By Zayla Saunders, BMO ETFs

(Sponsor Blog)

Diversifying your portfolio is a cornerstone of smart investing, reducing risk and potentially enhancing returns. While the Canadian market offers diversification by sector, it represents only about 3% of the world’s capital market. 1

This means that Canadian investors are missing out on a staggering 97% of global investment opportunities. However, the hurdles of currency conversion, foreign exchange costs and currency risk often deter Canadian investors from going global. Enter CDRs, a revolutionary tool that bridges this gap.

What exactly are CDRs?

Canadian Depositary Receipts (CDRs) are financial instruments that represent beneficial ownership in shares of foreign companies but are traded in Canadian dollars on Cboe, a Canadian stock exchange. This innovation simplifies global investing for Canadians, eliminating the need to navigate foreign exchanges and manage currency fluctuations.

Comparing CDRs to traditional Stocks and American Depositary Receipts (ADRs)

While traditional stocks directly represent ownership in companies, CDRs offer a streamlined approach to investing in international firms. Unlike ADRs that trade in U.S. dollars, CDRs cater specifically to Canadians, providing similar exposure to global markets without the complexities of trading at foreign exchanges and in foreign currencies.

A quick look at CDR History

The concept of depositary receipts traces back nearly a century, with ADRs emerging in the 1920s. By 2023, major banks listed over 2400 ADRs in the U.S. market. Canada joined the depositary receipt market in 2021 with offerings focused on U.S.-based companies. In 2025, Bank of Montreal (BMO) introduced its own CDR program, expanding access to global giants from Japan, Germany, Switzerland, Denmark, and the Netherlands.

Benefits of CDRs Explained

- Global Access: CDRs open doors to international investment opportunities, broadening investment horizons for Canadian investors.

