By Elias Barbour, Clearbridge Investments

(Sponsor Blog)

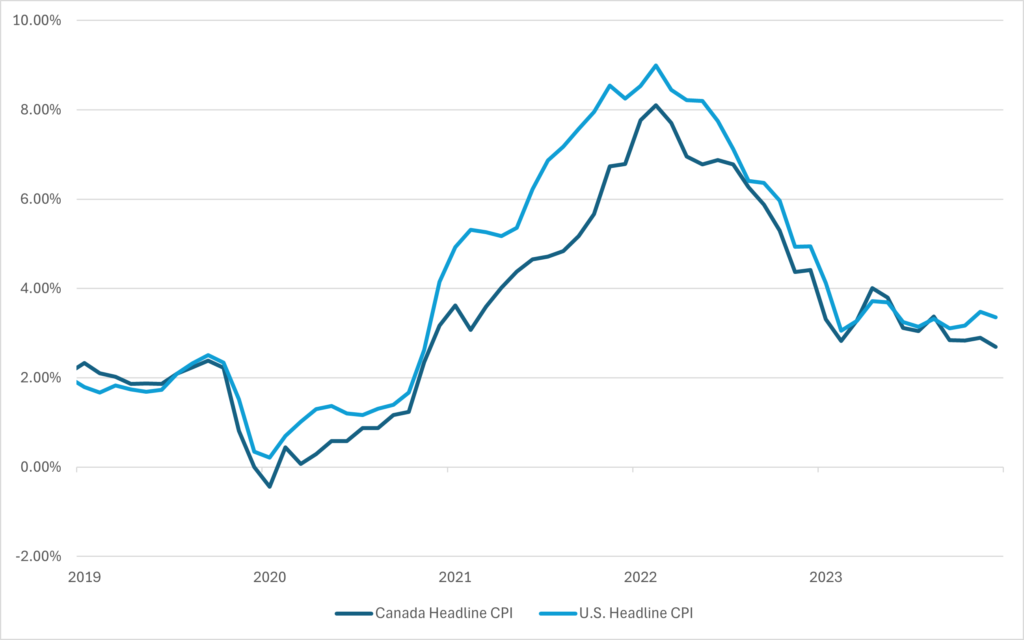

Inflation continues to be the biggest near-term driver for equity markets, given its influence on central bank decision-making regarding interest rates. Inflation rates have moderated from their peak levels; however, they remain above the 2% targets set by the Bank of Canada (BoC) and the U.S. Federal Reserve (Fed).

U.S. and Canada Inflation

As of April 30, 2024

Equity markets entered 2024 with six to seven U.S. interest rate cuts priced in over the course of 2024, with the first cut expected in March. Clearly, that did not happen. Both central banks have remained on hold, which has contributed to higher rates across the yield curve. That number has since moderated to only three cuts, and the timing of the first cut has now been pushed out to June in Canada and even later in the United States.

The effect of “higher for longer” interest rates has been particularly painful for interest rate-sensitive market sectors such as utilities and communication services. Nonetheless, pockets of the market that were expected to continue to grow have continued to advance, undeterred by the yield curve shifts.

Buoyed by hopes for a pivot in monetary policy as inflation trended closer towards the central banks’ targets, Canadian equities had a strong start to the year, although they paled compared to the ongoing boom in U.S. equities, where a large portion of the gains were derived from mega-cap information technology and related names with less representation in Canadian markets.

Mind the lag

Although decelerating, the economy continues to show sufficient resilience, with customer spending remaining robust since the reopening of economies after the global pandemic-induced shutdowns. Fiscal stimulus has moderated since the immediate aftermath of the pandemic outbreak; however, fiscal policy continues to operate at odds with monetary policy. Labour strength and wage gains have further reinforced this view, fuelling fears of lingering inflation and the potential for a higher-for-longer rate environment.

Despite the seemingly resilient macroeconomic backdrop, we remain mindful of the typical lag between interest rate changes and their associated impact on economic growth. As such, we expect the pick-up in rates that started in 2022 will inevitably have an impact on growth. Additionally, geopolitical risks remain top of mind and could further weigh on the prospects for the economy.

The market consensus is for somewhere between a soft landing and no landing. Given extreme equity market levels (i.e. valuations), we see considerable risk if the economy fares worse than expected. Whether the inflation rate falls to 2% or stalls out at around 3% will remain an important issue given the impact on short-term interest rates, but we expect that concerns about economic growth will take on a more important role in 2024.

Focus on fundamentals

Long gone is the world of zero interest rate policy — the “tide that lifted all boats”; the rise in interest rates has reintroduced gravity into the equation. Going forward, we believe a style that is more focused on fundamentals and valuations will be better rewarded in an environment with a higher cost of capital.

The focus in our Canadian equity portfolios is on absolute returns, closely managing risk to meet targets that allow us to maintain a superior risk profile relative to the benchmark. At the same time, we want to deliver compelling relative returns over full market cycles. It’s also about being patient: letting the market come to you. We stay patient, waiting for market inefficiencies and the opportunity to take advantage of those dislocations.

In general, we have become more defensive over the past 12 months, typically underweighting the more cyclical sectors and overweighting the more defensive sectors. Effectively, our defensive positioning and cash serve as dry powder to be deployed when better opportunities arise. We look forward to a market environment, possibly a market correction, that will benefit our patient and deliberate positioning. When the time comes, we will shift towards a more aggressive stance, transitioning the beta profile in our portfolios from the current lower end of our targeted range to the upper end of the range.

Elias Barbour, CFP, CIM, FCSI, is Vice President, Product Strategy Manager, for Franklin Templeton’s specialist investment manager, ClearBridge Investments. He is currently based in Calgary.

Elias Barbour, CFP, CIM, FCSI, is Vice President, Product Strategy Manager, for Franklin Templeton’s specialist investment manager, ClearBridge Investments. He is currently based in Calgary.

Editor’s Note: Franklin Templeton’s Mid-Year Market Outlook is taking place tomorrow (June 12) at Toronto’s Ritz-Carlton. One of the scheduled speakers is Jeff Schulze, Head of Economic and Market Strategy for ClearBridge Investments.

This commentary is for informational purposes only and reflects the analysis and opinions of the ClearBridge Investments Canadian equity team as of May 14th, 2024. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Franklin Templeton Canada is a business name used by Franklin Templeton Investments Corp.