Special to Financial Independence Hub

Around the middle of December, advisory firms and the people who work for them start putting out their retrospectives regarding the year that is just about to end and / or offer their forecast for the new year. I have long argued that forecasting is a mugs game. To the extent that I have grudgingly participated in the exercise previously, I have found it to be humbling. As such, I want to stress that what follows is not so much a forecast as it is a concern for what may – and I stress MAY – come to pass in light of what we already know about the incoming administration south of the border.

To begin, the President-elect is a criminal. He has literally been convicted of 34 felonies. This is in addition to two impeachments, various infidelities, an attempted insurrection, and the stealing of highly classified state secrets. We now have a good sense of what his cabinet will look like: assuming most of his forthcoming nominees are ultimately appointed. This is a man who is quite willing to appoint incompetent sycophants who will help him expand his ongoing criminal activity at the expense of more traditional character traits like relevant education, experience, and character. The notion of traditional public service seems to be foreign to many would-be cabinet appointees.

Will Trump manufacture a Recession?

Early in December, I was in Southern California and spoke with the founder of an AI company in Silicon Valley. He told me there is a theory making the rounds that Donald Trump intends to do something highly unconventional in his longstanding pursuit personal self-interest. The executive told me that a number of thought leaders are of the opinion that Trump intends to deliberately manufacture a recession immediately upon taking office.

Their view is that, given the experiences of both the global financial crisis and the COVID crisis, it has become apparent that when the economy is severely threatened and bailouts are required, billionaires and plutocrats end up doing very well. Meanwhile, ordinary middle-class people and those even lower on the social spectrum fall further behind.

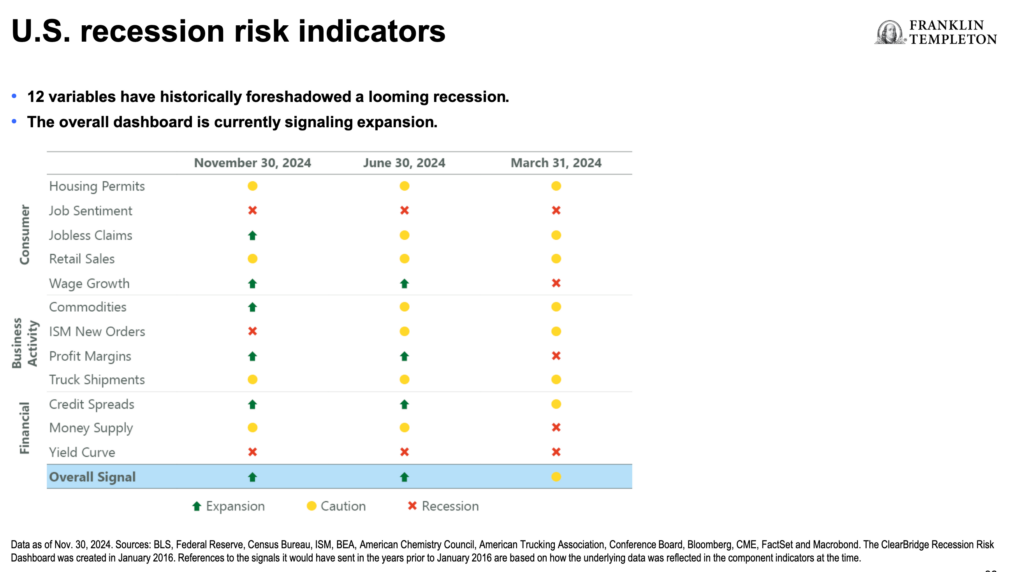

In the aftermath of the election on November 5th, American capital markets responded favorably based on the presumption that lower taxes and less regulation would be highly stimulative and favourable for the economy. This view held sway even though the President-elect campaigned on a platform of indiscriminately-high tariffs, mass deportations, and a draconian cutting of government services via the department of government efficiency (DOGE).

There are some who fear that the promise to rein in the debt will be used as an excuse to cut back on government programs that ordinary Americans rely on. As it stands, approximately three quarters of all U.S. annual expenditures are fixed in law and allocated toward entitlements such as Medicare, Medicaid, and Social Security, as well as interest on the national debt.

Cutting US$2 trillion from the budget is simply impossible without encroaching on at least some of these programs. Stated differently, even if Trump were to cut all other programs (including the CIA in the SEC) to zero, the savings would still be less than the $2 trillion a year he pledged to cut. He will, of course, blame Joe Biden for “the mess he inherited” either way.

No fiscal Conservatives left in America

Meanwhile, the evidence shows that for over half a century, the U.S. accumulated debt has been growing under both major parties. It seems there are no fiscal conservatives left in America. Again, I stress, this is not a forecast, but rather a recounting of a narrative that several thoughtful people who live south of the border believe to be plausible. If you think wealth inequality and income inequality are a problem now, you could be in for a rude awakening if anything close to this narrative comes to pass.

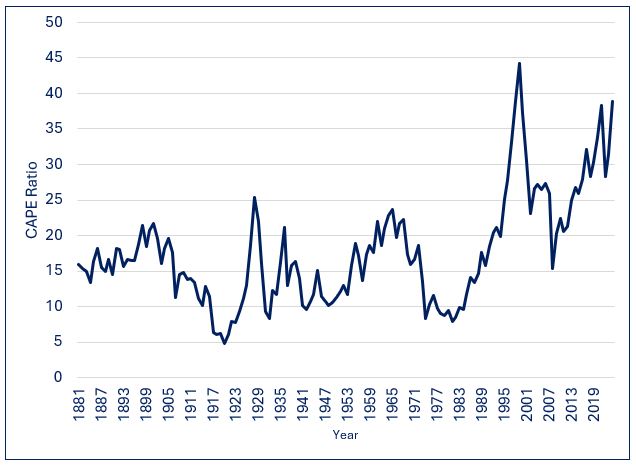

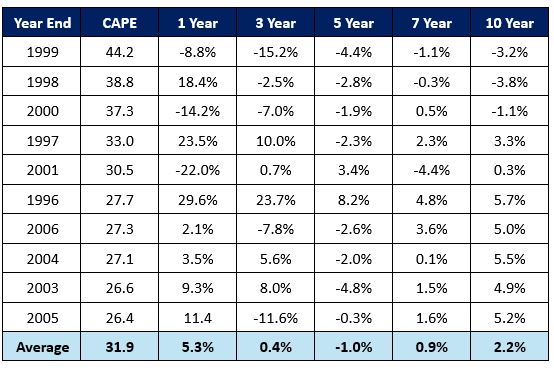

As many people know, I have long been a proponent of efficient capital markets. Any person who espouses this view believes that prices reflect all available information to the point where it is impractical to think that mispricings are sufficiently large and identifiable so as to allow people to engage in trading that would allow that person to make material profit. The American stock market clearly does not subscribe to the narrative I’ve just outlined. Of course, consensus opinions can be wrong. In this instance, perhaps more than any other in my lifetime, I actively want the consensus to be correct. Continue Reading…