Special to the Financial Independence Hub

It is always great to see innovation and new products in the banking and investing industry. A few months ago, CIBC introduced the Canadian Depositary Receipts (CDRs) on the NEO Exchange as a way to provide Canadian investors with yet another option for investing in non-Canadian companies.

Canadian Depositary Receipts, or CDRs, may not be a familiar name for many readers. However, some readers may be aware of American Depositary Receipts, or ADRs. ADRs have been trading in the US for many years as a way for investors to buy shares of companies that are listed outside of the US. For example, we own Unilever PLC via the Unilever ADR listed on NYSE. In case you’re wondering, there are many ADRs available on the NYSE.

With CDRs becoming increasingly more popular, a few readers have emailed me about whether it makes sense to invest in CDRs instead of directly trading US stocks.

What are Canadian Depositary Receipts (CDRs) and what are the benefits?

Canadian Depositary Receipts are created to allow Canadian investors to buy US stocks in Canadian dollars. For now, CDRs represent shares of US companies but are traded on the NEO Exchange. Since CDRs are traded on a stock exchange, you can view them like traditional stocks. Owning CDRs means you would receive dividends (if the company pays dividends) and have voting rights to the underlying company you’re holding.

What makes CDRs very attractive is the fact that you can buy them in Canadian dollars. You no longer need to convert CAD to USD and pay the extra currency conversion costs or perform Norbert’s Gambit. By buying CDRs in Canadian dollars, it is more cost effective. In addition, there are no management fees associated with CDRs.

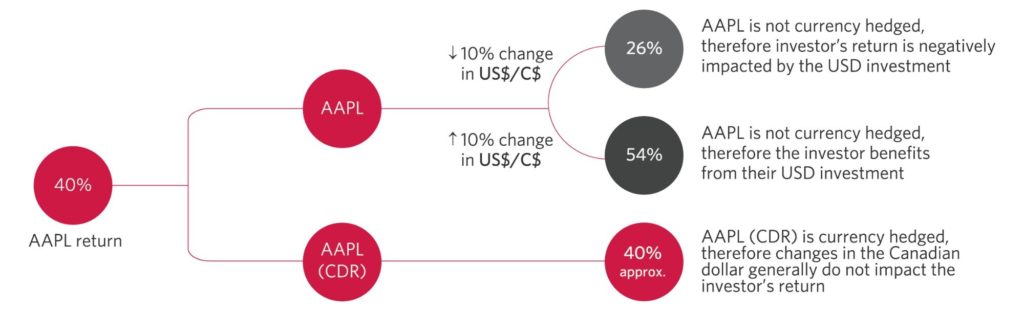

There is a built-in currency hedge in CDRs which eliminates the impact of exchange rate fluctuations over time. Therefore, in theory, the returns of the CDRs are tied directly to the performance of the underlying stocks and you do not have to worry about currency fluctuations.

Since the initial price for each CDR is around $20, CDRs allow Canadian investors to own fractional shares of the underlying stocks at a much lower cost. Essentially, CDRs utilize a ratio called the CDR ratio to represent the number of shares of the underlying stock. The CDR ratio is adjusted automatically daily to account for the currency hedge. If the Canadian dollar increases in value compared to the US dollar, the CDR ratio is adjusted to represent a larger number of underlying shares. The reverse is done when the Canadian dollar weakens.

In other words, rather than buying one share of Amazon at around $3,500 USD or $4,500 CAD, you can hold a few shares of Amazon CDR at around $20 per share at a much lower overall cost. You would still get all the equivalent benefits as a regular Amazon shareholder.

What stocks are available as Canadian Depositary Receipts?

