By Donna Johnson

Special to the Financial Independence Hub

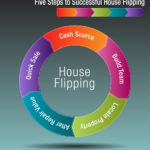

One of the top ways to make money historically has involved investing in real estate. Buying distressed houses at a good price and then selling them for a profit, known as flipping, is a great option for making money in housing. For those who are young adults, there is time to take risks and recover if they don’t pan out. Flipping houses is one of those calculated risks that could help younger American or Canadian adults achieve financial freedom in relatively short order. Here is how the flipping process works.

Find a house

In order to flip a house, it’s necessary to first own the house. A house that’s ripe for flipping might be a very distressed house in a great neighborhood. With tens of thousands of dollars of work, flippers could theoretically earn a profit that equals or exceeds their initial investment. Even a home that’s merely a bit dated in its decor could provide a good opportunity in the right location.

It’s important to know the market before purchasing a house to flip. It will be difficult to sell a house for a profit in a bad neighborhood no matter how impressive the renovations are. Additionally, comps in the local market will need to be high enough to provide a gap between what the flip initially costs and what you can sell it for. Otherwise, it will be difficult to make a profit.

Have money available

It’s important to have quite a bit of cash on hand before beginning a house flip. Those 3.5% down payments associated with FHA loans [in the U.S.] are only available for homes that will be occupied by the owner. Banks consider flips investment properties. Therefore, a flipper can expect a bank to require a 20% down payment as security for a loan. Continue Reading…