By Justin Bender, CFA, CFP

Special to Financial Independence Hub

In our last blog/video, we introduced the all-equity ETFs from iShares and Vanguard. These ETFs make it easy to gain and maintain exposure to global stock markets with the click of a mouse, eliminating the hassle of juggling several ETFs in your all-equity portfolio.

Vanguard and iShares don’t offer their services for free though.

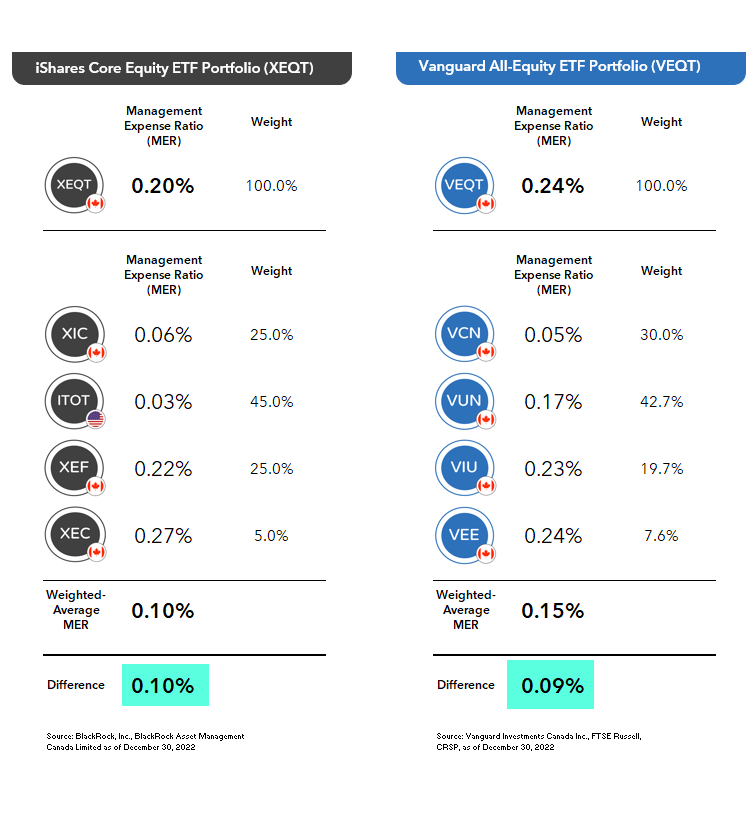

The MERs for their all-equity ETFs are slightly higher than the weighted-average MERs of their underlying holdings. Consider this modest surcharge as the price of admission for their professional asset allocation and rebalancing services. In my opinion, that’s a bargain for most investors.

Then again, there are those who might prefer to squeeze every last penny out of their portfolio costs. If that’s you, you may want to try skipping the value-add of an all-equity ETF, and simply purchase the underlying ETFs directly, in similar weights. If you take on the task of rebalancing back to your targets each month when you add new money to your portfolio, you should be able to mimic an all-equity ETF for a lower overall MER.

That’s the goal anyway. But it’s still going to take time, money, or both to keep your asset allocations on track each month. Let’s look at three potential strikes against trying to reinvent an all-equity ETF on your own, as well as one potential play that may serve as a suitable compromise.

Strike One: The potential cost savings are minimal.

For example, let’s say you’ve got $10,000 to invest. Instead of investing it in the Vanguard All-Equity ETF Portfolio, or VEQT, you could divide it up among VEQT’s component funds. The estimated cost savings might let you rent an extra movie each year, but are the savings really worth it? The extra time you’ll need to spend on rebalancing may not leave you much time to even enjoy your movie.

For larger amounts, the fee savings start adding up, but only if you can buy and sell ETF shares at zero commission as you rebalance. If not, you can forget about it.

Strike Two: Managing a portfolio of four ETFs (instead of just one) will be more difficult.

Sticking with our VEQT example, a DIY investor would either need to visit Vanguard’s website monthly to collect the individual ETF weights within VEQT, or use the market cap data from the FTSE and CRSP index fact sheets to determine how to allocate each of the underlying ETFs. They would then need to calculate how many ETF units to buy or sell across various accounts to get their portfolio back on target, and place multiple trades to get the job done.

