below). This point is driven home by this recent Vanguard article that projects future returns based on current market valuations:

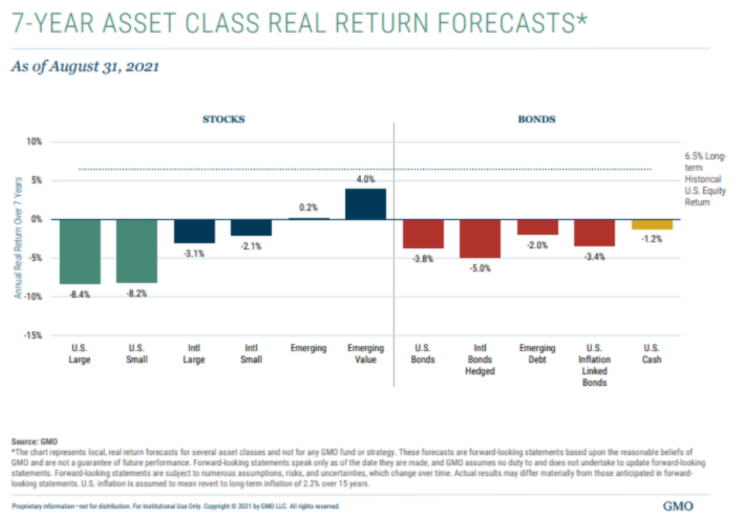

If you think the Vanguard outlook is depressing, check out this forecast from GMO as presented in this Wealth of Common Sense article titled “The Worst Stock and Bond Returns Ever”:

- Note the VG forecast is nominal (before inflation) whereas the GMO is real (after inflation).

Why Are Future Returns Expected to Be Below Average?

The biggest driver for the projected below-average returns is the high valuation in today’s equity market (particularly in the USA), and the fact that interest rate increases would negatively impact bond yield. In my view the CAPE Ratio is one of the best indicators of market valuations. Below is the current CAPE ratio as I write this post on November 16, 2021:

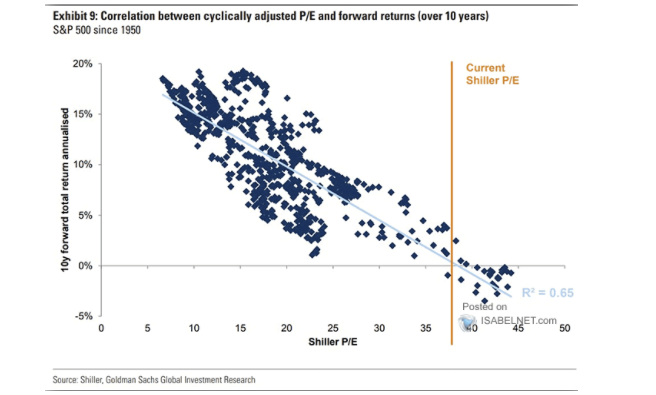

The reason current valuations matter is the fact that they’re highly correlated to future returns, as indicated from this concerning chart that I saw last weekend on cupthecrapinvesting:

Based on today’s CAPE ratio, the historical correlation suggests the forward total returns over the next 10 years could be close to 0%. Scary stuff for someone who’s planning on equity growth to pay for their retirement expenses. Scary stuff for someone who’s committed to the 4% safe withdrawal rule.

In addition to the bearish outlook for US equities, bonds could be negatively impacted if when interest rates increase. To get a sense of how low the US 10-year Treasury yields are now compared to long-term averages, below is the current chart of 10-year yields from CNBC:

Bond prices are inversely related to interest rates, so as rates go up, bond prices go down. So, if you’re holding 60% stocks and 40% bonds, it’s possible that you could see decreases in both asset classes.

As cited in this Marketwatch article, The Fed has begun signaling that interest rates are “on the table” for 2022, especially if the current bout of inflation proves to be less than a transitory event (for the record, I suspect it will be more than transitory, but what do I know?).

This brings us to the next concern …

My Other Big Concern With The 4% Safe Withdrawal Rule:

In addition to my concern above (the risk of an extended period of below-average market returns), I don’t like the part of the rule which states you should “increase your spending the following year based on the rate of inflation.” As most of you know, inflation has been on a bit of a tear lately, as demonstrated in this chart from usinflationcalculator.com:

Based on the 4% Safe Withdrawal Rule, you would be increasing spending next year based on the higher inflation rate, which could well be the same time you’re seeing lower than expected returns.

I don’t know about you, but that doesn’t sit well with me.

Suggested Modifications to the 4% Safe Withdrawal Rule

It wouldn’t be fair to cite my concerns with the 4% Safe Withdrawal Rule without suggesting an alternative. Following are the 3 modifications I’d suggest for your consideration. I’m applying all 3 of these modifications in our personal retirement strategy.

1.) Reduce Withdrawal Rate to 3.3%

Ironically, we’ve been targeting a 3.25% Withdrawal Rate since I retired 3.5 years ago. I based our target on the excellent Safe Withdrawal Rate Series from Early Retirement Now. The series comprises 48 posts dedicated to the topic, with more mathematics and graphics than you could imagine. I’m not ashamed to say that Karsten (“Big ERN”) is smarter than I am, and I respect his work. In a gross over-simplification of his amazing work, his conclusion is folks should target something in the 3.25% SWR range, and I took his advice.

