By Erin Allen, CIM, VP Online ETF Distribution, BMO ETFs

(Sponsor Content)

Asset allocation is one of the most critical investment decisions an investor can make. Studies, such as the influential Brinson, Hood and Beebower paper, “Determinants of Portfolio Performance,1” suggest that the long-term strategic asset allocation of a portfolio accounts for over 90% of the variation of its return.

Asset allocation is one of the most critical investment decisions an investor can make. Studies, such as the influential Brinson, Hood and Beebower paper, “Determinants of Portfolio Performance,1” suggest that the long-term strategic asset allocation of a portfolio accounts for over 90% of the variation of its return.

According to the study, the portfolio’s strategic – or target – asset allocation will have a greater impact on its performance than security selection or any short-term active or tactical asset allocation shifts.

The first step when constructing a portfolio is to determine the appropriate asset allocation, based on your risk profile and investment objectives, and then select investments across each asset class.

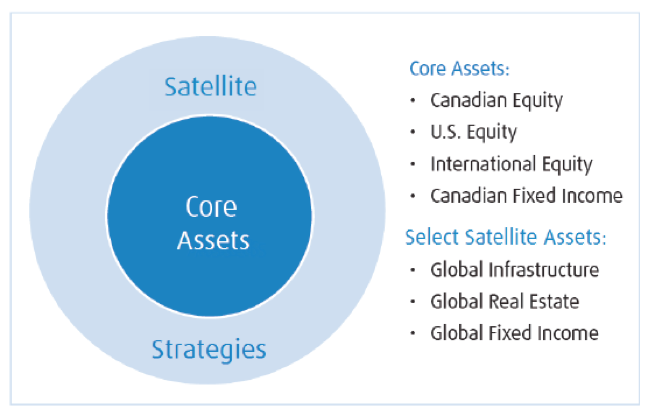

There are several approaches to constructing an investment portfolio. One such strategy is to adopt a core-satellite approach. Core-satellite investing involves using a core portfolio to anchor the portfolio’s strategic asset allocation, and adding satellite investments to enhance returns and/or mitigate risk.

Fundamentals of a core-satellite portfolio

A typical investment portfolio is comprised of traditional asset classes that represent the broad market, and generally include investment-grade fixed income securities and large-cap Canadian, U.S. and international equities, for example BMO S&P TSX Capped Composite Index ETF (ZCN), BMO S&P 500 Index ETF (ZSP), and BMO MSCI EAFE Index ETF (ZEA). These asset classes make up the portfolio’s “core” investments. Specific securities within each asset class will depend on the investor’s return objectives and risk tolerance.

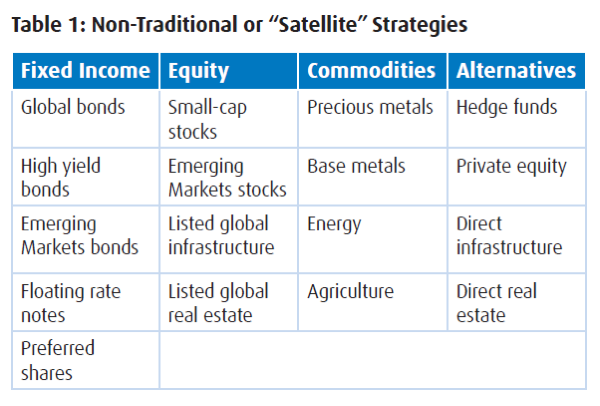

In order to further diversify the portfolio, non-traditional asset classes – referred to as “satellite” strategies – are used to enhance returns and manage risk. Satellite strategies often have greater return potential than core asset classes, but may be considered higher risk (with greater volatility) when held on their own. However, they often have a lower correlation – a measure of the degree to which two investments move in relation to each other – to traditional assets classes. Satellite strategies can include asset classes or themes that can be used as either short-term, tactical investments, or held for longer periods of time. Combining investments with a low correlation can improve the risk/return characteristics of a portfolio.

Examples of satellite strategies are shown in Table 1 [below]. By using one or more of these satellite strategies in tandem with a core portfolio, investors can further diversify their portfolio across additional asset classes, regions, sectors, market capitalizations, currencies and/or investment styles. For example, real assets such as commodities, infrastructure and real estate have a tangible value that can rise during periods of inflation.

Infrastructure and real estate can also offer a steady and predictable cash flow. Global fixed income securities provide Canadian investors with exposure to bonds in countries with different currencies and interest rate cycles, which can help reduce interest rate risk; while hedge funds, such as market neutral or multi-strategy funds, can actually lower volatility and improve a portfolio’s risk-adjusted performance.

