By Billy and Akaisha Kaderli, RetireEarlyLifestyle.com

Special to the Financial Independence Hub

These days, no matter what the topic, the talk is all about sustainability.

In regards to financial sustainability, there are three legs to the stool: income, spending and Investments.

1.) Income

Income is derived from money you make through your job using physical or mental labor or both. Passive income can be created through property rentals, bond interest, dividends and or capital gains from investments.

Increasing income can be done by learning a new skill, getting a promotion, or taking on a better or second job. Maximizing your skills and continued education either formal or on your own is a valuable asset. This could be as easy as teaching yourself about investments in your down time. There are plenty of online tools available to learn this.

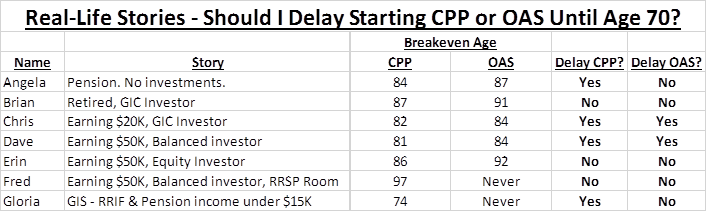

Also, don’t rule out that Social Security [or in Canada, CPP and OAS] will be available once you become eligible.

2.) Spending

How much you spend and the debt you carry are two areas that are completely manageable by you. The categories of largest spending in any household are housing, transport, taxes and food/entertainment. Depending where you live, it may make more sense to rent instead of buying a home, or rent out a room in the home you already own, or rent out a subsection of your home in order to help with the mortgage. Putting off that remodel of the bathroom or kitchen, or the re-do of the back yard will also allow you extra money to put into investments.

Regarding transportation, you could walk or bicycle to work, take public transportation instead of owning your own vehicle, car pool or use Uber or a ride sharing service. The cost of car ownership is over $8,000 per year, roughly $650 per month, or $22 per day according to AAA’s 2016 Your Driving Cost Study. How much of your day is spent covering your car expenses, which according to Fortune is parked 95% of the time?