By Mel Bucher, Co-Head of Global Distribution, Martin Currie, Edinburgh, UK

(Sponsor Content)

The investment choices we make can have a profound effect on the world around us. Investing according to sustainable principles allows investors to align their environmental, social and governance (ESG) goals with their investing choices.

Also, we believe sustainability can be a driver of long-term portfolio performance. As global equity markets recover from the COVID-19 pandemic, more Canadians want to invest in opportunities available within a wider sustainable context.

One new option is the sustainability investment expertise that Martin Currie brings to Canada.

Martin Currie may be a new name for many Canadian retail investors. Our firm is a Specialty Investment Manager of Franklin Templeton, based in Edinburgh, UK, and we focus on actively managing portfolios of the listed public equities of companies that generate long-term value from sustainable ESG polices. Our ESG framework helps to identify any material ESG issues related to a company’s cash flow, balance sheet and profit/loss account over time and whether these ESG issues could affect value creation. Having ESG analysis fully embedded in the research process enables our investment teams to uncover material issues.

Martin Currie’s leadership in ESG was recognized with the UN’s Principles for Responsible Investment A+ rating for 2017, 2018, 2019 and 2020.

This article considers our sustainable investing strategies in global equities and emerging markets equities, both of which are now available to Canadians.

A global equity strategy in a global recovery

We expect the strong comeback of the global equity market to be sustained under fairly benign inflation conditions and with asset prices supported by monetary policy. Our global equity strategy is well positioned in this environment.

The Franklin Martin Currie Global Equity strategy invests in companies with exposure to three established growth megatrends:

1. Demographic change (e.g., aging population, urbanization, healthcare)

2. Resource scarcity (e.g., electric vehicles, alternative energy, infrastructure)

3. The future of technology (e.g., outsourcing, cloud computing, security).

We believe these themes will drive long-term structural growth in the global economy. The portfolio seeks diversified holdings with exposures to the megatrends to capture growth.

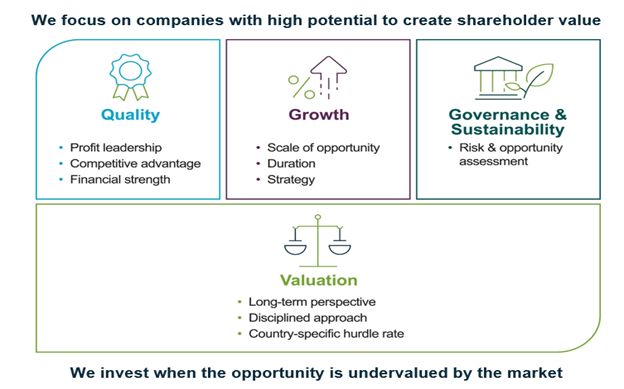

Global equities for growth, at the right price

The portfolio holds 20-40 stocks of sustainable, well-managed growth companies that dominate their respective industries and have high barriers to entry. They hold pricing power and face a low risk of disruption. These firms have potential for long-term structural growth and value creation. Companies undergo a systematic assessment of their industry, company, portfolio and governance/sustainability risks.

These equities may not be cheap, so the portfolio managers are highly selective about acquiring companies at the right valuations. The goal is to find equities that combine strong industry, financial and governance attributes at the right price.

This global equity strategy is now available to Canadians through the Franklin Martin Currie Global Equity Fund and Franklin Martin Currie Sustainable Global Equity Active ETF (FGSG). The mutual fund’s U.S. equivalent is a 4-star Morningstar-rated fund* in the International Unconstrained Equity category.

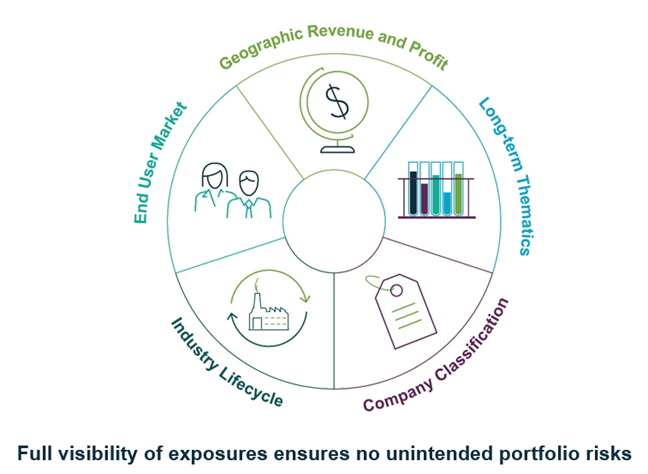

Unique Approach to Portfolio Analysis and Construction

Martin Currie’s sustainable emerging markets strategy

Our Emerging Markets team has been integrating ESG factors into its analysis and portfolio construction decisions for more than 10 years. They use proprietary tools to develop analytics of each company researched for the sustainable emerging markets strategy. The approach is highly selective, with only 40-60 names in the portfolio.

