By Brian Giuliano

Brandywine Global Investment Management, a specialist investment manager of Franklin Templeton

(Sponsor Content)

Flexibility and adaptability can work to an investor’s advantage in the challenging fixed income markets of 2021. Structural disinflationary trends are now clashing with cyclical inflationary forces in a global economy struggling to recover from the COVID-19 pandemic. Add on interest rates at record lows, demographic pressures, heavy government debt levels, and widespread technological disruption throughout the global economy.

The market environment of low interest rates makes it difficult to generate income while preserving capital. As a result, many investors have taken on additional credit or interest rate risk to try to earn a more attractive income from fixed income assets.

But there are pitfalls to this approach. Without a counterweight to the extra portfolio risk, investors could be vulnerable to an increase in interest rates or a selloff in credit markets.

One option for investors is a multisector strategy with the flexibility to adapt quickly to changing markets. A strategy that’s able to capture opportunities when available but also play defense when market conditions call for it.

Global Income Optimiser strategy

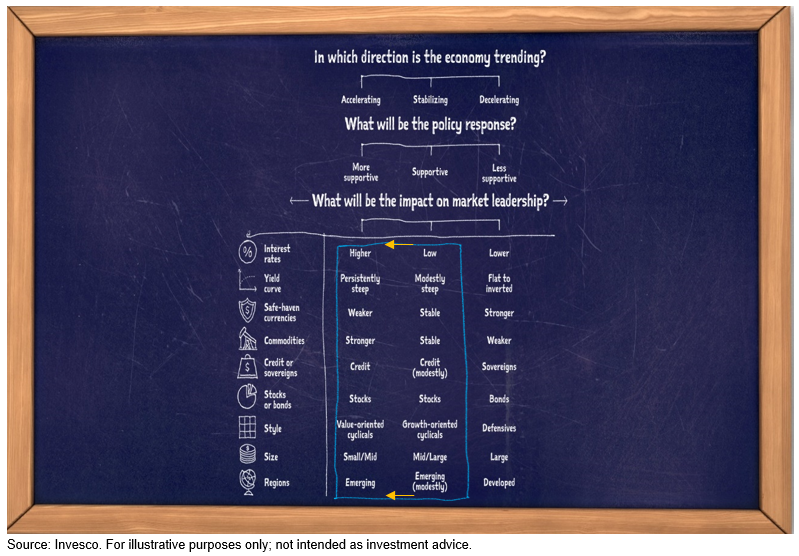

The portfolio team behind the Franklin Brandywine Global Income Optimiser strategy are strong believers in flexibility, which means we try to adapt the income and risk exposures in a portfolio to the market environment. This approach does not have any structural, home country or sectoral biases. We aim to rotate the portfolio across what we believe are the best risk-adjusted return opportunities in the global fixed income universe.

Our goal is to generate high-yield-like returns with investment-grade-like volatility for investors. We want to maximize the income that can safely be earned in a given market environment.

The Franklin Brandywine strategy seeks returns from across the investment universe, including global investment grade and high yield credit, developed market sovereigns, structured credit and emerging market debt. Furthermore, sector rotation, duration management, quality rotation and security selection are employed to meet the strategy’s investment objective. Foreign currency is hedged primarily back to an investor’s base currency, such as the Canadian dollar; however, limited exposure may be used opportunistically to add alpha for a portfolio.

This strategy became available to retail investors in Canada on June 4, when Franklin Templeton introduced the Franklin Brandywine Global Income Optimiser Fund*. Globally, the strategy has a successful track record, dating back to its inception in 2013. In the U.S, a similar fund, to the degree allowed by Canadian regulations, is 5-star rated by Morningstar.** Brandywine Global is a specialist investment manager that was part of Franklin Templeton’s acquisition of asset manager Legg Mason in 2020.

Portfolio positioning for the reopening

Brandywine Global sees growth and inflation returning to the global economy this year. We increased spread duration late in the first quarter of 2020 and began reducing high quality government bond duration; so overall portfolio duration was roughly flat last spring. From last summer through winter, we materially reduced portfolio duration.

Now, the positioning of the strategy is for a short duration, cyclically-oriented portfolio of companies that have some pricing power, given inflationary pressures from the reopening trade. There’s a mix of U.S. and European names with a concentration in the BBB and BB space. The level of credit risk is largely investment grade over the long term; less than 5% of the portfolio is in CCC securities. High quality government bonds can help manage volatility. These and other ‘safe’ assets offer lots of ‘episodic value’ for the portfolio at times, especially during volatile markets, by being sources of alpha and acting as a counterweight to riskier holdings.

Capital protection is a top priority, and the Brandywine team will not reach for yield in this strategy.

Environmental, social, governance assessments

Also, Brandywine Global integrates ESG analysis into our comprehensive assessment of information risk and price risk with this strategy. The focus is on the material ESG issues that can impact a country’s economic growth, the business activities of a corporation, or the integrity of securitized collateral. Continue Reading…