When CDRs were launched in July 2021, CIBC had only a handful of CDR stocks available to trade. Since then, CIBC has added more and more CDR stocks. At the time of writing, there are 18 CDRs available on NEO Exchange:

| Symbol | Name | Price | Trades | Volume |

| AMZN | AMAZON.COM CDR | 21.5 | 352 | 53,220 |

| GOOG | ALPHABET INC. CDR | 25.05 | 382 | 73,588 |

| TSLA | TESLA, INC. CDR | 32.66 | 1,779 | 207,169 |

| AAPL | APPLE CDR | 25.34 | 342 | 56,092 |

| NFLX | NETFLIX CDR | 25.11 | 125 | 10,358 |

| MVRS | META CDR | 18.68 | 181 | 8,509 |

| MSFT | MICROSOFT CDR | 24.94 | 437 | 64,181 |

| PYPL | PAYPAL CDR | 14.6 | 348 | 44,410 |

| VISA | VISA CDR | 20.13 | 292 | 33,288 |

| DIS | WALT DISNEY CDR | 18.32 | 339 | 24,460 |

| AMD | ADVANCED MICRO DEVICES CDR | 28.21 | 197 | 9,498 |

| BRK | BERKSHIRE HATHAWAY CDR | 22.1 | 147 | 25,926 |

| COST | COSTCO CDR | 25.67 | 155 | 8,254 |

| IBM | IBM CDR | 19.24 | 31 | 4,391 |

| JPM | JPMORGAN CDR | 22.48 | 25 | 1,143 |

| MA | MASTERCARD CDR | 21.97 | 111 | 14,719 |

| PFE | PFIZER CDR | 24.79 | 147 | 6,796 |

| CRM | SALESFORCE.COM CDR |

As you can see, there are some really big name, very popular stocks like Apple, Tesla, Alphabet, Netflix, Meta, and Berkshire Hathaway available as CDRs. I am virtually certain that CIBC will add more CDRs on NEO Exchange going forward.

Where can I buy Canadian Depositary Receipts?

Since CDRs are traded like normal stocks on the Canadian stock exchange, you can purchase these CDRs through any online discount broker, such as TD Direct Investing, Questrade, and National Bank Direct Brokerage. You can also trade CDRs on WealthSimple Trade.

Because these CDRs have the same symbols as the US equivalent, you need to pay extra attention to make sure you select the correct stock symbol when purchasing. For example, when you search Apple on WealthSimple Trade, Apple listed on NASDAQ and Apple CDR listed to NEO Exchange both will show up. If you do not pay attention, it is easy to select the Apple listed on NASDAQ and put in a buy order.

It would be a shame to end up buying US listed shares and incur currency exchange fees when that was the very opposite of what you intended to do.

Should you invest in CDRs?

It is always positive to have options, so I think overall CDRs are great for Canadian investors. Should you invest in CDRs? Well, that depends on your situation and preference.

If you are comfortable doing CAD to USD conversions using Norbert’s Gambit, then perhaps CDRs aren’t the right product for you. Now, if you don’t want to worry about currency exchange and just want to hold your portfolio in Canadian dollars, then I believe CDRs are a great option. Furthermore, rather than needing to invest around $4,500 CAD to hold a share of Amazon, you could hold a few shares of Amazon CDR with a much smaller investment.

If you do invest in CDRs and hold them in non-registered accounts, please note that the typical tax treatments for non-Canadian stocks apply. This means dividends paid from CDRs will be considered as regular income and a 15% withholding tax will be applied. You do get a 15% foreign tax credit to offset this withholding tax. You will also need to fill out W-8BEN form with your broker. If you don’t, the withholding tax will be increased to 30%.

Holding CDRs and holding fractional shares of the underlying companies also will allow you to have more geographical diversification. However, given the limited number of CDRs available, for geographical diversification purposes, you might be better off holding either VXC or XAW.

My thoughts on CDRs

Overall, I think CDRs are a great tool for Canadian investors. Here are a few of my thoughts on CDRs.

