Problems in the financial advice industry

The following examples of De Goey’s criticism of the financial advice industry are spot-on.

“Investors often accept the advice of their advisers not because the logic put forward is so compelling but because it is based on a viewpoint that everyone seems to prefer. People simply want happy explanations to be true and are more likely to act if they buy into the happy ending being promised.” We prefer to work with those who tell us what we want to hear.

Almost all advisers believe that “staying invested is good for investors — and it usually is. What is less obvious is that it’s generally good for the advisory firms, too.” “In greater fool markets, people overextend themselves using margin and home equity lines of credit to buy more, paying virtually any price for fear of missing out (FOMO).” When advisers encourage their clients to stay invested, it can be hard to tell if they are promoting the clients’ interests or their own. However, when they encourage their clients to leverage into expensive markets, they are serving their own interests.

“There are likely to be plenty of smiling faces and favourable long-term outlooks when you meet with financial professionals.” “In most businesses, the phrase ‘under-promise and over-deliver’ is championed. When it comes to financial advice, however, many people choose to work with whoever can set the highest expectation while still seeming plausible.” Investors shape the way the financial advice industry operates by seeking out optimistic projections.

“A significant portion of traditional financial advice is designed to manage liabilities for the advice-givers, not manage risk for the recipient.”

“Many advisers chase past performance, run concentrated portfolios, and pay little or no attention to product cost,” and they “often pursue these strategies with their own portfolios, even after they had retired from the business. They were not giving poor advice because they were conflicted, immoral, or improperly incentivized. They were doing so because they firmly believed it was good advice. They literally did not know any better.”

De Goey also does a good job explaining the problems with embedded commissions, why disclosure of conflicts of interest doesn’t work, and why we need a carbon tax.

Staying invested

On the subject of market timing, De Goey writes “there must surely be times when selling makes sense.” Whether selling makes sense depends on the observer. Consider a simplified investing game. We draw a card from a deck. If it is a heart, your portfolio drops 1%, and if not it goes up 1%. It’s not hard to make a case here that investors would do well to always remain invested in this game.

It seems that the assertion “there must surely be times when selling makes sense” is incorrect in this case. What would it take for it to make sense to “sell” in this game? One answer is that a close observer of the card shuffling might see that the odds of the next card being a heart exceeds 50%. While most players would not have this information, it is those who know more (or think they know more) who might choose not to gamble on the next card.

Another reason to not play this game is if the investor is only allowed to draw a few more cards but has already reached a desired portfolio level and doesn’t want to take a chance that the last few cards will be hearts. Outside of these possibilities, the advice to always be invested seems good.

Returning to the real world, staying invested is the default best choice because being invested usually beats sitting in cash. One exception is the investor who has no more need to take risks. Another exception is when we believe we have sufficient insight into the market’s future that we can see that being invested likely won’t outperform cash.

Deciding to sell out of the market temporarily is an expression of confidence in our read of the market’s near-term future. When others choose not to sell, they don’t have this confidence that markets will perform poorly. Sellers either have superior reading skills, or they are overconfident and likely wrong. It’s hard to tell which. Whether markets decline or not, it’s still hard to tell whether selling was a good decision based on the information available at the time.

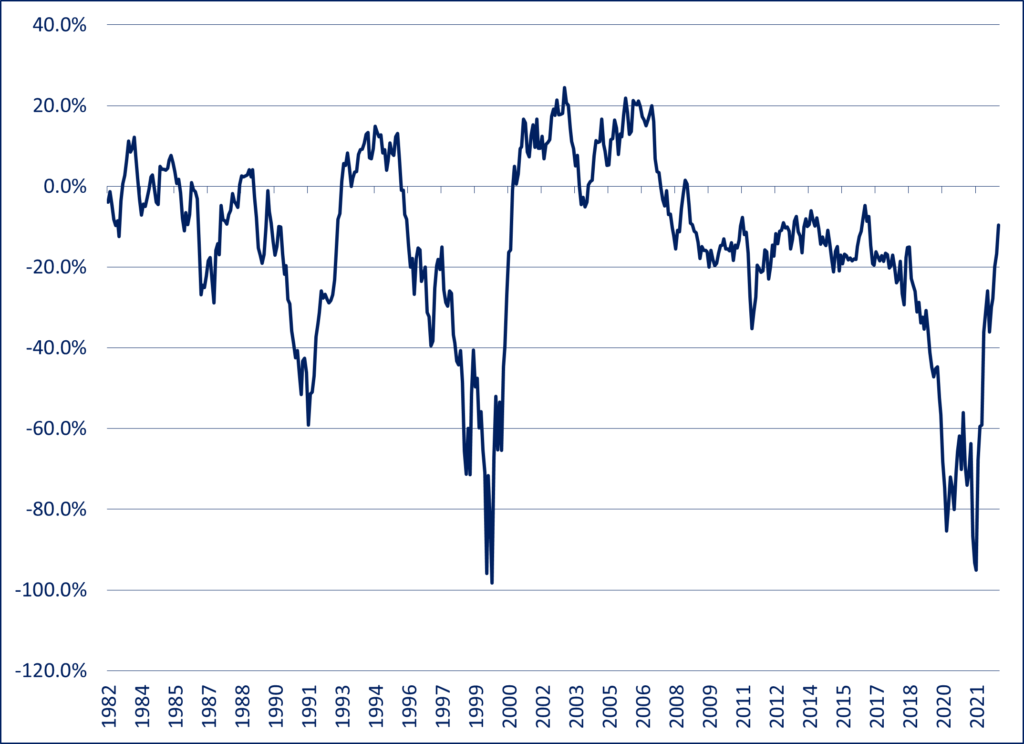

Elevated stock markets

Before December 2021, my DIY financial plan was to remain invested through all markets. As stock markets became increasingly expensive, I thought more about this plan. I realized that it was based on the expectation that markets would stay in a “reasonable range.” What would I do if stock prices kept rising to ever crazier levels?