If you were to perfectly execute this strategy each month, you may be able to eke out slightly higher returns than VEQT. If we compare VEQT’s past returns to the aggregate performance of its four underlying ETFs since February 2019, we see our component strategy did outperform VEQT during this time – which is good news.

But again, this assumed you made no mistakes along the way, rebalancing your portfolio like clockwork each month. With a busy schedule and constant distractions, could you honestly say you’d never miss a beat?

Strike Three: You’ll be working with stale data.

Let’s discuss whether we mere mortals really could flawlessly replicate VEQT’s returns by buying and rebalancing its underlying funds. While you can probably come close, perfection seems out of reach.

Consider, for example, Vanguard’s resources versus your own. Vanguard has constant daily inflows and outflows from thousands of investors, and they can use these flows to continuously fine-tune their target asset mix. They also have up-to-the-minute market cap index information to improve their aim.

You’ve got you, rebalancing monthly, based on more limited index information. It usually takes a couple weeks before Vanguard updates their website with VEQT’s asset class weightings from the previous month-end. The FTSE index data is also only publicly available several days after month-end, and the CRSP index data is only available several days after the end of each quarter. This means DIY investors will never be working with the most current ETF target weightings when rebalancing their portfolios each month.

Again, you can still probably come close. But there will be random differences, which will lead to positive or negative tracking error. In other words, if you’re unlucky, through no fault of your own, negative tracking error could potentially cost you more than the reduced MER may save you.

Bottom line, even if you perfectly execute your own buy-and-rebalance-monthly strategy, there’s still a risk you might underperform an all-equity ETF anyway, even after fee savings.

So does this mean we’ve struck out on building a cheaper all-equity ETF portfolio? Actually, there is one more play to consider.

You could ditch your three foreign equity ETFs for a single fund. Just like VEQT, the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC) also weights its underlying U.S., international, and emerging markets equity regions by market capitalization. This makes it a decent substitute for the VUN, VIU, VEE combination.

The main difference is that VXC’s U.S. equity allocation excludes micro-cap stocks, while VUN includes them. However, this small difference is not expected to have a material impact on VXC’s returns.

To use this approach, you would invest 30% in VCN and 70% in VXC, rebalancing the portfolio back to these target weights each month. The weighted-average MER of a VCN/VXC combo is also similar to the fees of our four-fund approach.

A back-test of this strategy also yielded similar results, but with tighter tracking and much less effort.

All things considered, I still prefer the simplicity of an all-equity ETF. But if you just can’t stand the thought of potentially leaving some cash on the table, a two-fund approach might be an appropriate compromise for you and your portfolio.

Justin Bender, CFA, CFP is a Portfolio Manager with PWL Capital in Toronto, where he helps clients reach their financial goals through disciplined, low-cost investing. With more than a decade of experience managing portfolios, Justin is focused on keeping costs and taxes low for his clients. His skills as an analyst and researcher have made him widely respected in the ETF industry.

Justin Bender, CFA, CFP is a Portfolio Manager with PWL Capital in Toronto, where he helps clients reach their financial goals through disciplined, low-cost investing. With more than a decade of experience managing portfolios, Justin is focused on keeping costs and taxes low for his clients. His skills as an analyst and researcher have made him widely respected in the ETF industry.

After graduating from the University of Guelph, Justin spent two years with a large mutual fund company and quickly learned that the financial industry doesn’t always serve its clients well. He spent his lunch hours reading books by John Bogle (the legendary founder of Vanguard) and hoped to one day work with a firm that put investors first. He joined PWL in 2007 and obtained his Certified Financial Planner designation the following year. He earned the Chartered Financial Analyst designation in 2010. This post originally appeared on the Canadian Portfolio Manager blog and is republished on the Hub with permission.

Justin, this comparison is very compelling. Switching to an all-in-one ETF won’t work for our TFSA and non-registered accounts as we only have Canadian equity in the latter, with the rest of the world in the TFSAs (plus some Canadian equity, as required). However, it might be a good fit for our RRIFs and LIFs. We are in the pension plan draw-down phase, so would an all-in-one ETF still work? Currently, we sell the “winning” assets quarterly, putting the cash into CASH.TO, and pull the cash out once a year, bringing the accounts back to the target allocation. This *feels* like we have more control as we know for sure that we’re only selling the winning assets, but are we mistaken and all-in-one, or the two-ETF option, will produce the same result? Thanks