By Justin Bender, CFA, CFP

Special to Financial Independence Hub

In our last blog/video, we introduced the all-equity ETFs from iShares and Vanguard. These ETFs make it easy to gain and maintain exposure to global stock markets with the click of a mouse, eliminating the hassle of juggling several ETFs in your all-equity portfolio.

Vanguard and iShares don’t offer their services for free though.

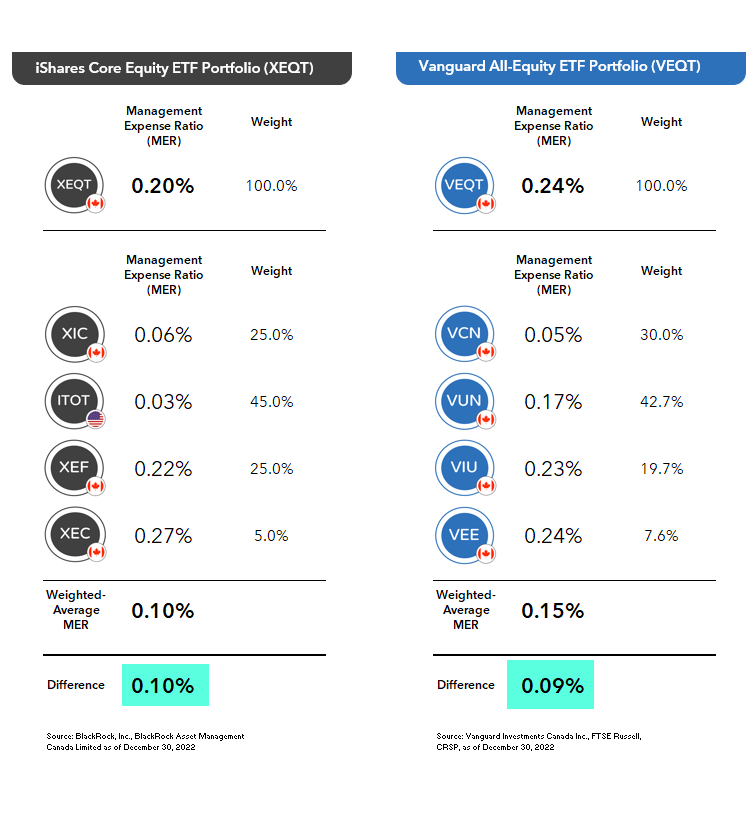

The MERs for their all-equity ETFs are slightly higher than the weighted-average MERs of their underlying holdings. Consider this modest surcharge as the price of admission for their professional asset allocation and rebalancing services. In my opinion, that’s a bargain for most investors.

Then again, there are those who might prefer to squeeze every last penny out of their portfolio costs. If that’s you, you may want to try skipping the value-add of an all-equity ETF, and simply purchase the underlying ETFs directly, in similar weights. If you take on the task of rebalancing back to your targets each month when you add new money to your portfolio, you should be able to mimic an all-equity ETF for a lower overall MER.

That’s the goal anyway. But it’s still going to take time, money, or both to keep your asset allocations on track each month. Let’s look at three potential strikes against trying to reinvent an all-equity ETF on your own, as well as one potential play that may serve as a suitable compromise.

Strike One: The potential cost savings are minimal.

For example, let’s say you’ve got $10,000 to invest. Instead of investing it in the Vanguard All-Equity ETF Portfolio, or VEQT, you could divide it up among VEQT’s component funds. The estimated cost savings might let you rent an extra movie each year, but are the savings really worth it? The extra time you’ll need to spend on rebalancing may not leave you much time to even enjoy your movie.

For larger amounts, the fee savings start adding up, but only if you can buy and sell ETF shares at zero commission as you rebalance. If not, you can forget about it.

Strike Two: Managing a portfolio of four ETFs (instead of just one) will be more difficult.

Sticking with our VEQT example, a DIY investor would either need to visit Vanguard’s website monthly to collect the individual ETF weights within VEQT, or use the market cap data from the FTSE and CRSP index fact sheets to determine how to allocate each of the underlying ETFs. They would then need to calculate how many ETF units to buy or sell across various accounts to get their portfolio back on target, and place multiple trades to get the job done. Continue Reading…