By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

If you ask a long-term homeowner whether they feel their home purchase has turned out to be a worthy investment, chances are they’ll say it was; real estate continues to be considered a safe and effective way to grow your money, according to 68% of homeowners who’ve owned a home for 10 years or longer, according to data collected by Zoocasa.

However, the Canadian housing market is coming off of an admittedly quieter year, with steep declines in sales activity recorded in some of the nation’s largest markets: The Greater Toronto Area, Greater Vancouver, and Calgary have all seen the number of homes changing hands plunge by double digit percentages, mainly due to the impact of tougher federal mortgage rules.

That has subsequently trickled down into home values, with the west coast markets posting year-over-year price declines, while the GTA experienced only moderate, single-digit growth.

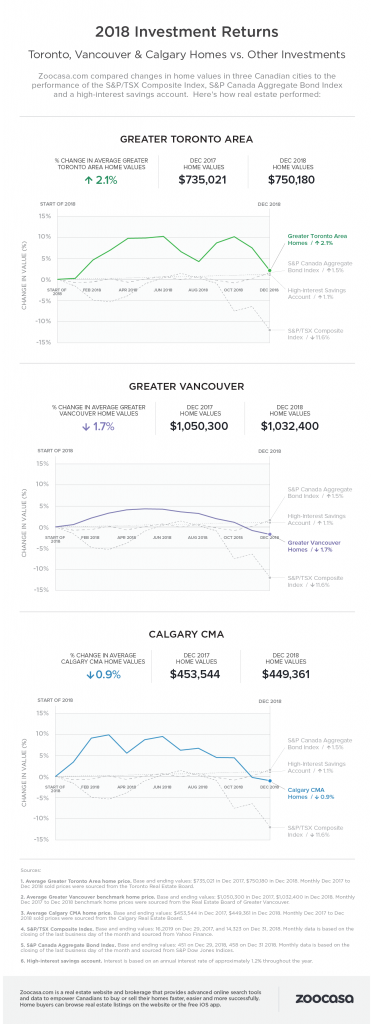

So, does the old adage of real estate being among the wisest of investments still hold true? To find out, Zoocasa.com compared average year-over-year price performance to that of three popular investments:

- The S&P / TSX Composite Index (-11.6%)

- The S&P Canada Aggregate Bond Index (+1.5% y-o-y)

- And a high-interest savings account (+1.1%)

Let’s take a look at how real estate price gains (or lack thereof) compared to the returns on these investments in the adjacent infographic.

GTA only market to outpace investment comparison

The GTA (Toronto) housing market ended the year on a positive note, posting an increase of 2.1% for the average home price of $750,180, and the only market to outpace all three investment types.

However, the market lost a considerable bit of steam over the course of the year, unable to hold onto the 9.9% gains achieved at the market peak in June, when prices hit an average of $807,871. Year-over-year December sales clocked in 16% lower than in 2017, which the Toronto Real Estate Board attributes to the federal mortgage stress test. This hurdle, introduced last January, requires borrowers to qualify at a higher rate than their actual contract rate, resulting in a smaller mortgage amount and squeezing affordability in an already expensive market.

“Higher borrowing costs coupled with the new mortgage stress test certainly prompted some households to temporarily move to the sidelines to reassess their housing options,” said TREB President Garry Bhaura, in the board’s December report.

Vancouver values fall from last year

It has been an especially painful year for the Greater Vancouver MLS, as sales have dipped a whopping 31.6% from December 2017: the lowest level of activity since the year 2000. That’s translated into an average price decline of 1.7% to $1,032,400. Continue Reading…