Vanguard Investments Canada Inc. has announced the listing of three new low-cost Asset Allocation ETFs that give investors one-stop shopping to the firm’s globally diversified strategies. They began trading on the TSX today (February 1, 2018.)

Both investors and advisors are asking for “simple yet sophisticated single-ticket investment solutions that provide well-diversified global equity and bond exposure within a low-cost ETF structure,” says Atul Tiwari, managing director for Vanguard Canada. The new ETFs offer investors three different risk profiles and regular rebalancing.

In effect, each ETF is a fund of funds although Vanguard describes them as having an “ETF of ETFs structure.” Each holds seven existing core Vanguard index ETFs (which I list in the postscript below). Each new ETF of ETFs has a management Fee of 0.22%. Vanguard says that when one of its ETFs invests in underlying Vanguard funds, “there shall be no duplication of management fees.” Spokesman Matthew Gierasimczuk said “There are no duplicate fees beyond the 0.22 management fee, other than a basis point or two for operating expense and the trading fee for buying or selling the ETF.”

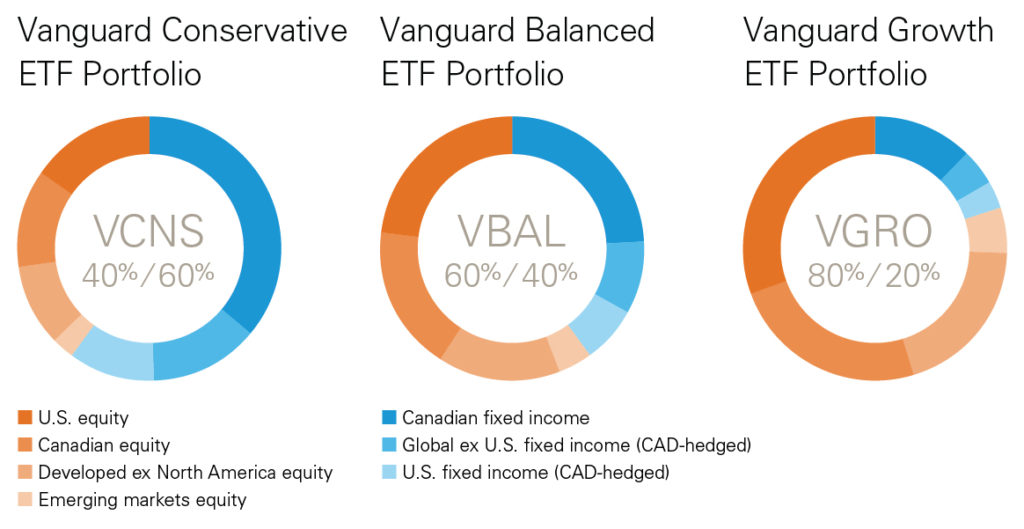

The three asset allocation ETFs cover the normal range from Conservative to Balanced to Growth, as reflected in the product names. Equity weights range from 40% for the Conservative offering, to 60% for the Balanced and 80% for the Growth.

Here are the 3 ETFs and their ticker symbols on the TSX:

Vanguard Conservative ETF Portfolio (VCNS) seeks to provide a combination of income and moderate long-term capital growth by investing in equity and fixed income securities with a strategic allocation of 40% equities and 60% fixed income.

Vanguard Balanced ETF Portfolio (VBAL) will provide long-term capital growth with a moderate level of income split 60% equities to 40% fixed income.

Vanguard Growth ETF Portfolio (VGRO) provides long-term capital growth by investing in equity and fixed income securities with 80% equities and 20% fixed income.

In a press release, Vanguard Canada head of product Tim Huver said the ETFs offer “a simplified and scalable solution for financial advisors, and a one-stop globally-diversified and transparent option for investors … Investors can rely on Vanguard’s global investment experts to continuously assess their portfolio’s exposure and rebalance it back to its intended risk level.”

With the three new ETFs, Vanguard Canada now offers 36 ETFs, with C$14 billion in assets under management. Vanguard Investments Canada Inc. is a wholly owned indirect subsidiary of The Vanguard Group, Inc.

You can find more at Vanguard Canada’s website.

Postscript: My Take

After sleeping on this announcement, it strikes me as more significant than I had initially perceived. Continue Reading…