Vanguard changed the self-directed investing game in Canada with the launch of its new suite of asset allocation ETFs. Now investors can get an ultra low cost, globally diversified portfolio of equities and bonds with just one product.

Vanguard changed the self-directed investing game in Canada with the launch of its new suite of asset allocation ETFs. Now investors can get an ultra low cost, globally diversified portfolio of equities and bonds with just one product.

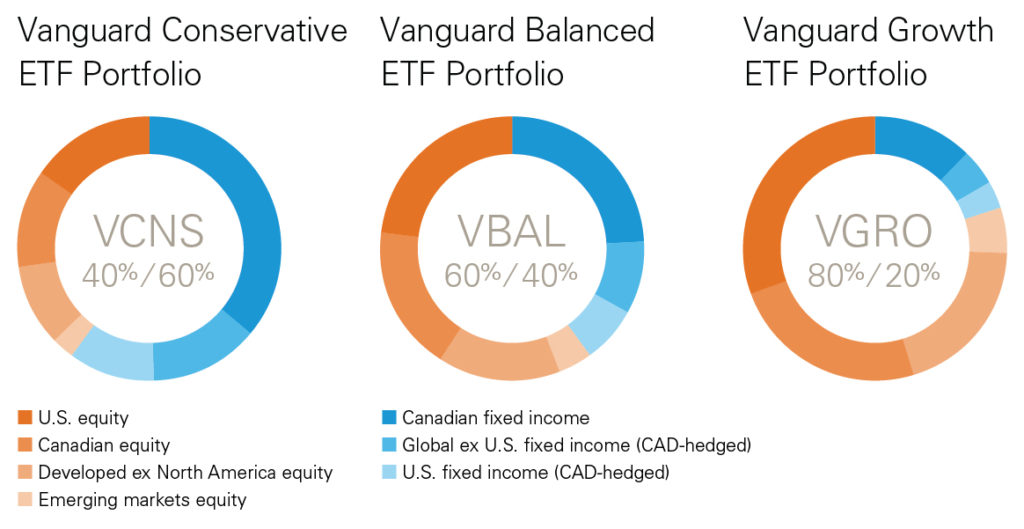

The funds first came in three flavours – VCNS, VBAL, and VGRO – each with a different target asset allocation for the conservative, balanced, and growth-minded investor.

Shortly after came the sweetener, at least for me, when Vanguard introduced an all-equity version called VEQT.

Asset allocation ETFs take away the biggest pain point for DIY investors by removing the need to periodically re-balance when adding new money or whenever markets veer off course. Simply buy units of a single ETF and hold, and/or add new money as needed. Vanguard’s professional managers take care of the rest so you can enjoy a mostly hands-off investing experience.

What is VEQT?

The Vanguard All Equity ETF Portfolio trades under the ticker symbol VEQT. It’s one of five asset allocation ETFs offered by Vanguard. Just like the name suggests, VEQT’s asset allocation is made up of 100 per cent equities. VEQT is a “fund of funds,” meaning it’s a wrapper that contains four other Vanguard ETFs. Here’s what’s under the hood:

- Vanguard US Total Market Index ETF 39.8%

- Vanguard FTSE Canada All Cap Index ETF 29.8%

- Vanguard FTSE Developed All Cap ex North America Index ETF 23.0%

- Vanguard FTSE Emerging Markets All Cap Index ETF 7.4%

While investors are often cautioned not to put all their eggs in one basket, in this case with just one ETF your investment portfolio would have exposure to more than 12,200 stocks from around the globe. It doesn’t get much more diversified than that.

Sector weightings for VEQT include:

- Financials 26.3%

- Industrials 13.5%

- Technology 12.1%

- Consumer Services 10.5%

- Oil & Gas 9.5%

- Consumer Goods 9.0%

- Health Care 7.6%

- Basic Materials 6.0%

- Utilities 3.0%

- Telecommunications 2.5%

Finally, VEQT (like all of Vanguard’s asset allocation ETFs) comes with a management fee of 0.22 per cent. The total management expense ratio (MER) will be known at a later date but it is expected to be 0.25 per cent.

VEQT | My New One-Ticket Investing Solution

It was January 2015 when I sold all of my dividend stocks and switched to an index investing strategy. At the time I went with a two-ETF solution comprised of Vanguard’s FTSE Canada All Cap Index ETF (VCN), and Vanguard’s FTSE Global All Cap ex Canada Index ETF (VXC). This was a variation on the three-fund model portfolio popularized on the Canadian Couch Potato blog (the third fund being Canadian bonds: VAB).

The simple two-fund portfolio worked out great for me, growing by a total of 41.43 per cent in the three years from January 2015 to January 2018. Last year was more challenging and the two-fund portfolio lost 4.25 per cent after a weak fourth quarter sunk the stock markets.

I wasn’t looking to make a change but back in February 2019 Vanguard launched VEQT: adding the 100 per cent equity allocation ETF to its product mix. I was intrigued enough and so on March 4th of this year I wrote about potentially adding VEQT to my portfolio in an effort to reduce my home country bias. Continue Reading…