By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

If you ask a long-term homeowner whether they feel their home purchase has turned out to be a worthy investment, chances are they’ll say it was; real estate continues to be considered a safe and effective way to grow your money, according to 68% of homeowners who’ve owned a home for 10 years or longer, according to data collected by Zoocasa.

However, the Canadian housing market is coming off of an admittedly quieter year, with steep declines in sales activity recorded in some of the nation’s largest markets: The Greater Toronto Area, Greater Vancouver, and Calgary have all seen the number of homes changing hands plunge by double digit percentages, mainly due to the impact of tougher federal mortgage rules.

That has subsequently trickled down into home values, with the west coast markets posting year-over-year price declines, while the GTA experienced only moderate, single-digit growth.

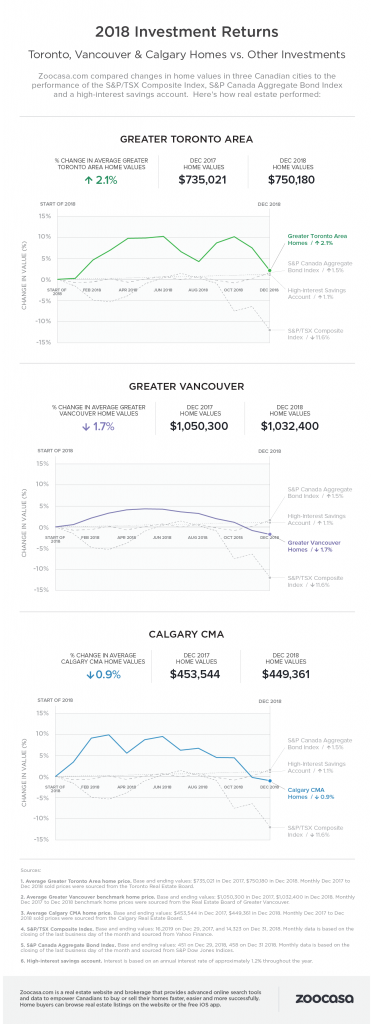

So, does the old adage of real estate being among the wisest of investments still hold true? To find out, Zoocasa.com compared average year-over-year price performance to that of three popular investments:

- The S&P / TSX Composite Index (-11.6%)

- The S&P Canada Aggregate Bond Index (+1.5% y-o-y)

- And a high-interest savings account (+1.1%)

Let’s take a look at how real estate price gains (or lack thereof) compared to the returns on these investments in the adjacent infographic.

GTA only market to outpace investment comparison

The GTA (Toronto) housing market ended the year on a positive note, posting an increase of 2.1% for the average home price of $750,180, and the only market to outpace all three investment types.

However, the market lost a considerable bit of steam over the course of the year, unable to hold onto the 9.9% gains achieved at the market peak in June, when prices hit an average of $807,871. Year-over-year December sales clocked in 16% lower than in 2017, which the Toronto Real Estate Board attributes to the federal mortgage stress test. This hurdle, introduced last January, requires borrowers to qualify at a higher rate than their actual contract rate, resulting in a smaller mortgage amount and squeezing affordability in an already expensive market.

“Higher borrowing costs coupled with the new mortgage stress test certainly prompted some households to temporarily move to the sidelines to reassess their housing options,” said TREB President Garry Bhaura, in the board’s December report.

Vancouver values fall from last year

It has been an especially painful year for the Greater Vancouver MLS, as sales have dipped a whopping 31.6% from December 2017: the lowest level of activity since the year 2000. That’s translated into an average price decline of 1.7% to $1,032,400.

In addition to the national stress test, Vancouver’s market has also had to absorb considerable changes at the provincial level, including an empty homes tax, out-of-province speculation tax, as well as the controversial foreign buyers’ tax introduced in 2016.

“This past year has been a transition period for the Metro Vancouver housing market away from the sellers’ market conditions we experienced in previous years,” says Phil Moore, president of the Real Estate Board of Greater Vancouver. “High home prices, rising interest rates and new mortgage requirements and taxes all contributed to the market conditions we saw in 2018.”

Calgary experiencing Supply-Demand imbalance

It’s been a tough slog in wild rose country for some time now, as a downturn in the oil patch has let pressure out of the housing market, and sales and prices sag from a lack of buyers. Calgary real estate sales fell 21% year over year: 20% below the long-term average, according to the Calgary Real Estate Board – with home values relatively flat, down 0.9% to an average of $449,361. Like Vancouver, that’s below the return of even a high-interest savings account.

“Persistent weakness in the job market and changes in the lending market impacted sales activity in the rea estate market this year,” stated CREB’s Chief Economist Ann-Marie Lurie.

What should Homeowners do?

While the numbers may not look promising, it’s important to keep in mind that real estate typically has a long-term horizon as an investment; common advice is for buyers to remain in their properties for a minimum of five years to build equity and offset costs such as land transfer tax, before moving up in the market. And, with the exception of those looking to purely invest in the market, home buyers should consider whether a home fits their lifestyle and financial picture, rather than potential return on investment.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

68% of homeowners who have owned for 10 years or longer *think* it’s worthwhile – but how many of those have calculated their real rate of return, to determine if it was truly worthwhile (after they deduct buying and selling costs, and home ownership costs, like a new furnace, renos, property taxes, etc.)? What would they have earned in a 60/40 (i.e. etf balanced) stock market investment during the same period? Isn’t that the only valid objective way to compare?

The only other factor (in my opinion) is the value you place in the freedom of truly owning your own space and land (can’t get evicted, you get to decide what gets done and when, etc.). To me that has a lot of value, but it is not a financial benefit (which I assume this article is inferring as the main benefit).

In my opinion, you should buy only if you can afford it, but assume that you will at best break even. We have owned our home for 35 years, paid $220K, now worth $450K, but when I calculate all our expenses over that time, we might be breaking even (property taxes $140K over that period, various renos $50K, new furnace/ac 15K, and more).

BUT…. I do love owning my own home. ;-) But it is a luxury, not a money maker, and not a right.

Having said all this – yes, if you bought in Toronto or Vancouver at the right time, you could make out great. But that, in my opinion, is not investing, it is speculation. Nothing wrong with that, but (again, in my opinion), you should only speculate with money you can afford to lose.

Best regards,

Jean.

@Jean beg to differ on owning in YYZ or YYV home owners making out great- I live in Toronto (YYZ ) and ran the ROI on my house vs. my long term hold of BCE (DRIPed no – sell. no buy) on the same timeframe (35yrs) – winner BCE – 8.8% vs house 7.3% even with the insane YYZ house price increases – btw I consider taxes and maintenance as living costs i.e. rent).

All said buying the house was still one of the best decisions I’ve made for the reasons you gave which basically boil down to control.

Surely you are kidding – one year time span comparison – if you are going to this on that timeframe then add in the transaction costs – guess what RE loses. How about a real comparison say over 25-30-50 years? Silly self-serving article. I expect more from this blog.

Very poor quality write up. Shows bias and a self serving attitude. Instead of asking people about their “feelings” why not compare actual returns on housing versus the Toronto Stock Exchange, TSE 60 index, over the last 50 years. And make sure to subtract costs which would be substantial for house owners. Ms. Graham should apologise for the implications of this article which are misleading at best and actually quite dishonest when you consider her motive to promote housing speculation.

You make some solid points, AI.