Is buying a house a good investment? Recently we spoke to the son of one of our Successful Investor Wealth Management clients who has to make a decision about housing, but needs to look at it from a financial point of view.

Is buying a house a good investment? Recently we spoke to the son of one of our Successful Investor Wealth Management clients who has to make a decision about housing, but needs to look at it from a financial point of view.

He and his wife bought a small starter home on a tiny lot in an old part of downtown Toronto. They both work in the north end of the city, so they had a long commute. But they liked the neighbourhood, and a number of friends lived nearby.

New considerations came up after their first child’s birth.

As it happens, a family member owns an investment house in the north end of the city, in an area that’s renowned for having some of Toronto’s top public schools. It’s twice the size of their current home, half as old, worth three times as much, and is in livable condition. It has a driveway that can park three or four cars, plus a garage. In winter, it has room for an enormous backyard skating rink. In summer, it can accommodate barbeque get-togethers with 50 or more guests. The location makes the house an easier commute for both of them.

The family member/owner is willing to accept a yearly rent equal to 1.2% of the value of the home, which is less than his interest cost. He’s even agreeable to making modest improvements at his own expense, since he can write off the cost against his rental income. The house plays a key role in his estate plan, since it’s part of a long-term land-assembly project. He is willing to let them live there for as long as they want, or until he dies, with little if any change in the rent. He just wants a trouble-free tenant.

Is buying a house a good investment? Here’s a specific case where it wasn’t

They asked our advice on buying a house before, and they asked again when this sell-or-hold question came along.

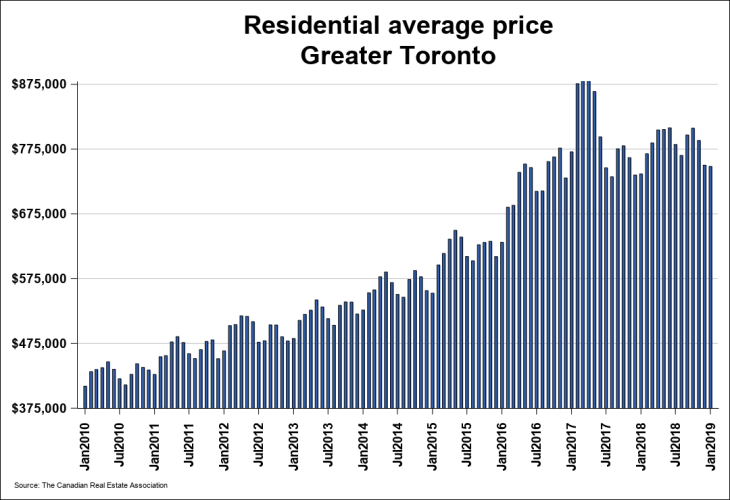

Back in 2015, we told them the same thing we’ve repeatedly told other clients and Inner Circle members. Since the 2008/2009 recession, central banks in Canada, the U.S. and other countries have set off on a unique economic experiment. They have artificially pushed interest rates down to historically low levels, for two reasons: to keep the economy out of recession, and to make it possible to pay the interest costs on extraordinarily high and rising government debt.

Now, with this sell-or-hold decision to make, the situation has changed. House prices and interest rates have both gone up substantially. This means far more potential Toronto-area house buyers have been priced out of the market. In addition, the artificial interest-rate paradise is coming to an end. Interest rates have gone up and our view is that they will keep rising.

Our advice for this particular young family was to accept the sweet deal on the rental house, and sell the starter. They can save the money they’d otherwise pay on property taxes toward a down payment on their dream home. Their incomes are likely to rise, since they are in the prime of their careers, so they’ll have that much more to add to the dream-home fund. When they are ready to buy, here are some tips:

Is buying a house a good investment? 6 key real estate investing tips for Successful Investors

Tax pluses. Homeowners get a tax-free, rent-free benefit of having a place to live. Profits on sales of principal residences are also tax-free. Continue Reading…