- Currently, CDRs are only for US stocks, allowing US stocks to be more accessible to Canadian investors through fractional ownership. I really hope in the future CIBC can offer CDRs for non-US, international stocks, like Samsung and other stocks that aren’t traded in the US as ADRs. In other words, non-North American stocks that are hard to purchase for the average Canadian. This would give Canadian investors more options and the possibility of investing in international companies rather than having to rely on index ETFs.

- I get the attraction of owning the likes of Apple, Tesla, Amazon, and Google at a fraction of the cost. But for me, why buy an Apple CDR when you can buy the real version just as easily? I would rather own these companies in USD and full shares rather than utilize CDRs. However, this is totally a personal preference though.

- For an investor considering purchasing CDRs,as noted earlier, it is very important to pay attention to the ticker symbol prior to the purchase. For example, AMNZ (NASD) vs. AMAZ (NEO). Given I have had mistakenly selected the wrong ticker on Questrade before (i.e. RY (NYSE) rather than RY (TSX) ), I can see myself making the same mistake with CDRs as well.

- The 18 CDRs available all have a high trading volume on the US exchanges. But the CDRs are not heavily traded on the NEO Exchange, so liquidity may be an issue. If you hold the JPM CDR and want to sell it, will you be able to sell it quickly, especially given there were only 25 trades total on the day I wrote this article? Will the popularity of CDRs increase over time so trading volume will increase? That’s a big question. Another question is whether the NEO Exchange will be able to handle the almost certain increase in volume.

- Because the CDRs are only lightly traded currently, the price tracking to the actual underlying stock may be off from time to time due to the bid/offer spreads. For example, Tesla might be trading with a 0.5% loss but the Tesla CDR might be trading at a 3% loss. This can go the other way too when the stock is gaining. As CDRs get more popular, this issue should resolve itself.

- I am not fully convinced that hedging will result in long term gains between Canadian dollars and US dollars. Sure, short-term the CAD and USD exchange rate does fluctuate, but over the long term, the exchange rate usually stays around the same level. Currency hedging might make sense for more volatile currencies.

- For now, I will just continue to buy the actual US stocks rather than relying on CDRs. If CIBC and the NEO Exchange start to offer CDRs for international companies that are not listed on the US exchanges, I may consider buying them.

Canadian Depositary Receipts – Summary

Although ADRs have been around for many decades, the Canadian Depositary Receipts, or CDRs, are a relatively new product in Canada. For some Canadian investors, investing in CDRs and not having to deal with currency exchange makes a lot of sense, especially when you consider that CDRs also offer fractional share ownership, currency hedging, and full shareholder benefits.

For me, since I do not find currency exchange between CAD and USD that troublesome, I prefer to own the actual stocks listed on the US exchanges. The real benefit, I think, is when there are CDRs that track hard to purchase non-US-exchange-listed stocks.

Dear readers, are you currently investing in CDRs? If so, I would love to hear your reasons for using CDRs.

This blog originally appeared on the Tawcan site on Dec. 20, 2021 and is republished on the Hub with the permission of Bob Lai. Here’s his bio: Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,250 dividend per month, which covers >55% of our expenses.

This blog originally appeared on the Tawcan site on Dec. 20, 2021 and is republished on the Hub with the permission of Bob Lai. Here’s his bio: Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,250 dividend per month, which covers >55% of our expenses.

Great article but there is no mention of PFIC status/benefit…

Hi Bob. Great article. You ask why I would consider using CDRs. Well perhaps you could help me figure out how to buy say $10,000 worth of US$ stock without buying CDRs. . What’s the currency charge fee I’m going to pay to buy the stock ? 2% ? Then selling I face another 2% in my Cdn $ account? I hate buying US$ for travel as the rate is unfair and fees very high. Yes I have set up a US$ trading account and have never got it started. I know I would only need to buy currency once and keep US dollars in it. But how much would it cost on exchange fees for $10,000 or $100,000 then. Do you carefully analyze costs to buy US$ from your broker?

I look forward to your feedback.