I write a lot about seeking financial independence rather than early retirement. That’s intentional. I don’t necessarily want to retire – not anytime soon – but what fires me up is the idea of working on my own terms.

I write a lot about seeking financial independence rather than early retirement. That’s intentional. I don’t necessarily want to retire – not anytime soon – but what fires me up is the idea of working on my own terms.

My goal is to be financially free by age 45. That means I’d be free to ditch my day job and pursue my passion of helping people with their finances (through educational writing, financial planning, and hosting seminars or workshops). I wouldn’t be retired, since I’d still derive an income from these activities.

Many FIRE [Financial Independence/Retire Early] bloggers have the same idea: work hard, save a large percentage of their salary, and eventually ditch the cubicle life. The dream is to retire early, but more often than not their “work” turns into blogging, book writing, and speaking about early retirement.

Ironically, selling the dream of early retirement tends to be another full-time pursuit. Just look at one of the original FIRE personalities, Canada’s self-professed youngest retiree Derek Foster. He’s written six books and runs a website where he sells his “portfolio picks.” He says “retired,” I say he “quit his job to become a writer.”

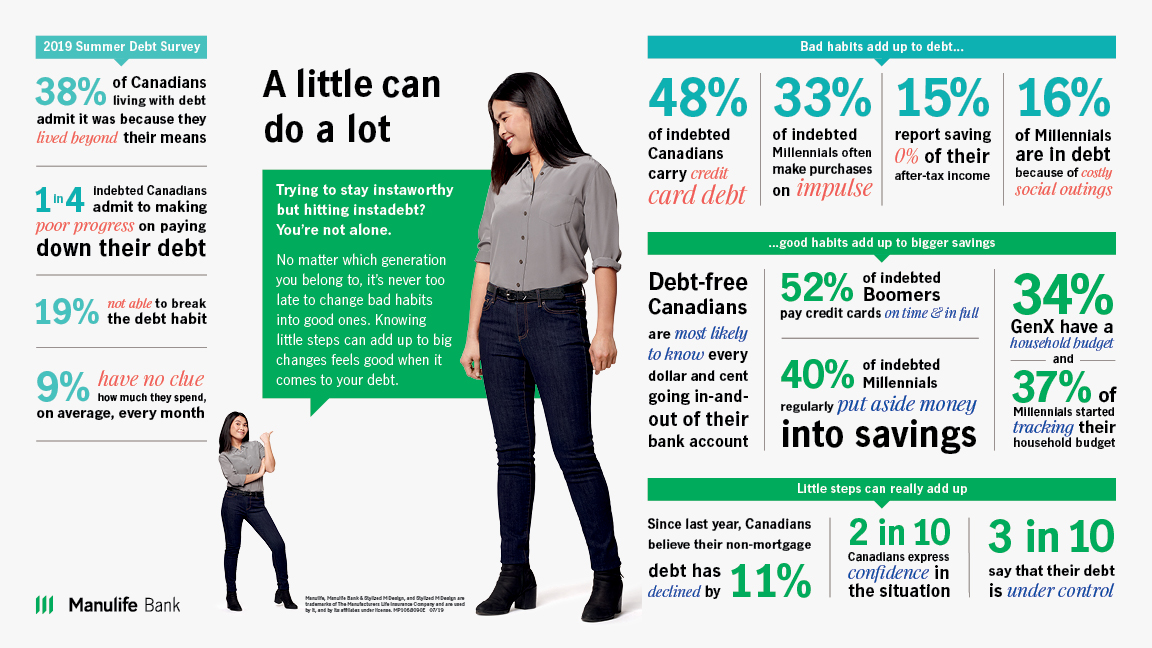

To be clear, there’s nothing wrong with pursuing financial independence or wanting to retire early. Any movement that helps people spend less, save more, and strive for a happier life is to be celebrated.

[From Twitter:]

CutTheCrapInvestingGreat article. I too am a fan of saving and investing but many FIRE will get wiped out in a real correction. Worse than this article projects. FIRE is out of control, reality may hit. @myownadvisor @esb_fi @RobbEngen @JonChevreau @The_Money_Geek https://seekingalpha.com/article/4277415-f-r-e-ignited-bull-extinguished-bear …

F.I.R.E. – Ignited By The Bull, Extinguished By The Bear

Retiring early is far more expensive than most realize.Not accounting for variable rates of returns, lower forward returns due to high valuations, and not adjusting for inflation and taxes will leave

seekingalpha.com

The safe withdrawal math is easily ignored when the income needed to live is actually earned through blog revenue. The dirty secret of the FIRE blogger movement is they dont have to touch their investments while they’re out there selling the dream. Continue Reading…