Special to the Financial Independence Hub

In an online survey about savings habits, financial comparison site Ratehub.ca reports that although Canadian men and women save almost the same amount of money, men have a greater level of confidence in their financial planning.

Inspired by 2014 Statistics Canada data that says Canadian women have lower financial literacy scores than men and were less likely to consider themselves “financially knowledgeable” (31% of women versus 43% of men), Ratehub.ca set out to discover if there truly is a gender divide.

The company digitally surveyed a random sample of 1,087 Canadians in November, with respondents self-identifying their gender.

“Our survey revealed that while men and women differ in aspects of their financial planning, at the core, their personal finance goals and concerns are nearly identical,” the report says.

Both genders have similar financial goals

Indeed, both genders report almost the exact same financial goals. At the top of list of priorities is retirement, followed by travel and then having an emergency fund.

Both men and women prefer to save and invest in registered accounts, especially the registered retirement savings plan (RRSP) and tax-free savings account (TFSA). What they choose to invest in within these accounts — guaranteed income certificates (GICs), exchange traded funds (ETFs), stocks, or other products — is unknown.

Yet men and women diverge most in how confident they are that they’ll have enough money to retire: less than half of women, 41%, say they’re confident compared to over half of men surveyed, at 56%.

Odd, because both genders save almost the same amount of their salaries, with women saving 26% and men 29%.

The gap could potentially be explained in how able they are to grow those savings through investing. Eighty-five per cent of men invest their money, while only 76% of women do.

Of those that do invest, less women than men self-manage their investments, potentially indicating another worrisome lack of confidence in their financial knowledge.

This is supported by the original Statistics Canada data, which found women were less likely to state they “know enough about investments to choose the right ones that are suitable for their circumstances.”

Confidence doesn’t mean financial knowledge

But does confidence translate to actual financial knowledge? Apparently not. When Statistics Canada quizzed Canadians who rated themselves financially literate, one in every three women failed, while one in every four men failed. Continue Reading…

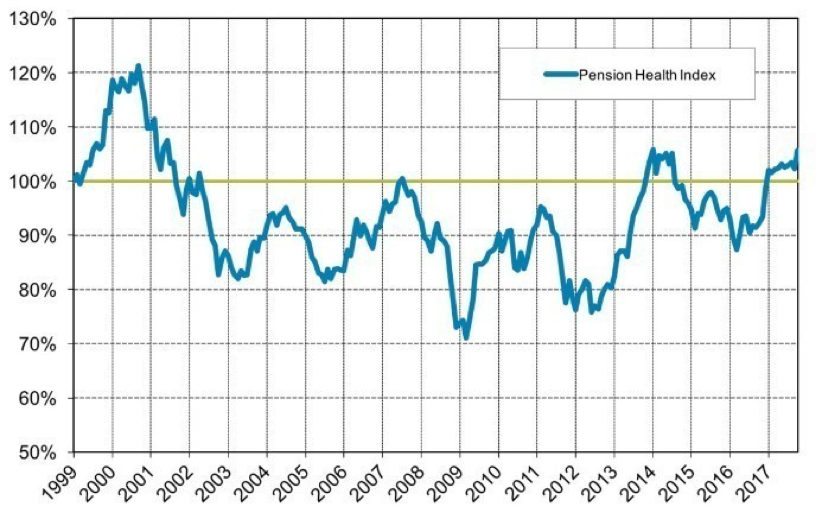

Source: Mercer Pension Health Index published October 2, 2017

Source: Mercer Pension Health Index published October 2, 2017