In the end I formed a plan that had me tapering stock ownership as the blended CAPE of world stocks exceeded 25. So, during “normal” times I would stay invested, and during crazy times, I would slowly shift out of stocks in proportion to how high prices became. I was a market timer. My target stock allocation was 80%, but at the CAPE’s highest point after making this change, my chosen formula had dropped my stock allocation to 73%. That’s not much of a shift, but it did reduce my 2022 investment losses by 1.3 percentage points.

So, I agree with De Goey that selling sometimes makes sense. Although I prefer a formulaic smooth taper rather than a sudden sell-off of some fraction of a portfolio. I didn’t share De Goey’s conviction that a market drop was definitely coming. I had benefited from the run-up in stock prices, believed that the odds of a significant drop were elevated, and was happy to protect some of my gains in cash. I had no idea how high stocks would go and took a middle-of-the-road approach where I was happy to give up some upside to reduce the possible downside. “Sound financial planning should involve thinking ahead and taking into account positive and negative scenarios.” “Options should be weighed on a balance of probabilities basis where there are a range of possible outcomes.”

As of early 2022, “the United States had the following: 5 percent of global population, 15 percent of global public companies, 25 percent of global GDP, 60 percent of global market cap, 80 percent of average U.S. investor allocation, the world’s most expensive stock markets.” These indicators “point to a high likelihood that a bubble had formed.” I see these indicators as a sign that risk was elevated, but I didn’t believe that a crash was certain.

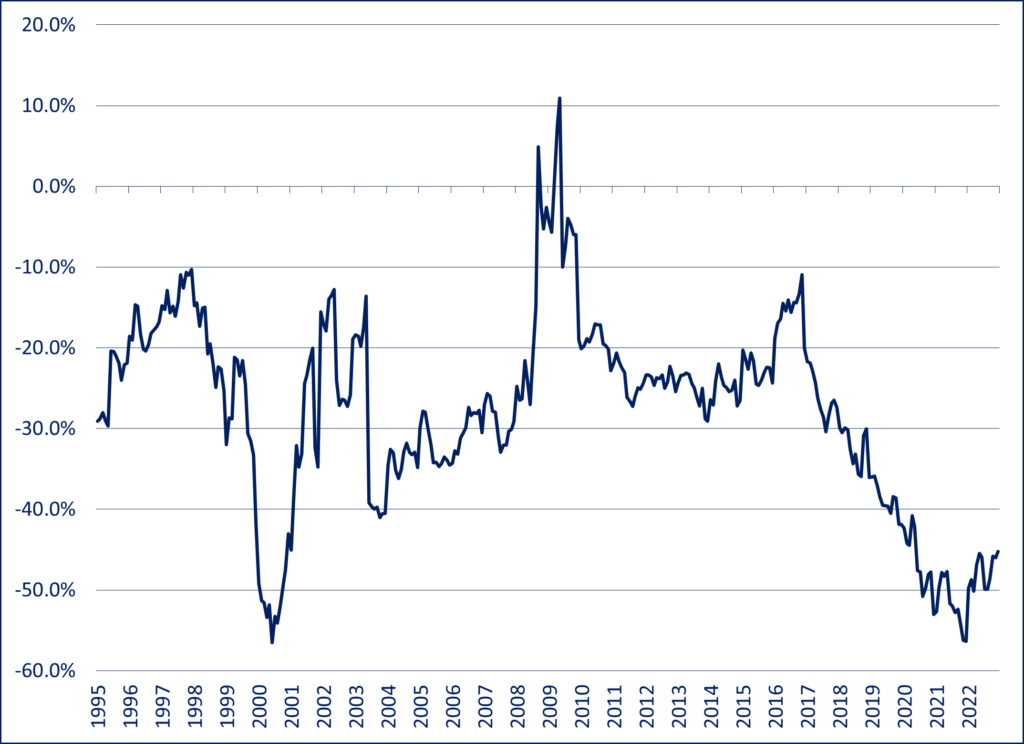

When markets start to decline

“If no one can reliably know for sure what will happen, why does the industry almost always offer the same counsel when the downward trend begins?”

Implicit in this question is the belief that we can tell whether we’re in a period when near future prices are rising or falling. Markets routinely zig-zag. During bull markets, there are days, weeks, and even months of declines, but when we look back over a strong year, we forget about these short declines. But the truth is that we never know whether recent trends will continue or reverse.

De Goey’s question above assumes that we know markets are declining and it’s just a question of how low they will go. I can see the logic of shifting away from stocks as their prices rise to great heights because average returns over the following decade could be dismal, but I can’t predict short-term market moves.

Conviction that the market will crash

‘In the post-Covid-19 world, there was considerable evidence that the market run-up of 2020 and 2021 would not end well. Some advisers did little to manage risk in anticipation of a major drop.”

I’ve never looked at economic conditions and felt certain that markets would drop. My assessment of the probabilities may change over time, but I’m never certain. I have managed the risk in my portfolio by choosing an asset allocation. If I shared De Goey’s conviction about a major drop, I might have acted, but I didn’t share this conviction. Continue Reading…