Even if they’ve saved a million dollars, retiring baby boomers lacking Defined Benefit plans and their inherent longevity insurance justly fear outliving their money. It’s been said some fear this more than death itself.

Even if they’ve saved a million dollars, retiring baby boomers lacking Defined Benefit plans and their inherent longevity insurance justly fear outliving their money. It’s been said some fear this more than death itself.

The latest instalment of my MoneySense Retired Money column looks at an intriguing proposal made this week by the CD Howe Institute. Click on this highlighted text for the full link: An annuity that pays off — if you live long enough.

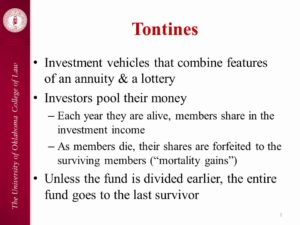

CD Howe has proposed the creation of a “pooled risk insurance” scheme called LIFE, which has all the hallmarks of a 17th century concept known as the tontine.

Annuity expert Moshe Milevsky — also a finance professor at the Schulich School of Business and author of books like Pensionize Your Nest Egg — says LIFE is a “great idea.” He actually made the case for the resurrection of “tontine thinking” three years ago in a book I reviewed at the time also at MoneySense: Tontine: Retirement Plan of the Future?

The CD Howe paper (Headed for the Poor House) authored by Bonnie-Jeanne MacDonald doesn’t actually come out and call LIFE a tontine scheme but it certainly appears to contain the DNA of one.

LIFE stands for Living Income for the Elderly. The idea is that by sharing mortality risk, those who make it to age 85 start to receive monthly payouts for as long as they live, funded in part by the less fortunate members who die between 65 and 84. Apart from normal investment returns, the lucky survivors would enjoy the “added return” of the mortality premium.

It’s worth noting that this feature is part of the design of traditional Defined Benefit pension plans, but is NOT incorporated into the Defined Contribution pensions that are displacing it, primarily in the private sector. Nor do those million-dollar RRSPs described in the FP article in the last Hub post include mortality risk sharing, or indeed TFSAs or non-registered savings.

It’s worth noting that this feature is part of the design of traditional Defined Benefit pension plans, but is NOT incorporated into the Defined Contribution pensions that are displacing it, primarily in the private sector. Nor do those million-dollar RRSPs described in the FP article in the last Hub post include mortality risk sharing, or indeed TFSAs or non-registered savings.

We’re big fans of Defined Benefit pensions here at the Hub but sadly they are disappearing everywhere but the public sector. Hence the term pension envy I often use to describe the growing disparity between the lush retirements of government workers, politicians and a handful of private plans (many associated with labour unions) and the “you’re on your own” situation of most middle-class private-sector workers.

For most of us without DB plans, the challenge is to convert those big RRSPs into annuities when it comes time (at the end of the 71st year) to choose between converting to a RRIF or buying an annuity. Indeed, this was the topic of an RBC blog post right here on the Hub earlier this week: How Annuities can fund a Full Lifestyle in Retirement.

Of course, this doesn’t have to be an all-or-nothing decision: you can gradually and partly annuities, perhaps starting at 65, adding more at 70 and beyond, which we’ll explore in the coming months here at the Hub and in various other media outlets.

Anxious retiring Boomers focus of upcoming Zoomer TV show.

Certainly these topics featured in the Post and MoneySense are top of mind for Boomers already retired or worried about doing so and suffering a precipitous drop in income. This dilemma was the theme of an upcoming instalment of Zoomer TV.

I was one of several panelists for a taping before a live audience on Wednesday: once it runs I’ll post a link on my social media feeds. I do know the episode attracted a larger-than-usual attendance, and they were primarily aging boomers — sorry, Zoomers! — all of whom felt anxious about generating enough money to retire comfortably.

With 1,100 Canadian baby boomers turning 65 every day (I’ll do so myself in April), pension envy isn’t going to be going away any time soon. Those of us fortunate enough to have long lives indeed need to start worrying about outliving their money. Studies have shown that many fear outliving their money more than death itself.

So why not embrace tontine thinking and embrace innovative new products that pool mortality risk? But while you’re waiting for it, remember to max out your RRSP contribution for calendar 2017. The deadline is March 1, 2018.

I see this LIFE annuity effective as the monthly payout could be designed to top-up CPP/OAS to the amount of your essential lifestyle spending WITHOUT indexing. If you happen to live longer than average, the extra mortality premium would boost your income. An efficient way to design guaranteed income around your mortality.