By Mark Seed

Special to the Financial Independence Hub

You’ve worked your entire life. You put some money away; invested, watched that money now and then over time.

Yet instead of living it up for everything you’ve worked so hard for you’re counting coins to make ends meet.

I don’t want this to happen to me. I don’t want it to happen to you either.

Inspired by an article I read some time ago, why retirement might not work out for you, I’m going to go on the offensive: here are 10 ways I plan to get retirement ready.

Retirees or prospective retirees please chime in!

1.) I will favour stocks over bonds

Most retirees are worried about out-living their savings. With inflation as a massive wildcard in our collective financial future, this fear is not unwarranted.

One way to combat inflation is to own more stocks (for growth) than bonds (for income security when equities tank) in retirement. You could argue that a 70/30 stock to bond split might be a good starting point to enter retirement with.

I own 100% equities in our portfolio now. We have that bias to equities because I consider my future defined benefit pension plan “a big bond.” Eventual Canada Pension Plan (CPP) and Old Age Security (OAS) payments in our 60s will also be part of our fixed-income component.

Got a pension plan? Lucky you. Consider that a big bond.

Here are the facts about taking OAS you need to know.

While it might be scary (for some) to watch the volatility of your stock portfolio go up and down like a yo-yo short-term, owning a nice blend of stocks and bonds should help you combat inflation rather well.

What % of stocks and bonds and cash do retirees out there use today?

2.) I will embrace diversification

Diversification is important when it comes to investing because by doing so, you can enhance returns while reducing the portfolio risk long-term. A pretty great deal.

For most of us, diversification means an appropriate mix of stocks and bonds, a blend of small-cap, medium-cap, and large-cap stocks; owning various sectors of the economy; owning stocks from countries or investing in economies from around the world.

It can also mean owning assets that are not always correlated to common stocks, like real estate investment trusts (REITs).

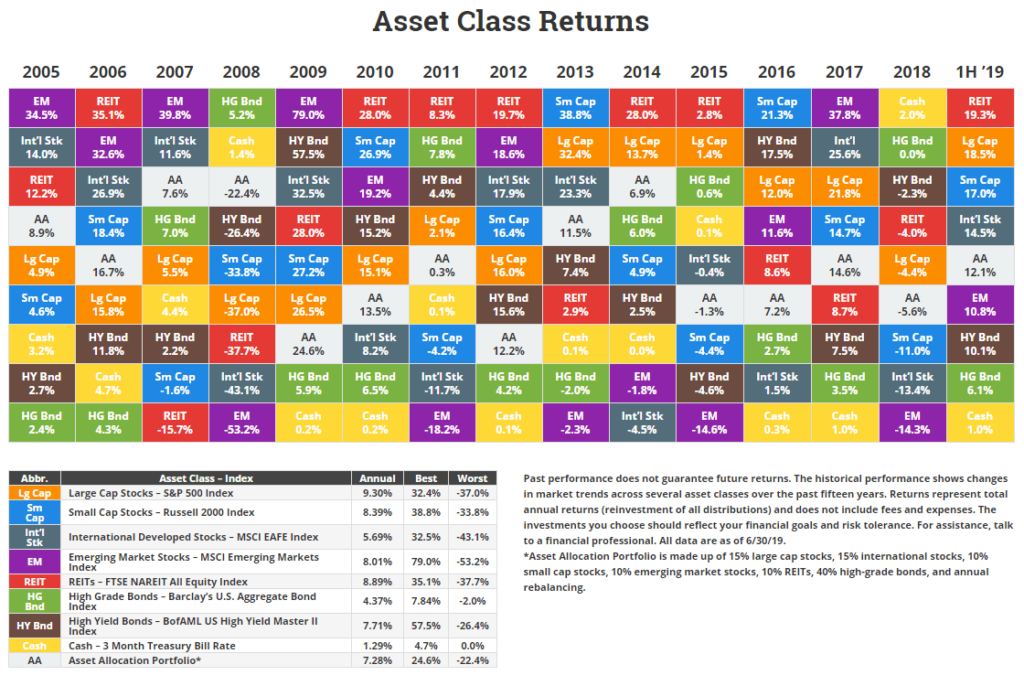

Source: NovelInvestor.com

While diversification will never guarantee you big profits, it will help you eliminate the risk of investment losses given that not all assets move in the same direction at the same time.

When it comes to getting ready for my semi-retirement, I may consider owning some low-cost, all-in-one asset allocation Exchange Traded Funds (ETFs) to increase the diversification across my portfolio while simplifying my investing approach for my senior years.

These are some of the best all-in-one ETFs to own.

3.) I will consider a die-broke plan

My parents are very fortunate to have defined benefit pension plans and have a bit of RRSP/RRIF money to draw down in the coming few years. I’ll be working on their strategy this year.

They also own most (not quite all) of their home.

With good planning and careful spending in their 70s, they will definitely have enough money to live comfortably for a few more decades: thanks to their workplace pensions and government benefits.

However, they are not planning to leave any inheritance: and that’s more than OK with the kids (!).

They have a die-broke or at least a near die-broke plan to around age 95

I think this makes great sense. Working backwards (from age 95), you can calculate a more measured approach to spending money now while earmarking some funds to fight any longevity risk.

At the end of the day, as our lawyer said recently to us when we closed on our condo purchase: “it’s only money.”

Figure out your estate plan and work backwards. I suspect in doing so that will help your retirement preparedness.

Do retirees reading this site have a die-broke plan or an estate plan?

4.) I will track my spending (in more detail)

Ideally, all any retiree would need to know is: is enough money coming in to cover what expenses are going out?

Consider the following as part of your back-of-the-napkin calculations:

- Do you have a rolling monthly credit card balance? If so, you’re spending too much.

- Do you have a growing line of credit balance? If so, you’re spending too much.

- Are you able to keep a cash wedge or an emergency fund topped up with cash? If not, you’re spending too much.

To get to retirement in the first place, you probably needed a budget. There is no reason why you shouldn’t keep one throughout retirement.

I plan to up my game in the coming years, to keep a more detailed tracking log of our spending as we enter semi-retirement. This will allow me to better forecast any travel expenses we intend to incur.

For now though, I believe this is a better way to budget.

How do you budget?

5.) I will rely on multiple income streams

Canada Pension Plan (CPP) and Old Age Security (OAS) won’t be enough for us. It might not be enough for you.

While a base-level of income security will be provided from both government programs, for most adults who have worked and lived in Canada for many decades, the sum of this income probably won’t be enough to cover all housing, food, transportation and health-related expenses.

By relying on multiple income streams, beyond government benefits, this will increase your chances to meet retirement income needs and wants.

Here are our projected income needs and wants in retirement. Do you know yours?