By Dale Roberts, cutthecrapinvesting

Special to the Financial Independence Hub

Most investors do not like volatility. They do not like looking at their investment account balance observing that they’ve ‘lost money.’

Of course, you have not lost money until you buy an asset at a certain price and then sell at a lower price. You’ve then just realized your losses. You have not lost money when your portfolio value goes down. And in fact, swings in portfolio values are just par for the course. Stocks and bonds and real estate change in price (with wild swings at times) in regular fashion: it’s normal behaviour. If the stock markets have you spooked, there is a simple and timeless plan of action.

With this strategy, you can ‘win’ if stocks go up. You can win if stocks go down. It’s a strategy that worked during the worst period in stock market history: the Great Depression of the 1930s .

The answer of course is adding money on a regular schedule. In the investment world they call it dollar cost averaging; we can abbreviate that to DCA. There is no need to guess about which way the market is going to go today, next week, next month, next year, or even the next five years. We simply expect or hope that the markets will go up over longer periods, as they have throughout history.

Stock market history

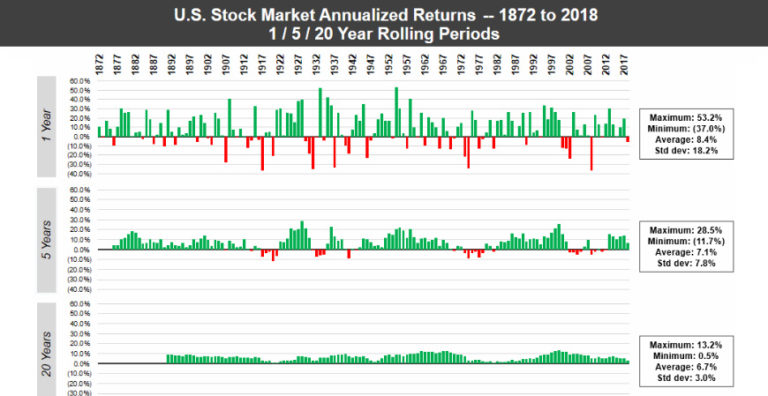

You can see that there is lots of green on the board. Stocks mostly go up. It is those pink years (on the table) that usually trip up many investors

The key to long-term wealth building is being able to invest through those down years. And in fact, adding money in those years is quite beneficial as the stocks go on sale.

But keep in mind that stocks can stay under water for extended periods.

Dollar cost averaging

Now this is a consideration for those who have very little exposure to stocks, or who have been out of the markets for quite some time. That event is not as rare as you might think. Many investors have left the markets, though they recognize that they need to be invested to reach their financial goals and enjoy a prosperous retirement. They also want their wealth protected from inflation.

Here’s the demonstration: investing through the initial stages of the Great Depression.

In the above charts we see equal amounts invested, but the dollar cost averaging strategy still delivered positive returns in a vicious bear market. Buying at those lower prices was very beneficial. Now keep in mind for the above to work, the markets have to go up over time. They have to recover. And historically they have.

Time reduces risk

Here is a wonderful graphic that demonstrates the returns over various periods. Our odds increase as we lengthen the time period that we remain invested.

And a table that frames the probabilities of positive returns.

Spread out that lump sum

If you are sitting on a large sum that you want to get invested you will have to have a plan. Over what time period should you get those monies into the market?

If you start investing and the markets keep going up, great. Mission accomplished. The money you’ve invested has increased in value. You are collecting dividends along the way.

But of course when we enter a stock market correction, your total portfolio value will decline. Though you might get enough of a head start so that your money invested remains in positive territory.

At that point when markets are declining, remember that lower prices are good. The stocks are going on sale. And of course, you do not have to invest in an all-equity portfolio. You can dollar cost average into a balanced portfolio.

I’d suggest that you spread the money out over 2 or 3 years. For example, If you are on the 2-year plan and have $100,000 to invest and you’re investing every month, you’d invest $4,167 per month.

You can’t time the markets

For those who already have substantial assets invested, you can’t move in and out of the markets. We don’t know when the corrections will occur. The most reasonable course of actions is still dollar cost averaging. That said, whenever you have money to invest, stock market history says get it invested. The sooner the better.

From My Own Advisor here ‘s – Dollar cost averaging vs lump sum investing.

Invest within your risk tolerance level

This is key. If you get scared and sell, you might lose money.

You might have to accept a lower-risk portfolio that is likely to earn less over time compared to a more aggressive stock-heavy portfolio or balanced portfolio. It’s also possible that you do not have the risk tolerance to invest (at all), even in a very conservative ETF portfolio. If that is the case you would have to stick with GICs and high-interest savings accounts. You might add to your real estate exposure for growth. In retirement, you might use annuities to boost your income.

For savings we use EQ Bank. 3-and 6-month GIC’s now 2.05%

To help gauge your risk tolerance level and the appropriate level of portfolio risk, please have a read of the core couch potato portfolios on MoneySense. You’ll find a table within that post that breaks it down.

If you are risk averse, you likely need a managed portfolio and advice. You might consider a Canadian Robo Advisor. These investment companies provide lower-fee portfolios at various risk levels. Advice is also included. A few of these firms also offer financial planning.

At Justwealth, you get access to advice and financial planning. In fact, you’ll have your own dedicated advisor.

Justwealth. The Canadian Robo Advisor that knows when to get personal.

They will do a risk evaluation to see if investing is right for you, and then you will be placed in the appropriate portfolio(s). And once again, you’ll be offered the greater financial plan as well.

Start investing

Preet [Banerjee] puts some of the above in video form [YouTube.com]. Preet also goes over how much you might market over various time frames, at different rates of return.

Preet [Banerjee] puts some of the above in video form [YouTube.com]. Preet also goes over how much you might market over various time frames, at different rates of return.

The key is to not be frozen on the sidelines. We might refer to that as ‘paralysis by analysis’.

Build wealth at your own comfort level, at your own pace. You will learn as you go. You can build up your comfort level for risk and volatility. It’s quite possible that you can increase your risk tolerance level over time. We develop risk callouses.

Walk before you run, perhaps.

Robo Advisors are a great training ground for investors.

Thanks for reading. We’ll see you in the comment section. If you’re not sure what to do, feel free to flip me a note.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on Feb. 12, 2022 and is republished on the Hub with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on Feb. 12, 2022 and is republished on the Hub with his permission.