By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

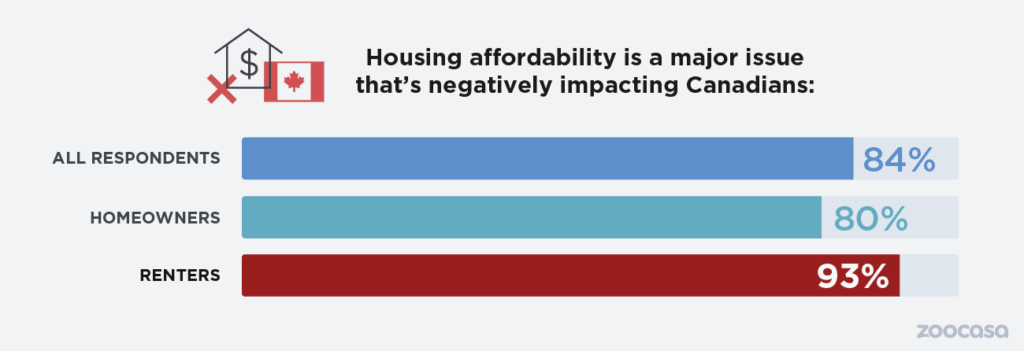

Election season may have come and gone, but the need for affordable housing remains a top-of-mind issue for Canadians, regardless of governing political party. According to a recent national survey conducted by Zoocasa, a whopping 84% say they feel the ability to afford a home is a major issue that’s negatively impacted the population: and 78% feel the government needs to make it a priority focus.

As well, the survey findings reveal that anxiety around affordability extends beyond those who wish to get onto the property ladder; while renters express particularly strong feelings of uncertainty (93%), current homeowners are also feeling the squeeze from spiralling home values, with 80% in agreement.

Let’s take a look at the top concerns indicated by Canadians.

Incomes can’t keep pace with Real Estate prices

It’s no secret that prices for houses for sale in markets across Canada have seen enormous growth over the last five years. According to the Canadian Real Estate Association, the national average home price now exceeds half a million dollars, at $515,500 (though it should be noted that removing Vancouver and Toronto houses and condos from the equation would trim that total to $397,000).

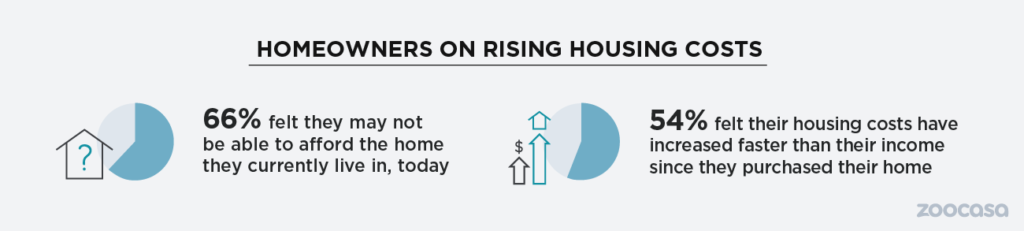

This has left the majority of Canadians – 91% – feeling as though home prices have outstripped wages in their city or town, while another 92% say they feel rising home prices have reduced the ability of middle-class Canadians’ abilities to purchase a home.

As a result, in order to seek out greater affordability, more than half of first-time buyers said they’d leave their current location and move to a market with lower home prices, contributing to what’s referred to in real estate circles as “driving until you qualify.”

Other homeownership hurdles

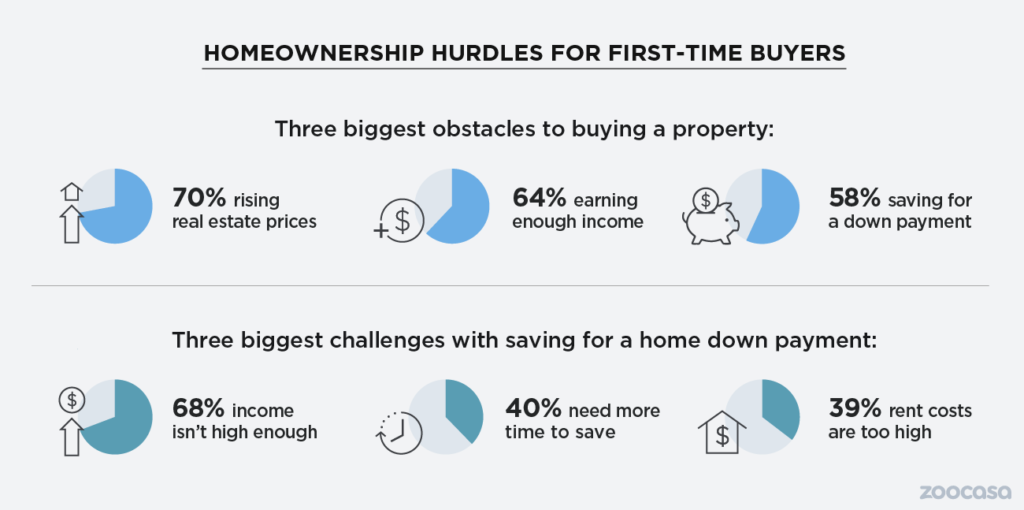

But rising home prices only tell a portion of the story: while 70% of respondents agree they’re the largest obstacle to getting on the property ladder, the inability to save enough for a down payment also ranks highly on the list of challenges. Continue Reading…