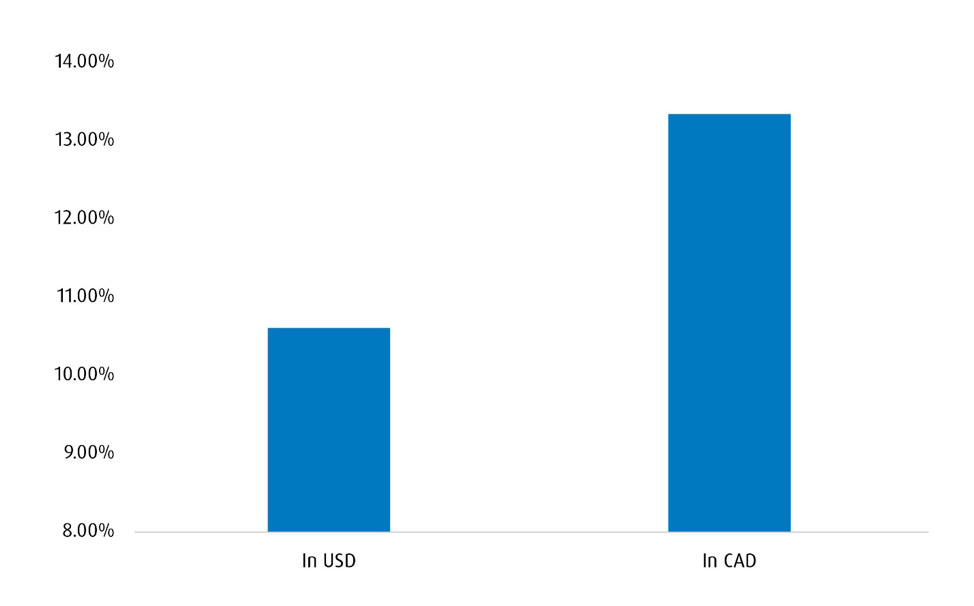

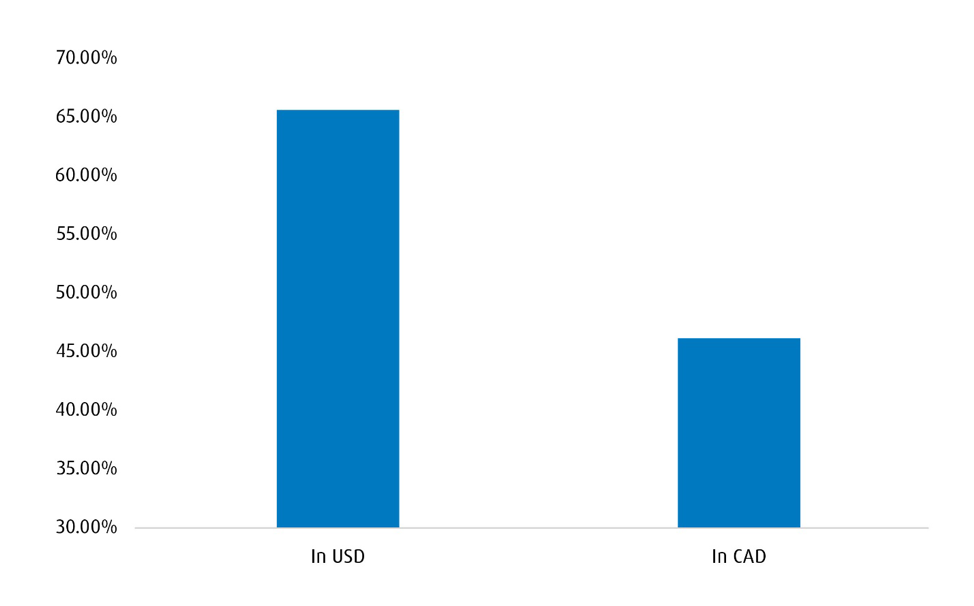

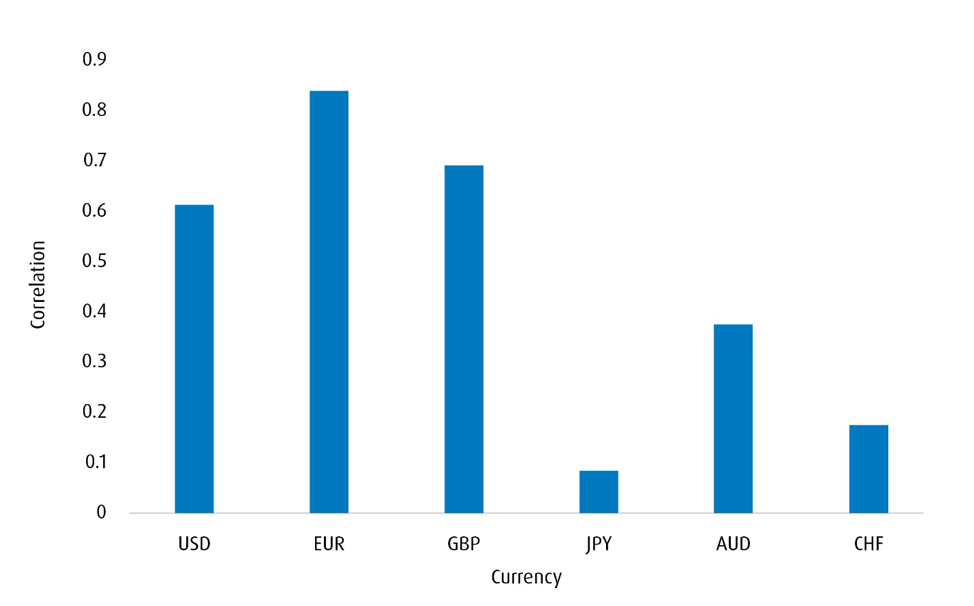

- Currency Risk Management: CDRs mitigate the impact of foreign currency fluctuations on returns through a notional currency hedge.

- Fractional Shares: With a starting price of around CAD $10, investors can afford fractional exposure to shares of otherwise expensive global companies.

- Diversification: CDRs enable effortless geographic diversification, reducing reliance on any single market.

Understanding CDR Features

- Currency Efficiency: CDRs allow Canadians to get exposure to global stocks in Canadian dollars, eliminating currency conversion costs.

- Currency Hedge: CDRs minimize the impact of currency fluctuations while reflecting the performance of the underlying foreign company.

- Fractional Exposure: Affordable entry-point to high-priced stocks as CDRs are generally issued at a price lower than the underlying share effectively providing Canadians with fractional exposure to listed stocks of large global companies.

- Dividends: Investors will be entitled to any distributions paid on the underlying shares in Canadian dollars proportional to the number of underlying shares to which they are entitled. Taxes on distributions may be withheld by the CDR underlying company’s local or national tax authority. Whether distributions, such as dividends, are subject to foreign withholding tax in the same manner as if the underlying share were directly held by the investor will vary by jurisdiction Since the dividends are paid in Canadian dollars, investors do not have to subsequently go through the process of any currency conversion.

- Market Accessibility: CDRs trade seamlessly on a Canadian exchange, ensuring ease of buying and selling.

How do CDRs work in practice?

Each series of CDRs provides economic exposure corresponding to a number of underlying shares. The specific number of shares that each series of CDRs represents is called the CDR ratio. For example, if the CDR ratio for a particular series is 0.50, this means that such series of CDR represent 0.50, or half, of a company share, so an investor would need to purchase 2 CDRs of the series to obtain the economic exposure corresponding to 1 underlying share. The CDR ratio for each series of CDRs is adjusted daily to provide the notional currency hedge as the foreign currency increases/decreases in value to the Canadian dollar. Continue Reading…