Special to the Findependence Hub

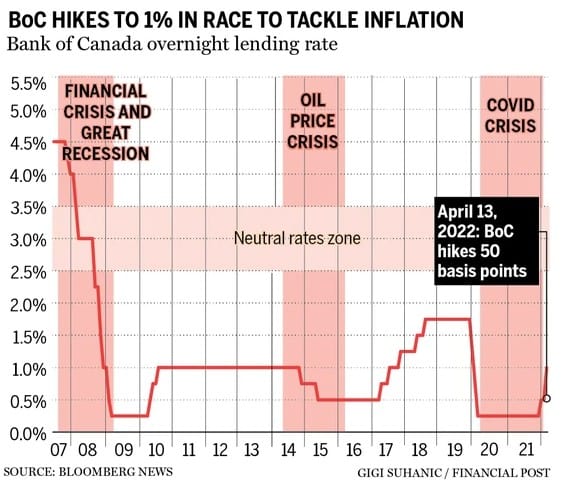

Lately, the talk of the town seems to be rising interest rates. In April, the Bank of Canada raised the benchmark interest rate by a whopping 0.5% to 1%, making it the biggest rate hike since 2000. Given the high inflation rate, it is almost a given that these rate hikes will continue throughout 2022 and beyond. [On July 13, 2022, the BOC hiked a further 1%: editor.]

But before you freak out, let’s step back and look at the big picture. At 1%, the benchmark interest rate is still relatively low compared to the past interest rates.

I still remember years ago before the financial crisis, being able to get GIC rates at around 5%. And some people may remember +10% interest rates in the 80s or early 90s. Back then, interest rates were much much higher than measly below 1% rates we’ve been seeing the last decade.

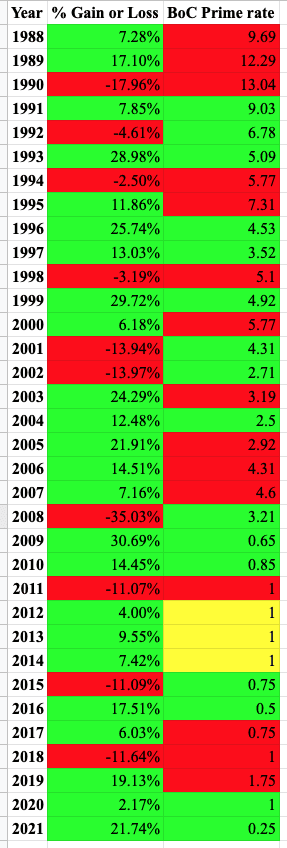

Does that mean the stock market will start performing poorly and we should all switch to buying bonds and GIC’s and forget about the stock market?

Well, not necessarily. I looked around on the internet for data and put together the TSX performance vs. BoC prime rate comparison table below. Please note, this is not the most scientific study and I took data from multiple sites.

And what about the Canadian real estate market? The rising interest rates should for sure put some pressure on the high housing price in Canada. Will the higher borrowing cost, ban on foreign home purchases for two years, taxation for property flippers, and end of blind bidding cool down the hot Canadian housing market? I guess we’ll have to wait and see.

Good Reads From The PF Community

Here are some good reads from the personal finance community that I’ve come across in the past few weeks.

I always enjoy Dave at Accidental FIRE’s unique writing perspective and style. The Money to Anxiety Ratio is something we should all consider when we examine our mental health – “she took more than a $150,000 pay cut for her new job in Norfolk. Her new job is as a lawyer for the Department of Defense, aka the Federal Gubment. And even though her pay was cut by more than twice the amount of the median household income in America, she’s happier than ever. At one point she texted me “my anxiety to money ratio is better than I could have ever imagined. This is what healthy living feels like, I should have done this earlier.” Money to anxiety ratio. What a great concept. She now works 40 hours a week, no more. She never works on weekends. Her caseload is reasonable. So although her pay went down a sh$t-ton, her anxiety level went down even more.”

Amazon, Alphabet, Tesla, CIBC are all planning to split their stocks to reduce the share price in 2022. Preet made an excellent video explaining stock splits.

Darius Foroux explained The Paradox of Happiness: Why desiring more makes us miserable – “When you see someone with a desirable career, your mind might downplay your own, and say, “Maybe you should change your job.” I became aware of the thought pattern and quickly stopped it by ignoring my thoughts. The truth is that more things will not make you happier. In fact, I believe that anything beyond having enough can only destroy your happiness. That’s because chasing desires is an endless pit that can really harm you.”

Most of us invest in RRSP and TFSA to take advantage of these tax-advantaged accounts. But what happens when you need the money? Mark from My Own Advisor wrote an excellent article on How and when to withdraw from RRSP and TFSA – “We don’t intend to touch our TFSA assets in any early retirement years at all… Instead, this will allow both TFSAs to compound over time. In our 70s, with RRSP/RRIF assets largely gone, our plan will be to live off tax-free income from our TFSAs and government benefits (CPP and OAS). I’ve anticipated our TFSAs are likely going to be worth hundreds of thousands of dollars in the coming decades, which should be more than enough to fund senior care. So, our NRT drawdown order will support that.“

Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This blog originally appeared on the Tawcan site on Apr. 22, 2022 and is republished on the Hub with the permission of Bob Lai.

Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This blog originally appeared on the Tawcan site on Apr. 22, 2022 and is republished on the Hub with the permission of Bob Lai.