Constructing a core-satellite portfolio

A core-satellite portfolio can be implemented by using:

- Active strategies that seek to add value through security selection;

- Passive strategies that seek to track the performance of an index representing a particular investment market;

- A combination of active and passive strategies.

There is a fundamental investment theory that states markets are efficient and the price of any individual security already reflects all available relevant information, which makes it more difficult for active managers to outperform. Investors who share this view would generally purchase passive investments. Conversely, others believe markets are not efficient and do not always behave rationally, providing active managers with the opportunity to select undervalued securities and avoid overvalued securities – and increasing their potential to add value above the market and/or provide better risk controls and downside protection. While some studies show that the “average” active manager does not add value, well-selected managers have demonstrated the ability to add value and/or reduce risk over the long term.

One approach to constructing a core-satellite portfolio is to use passive investments for efficient markets and active investments for less efficient markets. Many traditional asset classes, such as the U.S. equity market, are considered to be very efficient, making it difficult for active managers to outperform. Non-traditional asset classes, such as Emerging Markets equities or high yield bonds, are often considered less efficient. Many of these asset classes may be more difficult to access, can be less liquid, and are not covered as broadly by research analysts, which can enable active managers greater potential to add value.

The most critical step

Determining the appropriate asset allocation (mix of stocks, bonds and other asset classes) is the most important step when building your portfolio. Whether you use a passive strategy, an active strategy, or a combination of both, the addition of one, or more, satellite strategies to a core portfolio can potentially enhance returns, reduce risk and provide a better return/risk profile for your portfolio.

Simple to use All-in-One Core Portfolio ETFs

BMO ETFs offers a range of all-in-one Asset Allocation ETFs you can select as your core investment portfolio, based on your risk tolerance and time horizon. These ETFs are a one-ticket solution where the asset allocation is determined by professional managers, and where the asset allocation is automatically rebalanced for you on a regular basis to ensure you are on track to meeting your goals. They are low cost, and there is no double dipping on the fees (all-in MER of 0.20%* includes the cost of the underlying ETFs). Examples include our BMO Balanced ETF (ZBAL), or BMO Growth ETF (ZGRO) and BMO All-Equity ETF (ZEQT). Click Here to learn more.

Erin Allen has been a part of the BMO ETFs team driving growth since the beginning, joining BMO Global Asset Management in 2010 and working her way through a variety of roles gaining experience in both sales and product development. For the past 5+ years, Ms. Allen has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market. More recently, she is committed to helping empower investors to feel confident in their investment choices through ETF education. Ms. Allen hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner. She has an honors degree from Laurier University and a CIM designation.

Erin Allen has been a part of the BMO ETFs team driving growth since the beginning, joining BMO Global Asset Management in 2010 and working her way through a variety of roles gaining experience in both sales and product development. For the past 5+ years, Ms. Allen has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market. More recently, she is committed to helping empower investors to feel confident in their investment choices through ETF education. Ms. Allen hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner. She has an honors degree from Laurier University and a CIM designation.

* Management Expense Ratios (MERs) are the audited MERs as of the fund’s fiscal year end or an estimate if the fund is less than one year old since the audited MER of the ETF has not gone through a financial reporting period. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. Commissions, management fees and expenses (if applicable) may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts, ETF Facts or prospectus of the relevant mutual fund or ETF before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in BMO Mutual Funds or BMO ETFs, please see the specific risks set out in the prospectus of the relevant mutual fund or ETF . BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. S&P®, S&P/TSX Capped Composite®, S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and “TSX” is a trademark of TSX Inc. These trademarks have been licensed for use by S&P Dow Jones Indices LLC and sublicensed to BMO Asset Management Inc. in connection with the above mentioned BMO ETFs. These BMO ETFs are not sponsored, endorsed, sold or promoted by S&P Dow Jones LLC, S&P, TSX, or their respective affiliates and S&P Dow Jones Indices LLC, S&P, TSX and their affiliates make no representation regarding the advisability of trading or investing in such BMO ETF(s).The BMO ETFs or securities referred to herein are not sponsored, endorsed or promoted by MSCI Inc. (“MSCI”), and MSCI bears no liability with respect to any such BMO ETFs or securities or any index on which such BMO ETFs or securities are based. The prospectus of the BMO ETFs contains a more detailed description of the limited relationship MSCI has with BMO Asset Management Inc. and any related BMO ETFs. BMO Mutual Funds are offered by BMO Investments Inc., a financial services firm and separate entity from Bank of Montreal. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.