Our portfolio team wants investment returns in emerging markets to come through the alpha of the stocks, not through country allocations. For example, stocks such as China Gas, which participates in the clean energy transition, and CATL, an energy storage company linked to electric vehicles. Many of our holdings have direct exposure to sustainability themes such as electrical efficiency, energy storage and the clean energy transition.

Our goal is to capture growth in emerging markets through a stock-driven portfolio of undervalued, high-quality companies with sustainable long-term growth prospects.

Engagement in emerging markets

Engaging with company management is key to a sustainable investing process in emerging markets. Our team conducted 186 engagements with management in 2020. The goal is to build partnerships by discussing issues such as climate change, employee relations, fracking and water risks. These interactions are intended to help move companies ‘up the ladder’ in enhancing their ability to analyze and disclose ESG risks, which can improve prospects for value creation.

This commitment to engagement aligns with Martin Currie’s overall view that active management requires active ownership as an investor. Our portfolio managers are responsible for the engagement and voting of client capital. They work with companies that we invest in around the world to help them meet their reporting requirements and their specific stakeholder needs.

Our sustainable emerging markets strategy is available to Canadian retail investors through the recently launched Franklin Martin Currie Sustainable Emerging Markets Fund and Franklin Martin Currie Sustainable Emerging Markets Active ETF (FSEM).

Leadership in sustainable investing

In July 2021, Martin Currie joined Franklin Templeton as signatories of the Net Zero Asset Managers Initiative. This initiative was launched in December 2020 by an international group of asset managers committed to supporting the goal of achieving net zero greenhouse gas emissions by 2050 or sooner. This commitment includes prioritizing the reduction of real economy emissions within the sectors and companies in which the asset managers invest.

As an active manager, Martin Currie believes that true stewardship of client investments entails going beyond passive investing. Stewardship requires us to take an active approach to steering the companies that we invest in towards creating superior ESG outcomes. The goal is to have these investment choices make positive effects on the world around us.

Mel Bucher is Co-Head of Global Distribution, Martin Currie, Edinburgh, UK. Mel joined Martin Currie in 2013 and is Co-Head of Global Distribution, managing institutional sales, consultant relations and client service. He is also a member of Martin Currie’s Executive Committee. Before joining Martin Currie, Mel spent eight years at SVM Asset Management, where he was head of institutional business. Prior to that, Mel worked in the institutional clients’ department at Baillie Gifford, servicing pension-fund clients. He began his career at Franklin Templeton in 1994. He holds both the General Securities Principal (Series 24), General Securities Representative (Series 7) and the Uniform Securities Agent State Law (Series 63) qualifications, and also the Investment Management Certificate (UK SIP).

Mel Bucher is Co-Head of Global Distribution, Martin Currie, Edinburgh, UK. Mel joined Martin Currie in 2013 and is Co-Head of Global Distribution, managing institutional sales, consultant relations and client service. He is also a member of Martin Currie’s Executive Committee. Before joining Martin Currie, Mel spent eight years at SVM Asset Management, where he was head of institutional business. Prior to that, Mel worked in the institutional clients’ department at Baillie Gifford, servicing pension-fund clients. He began his career at Franklin Templeton in 1994. He holds both the General Securities Principal (Series 24), General Securities Representative (Series 7) and the Uniform Securities Agent State Law (Series 63) qualifications, and also the Investment Management Certificate (UK SIP).

Martin Currie, LLC is a wholly-owned subsidiary of Franklin Resources, Inc. Franklin Martin Currie Global Equity Fund is available following the repositioning of Franklin Mutual Global Discovery Fund. *Source: Morningstar®. For each mutual fund and exchange traded fund with at least a 3-year history, Morningstar calculates a Morningstar RatingTM based on how a fund ranks on a Morningstar Risk-Adjusted Return measure against other funds in the same category. This measure takes into account variations in a fund's monthly performance and does not take into account the effects of sales charges and loads, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The weights are: 100% 3-year rating for 36-59 months of total returns, 60% 5-year rating/40% 3-year rating for 60-119 months of total returns, and 50% 10-year rating/30% 5-year rating/20% 3-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent 3-year period actually has the greatest impact because it is included in all three rating periods. Morningstar Rating is for the named share class only; other classes may have different performance characteristics. Past performance is not an indicator or a guarantee of future performance. ©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. This commentary is for informational purposes only and reflects the analysis and opinions of the Franklin Bissett Investment Management fixed income team as of May 17, 2021. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation, nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.