Big ERN may have been the first to come up with that number, but more serious heavyweights in the industry have recently come on board. Most notably, Christine Benz and her team at Morningstar came out with a must-read postearlier this month titled What’s A Safe Retirement Spending Rate In The Years Ahead.

A quote from that article:

Using forward-looking estimates for investment performance and inflation, we estimate that the standard rule of thumb should be lowered to 3.3% from 4.0%, assuming a balanced portfolio, fixed real withdrawals over a 30-year time horizon, and a 90% probability of success. – Morningstar Nov 11, 2021

In fairness, I should point out that there are others who suggest an even more conservative approach. My friend Casey Weade, CEO at Howard Bailey summarized David Blanchett’s article Retirement Planning in the Post-4% World as follows:

2.) Adjust Your Spending Based on Market Returns

Rather than automatically adjusting your spending based on inflation, as suggested by the 4% safe withdrawal rule, we’re planning on adjusting our spending for the following year based on how the market performs in the current year. Each year during our Annual Financial Update, after we’ve updated our Net Worth, we multiply our retirement account balances by 3%, 3.5% and 4% to determine a range of potential spending for the following year. Thus far, the process has worked well and I plan on continuing it for the foreseeable future (especially given the fact that we retired “early,” and would prefer avoiding a 4% withdrawal rate until our mid-60s at the earliest).

There are a wide variety of “Dynamic Spending Rules” available. One I found of particular interest was included in this excellent Vanguard White Paper, which suggests a “ceiling” of 5% and a “floor” of -1.5%. I’ve included another dynamic spending strategy in the “Related Posts” section below titled “How Much Can You Safely Spend in Retirement.” Being willing and able to adjust your spending based on actual market returns has been proven to increase your statistical chances of not outliving your money, and I’d strongly encourage everyone to build some flexibility into your retirement spending plans.

3.) Include International Equity Exposure

I’ve long been a fan of maintaining a broadly diversified portfolio, and currently have 20% of our portfolio invested in international stocks (along with 40% in US equities, 30% in bonds/cash, and 10% in Alternatives). The CAPE warnings given earlier in today’s post are specifically related to the S&P 500, which is a USA-based index. Many folks argue that investing in a broad index like the S&P 500 brings sufficient global exposure based on the global sales of the companies included, but I prefer to have a “clearer line of sight” on our international holdings. In full disclosure and as a Vanguard fan, our holdings include their Total International Stock Index Fund (VTIAX) and All-World ex-US Small Cap Index Fund (VFSAX). We also hold some international bonds through Vanguards Total International Bond Index (VTABX).

As you determine your appropriate asset allocation for retirement, I’d encourage you to consider adding some international exposure in light of the current valuation differential between USA equities and those in other parts f the world. I’d also encourage you to study, and understand, Home Country Bias.

Related Posts:

- 10 Steps to Make Sure You Have Enough Money to Retire

- How Much Can You Safely Spend In Retirement?

- Seven Strategies to Make Your Money Last Through Retirement

Conclusion

Running out of money is one of the biggest concerns people have as they plan for, and live in, retirement. Given today’s unusual market environment, I urge caution. If you’ve been a fan of the 4% safe withdrawal rule, I hope today’s post has given you some things to think about.

The good news is this: With the above-average return of the market over the past few years, you may be surprised with how much you can afford to spend, even if you reduce your withdrawal rate. Morningstar did a nice job of summarizing the phenomenon. In summary, the higher returns have likely increased your net worth significantly, and a lower withdrawal rate may not impact your planned spending as much as you’d initially expect.

Do yourself a favor.

Run the numbers.

Be safe out there.

Your Turn: What are your thoughts on the risk, if any, of using the 4% safe withdrawal rule given today’s market environment? If you’re retired, what withdrawal rate are you currently using? Any plans to reduce it? If you’re close to retirement, what withdrawal rate are you using in your plans? Let’s chat in the comments…

Fritz Gilbert is the Founder of The Retirement Manifesto, a Plutus Award winning blog dedicated to helping people Achieve A Great Retirement. After 30+ years in Corporate America, most recently as a Commodity Trader, Fritz retired as planned in June 2018 at Age 55. He and his wife are looking forward to extended travel and “giving back” to their community through charitable work in retirement. This blog was published on his website on Nov. 18, 2021 and is republished here with his permission.

Fritz Gilbert is the Founder of The Retirement Manifesto, a Plutus Award winning blog dedicated to helping people Achieve A Great Retirement. After 30+ years in Corporate America, most recently as a Commodity Trader, Fritz retired as planned in June 2018 at Age 55. He and his wife are looking forward to extended travel and “giving back” to their community through charitable work in retirement. This blog was published on his website on Nov. 18, 2021 and is republished here with his permission.

If you stay away from bonds, I would feel comfortable with a 4% rule

S&P 500 returns 2009-2022:

2009 +26%

2010 +15%

2011 +2%

2012 +16%

2013 +32%

2014 +14%

2015 +1%

2016 +12%

2017 +22%

2018 -4%

2019 +31%

2020 +18%

2021 +29%

2022 -5%