One of the most important developments in the financial world in recent years has been the growth of evidence-based investing. But what exactly is it? In the first of a new series of exclusive articles for Justwealth, the UK based author and journalist Robin Powell explains why founding your investment strategy on four basic principles can dramatically improve your chances of achieving your long-term goals.

One of the most important developments in the financial world in recent years has been the growth of evidence-based investing. But what exactly is it? In the first of a new series of exclusive articles for Justwealth, the UK based author and journalist Robin Powell explains why founding your investment strategy on four basic principles can dramatically improve your chances of achieving your long-term goals.

By Robin Powell, The Evidence-Based Investor

Special to Financial Independence Hub

It takes between seven and nine years to train to be a doctor in Canada. For surgeons it takes as many as 14. Even then, both doctors and surgeons are required to engage in continuous learning throughout their careers.

Becoming a financial adviser, investment consultant or money manager is considerably less onerous. What’s more, unless you deliberately set out to defraud your clients, you’re unlikely to be stripped of your right to operate.

Of course, there are still examples of poor medical practice. It was only as recently as the early 1990s that a group of epidemiologists at McMaster University in Hamilton, Ontario, first coined the phrase evidence-based medicine. Sadly, though, professional malpractice in the investing industry is far more common, and there are many who have worked in it for decades and yet act as if they have little or no grasp of the evidence on how investing works.

A glaring illustration of this is a study published in May 2018 called The Misguided Belief of Financial Advisers. The researchers analyzed the returns achieved by around 4,400 advisers across Canada: both for their clients and for themselves. They found that the advisers made the same mistakes investing their own money as they did when investing their clients’ money.

For example, they traded too frequently, chased returns, preferred expensive, actively managed funds, and weren’t sufficiently diversified. All of those things have been shown, time and again, to lead to lower returns. On average, the clients of the advisers analyzed underperformed the market by around three per cent a year: a huge margin.

What is evidence-based investing?

In recent years, we’ve seen the development of what’s called evidence-based investing (EBI). Like evidence-based medicine, it entails the ongoing critical appraisal of evidence, rather than relying on traditional practices or expert opinions.

In recent years, we’ve seen the development of what’s called evidence-based investing (EBI). Like evidence-based medicine, it entails the ongoing critical appraisal of evidence, rather than relying on traditional practices or expert opinions.

So what sort of evidence are we talking about? Essentially there are four main elements to the evidence that underpins EBI.

First, the evidence is based on research that is genuinely independent; in other words, the research wasn’t paid for or subsidized by organizations with a vested interest in the outcome.

Secondly, it’s peer-reviewed. This means that the findings are published in a peer-reviewed journal which is closely examined by experts on the subject.

Thirdly, the evidence is time-tested. Investment strategies often succeed over short time periods, but fail over longer ones. Investors should disregard any evidence that hasn’t stood the test of time.

Finally, the evidence results from rigorous data analysis. As everyone knows, data can be very misleading if it hasn’t been properly analysed.

The good news is that, even when all four of these filters are strictly applied, there is still plenty of evidence to inform our investment decisions. Since the 1950s, finance departments at universities across the globe have produced many thousands of relevant studies.

What does the evidence tell us?

What, then, are the main lessons from academic research on investing? This is a wide-ranging subject, and one we’ll look at in more detail in future articles, but there are four main takeaways.

Markets are broadly efficient

Because markets are competitive and prices reflect all knowable information, it’s very hard to identify stocks, bonds or entire asset classes which are either undervalued or overvalued at any one time. No, prices aren’t perfect, but they’re the most reliable guide we have as to how much a security is worth.

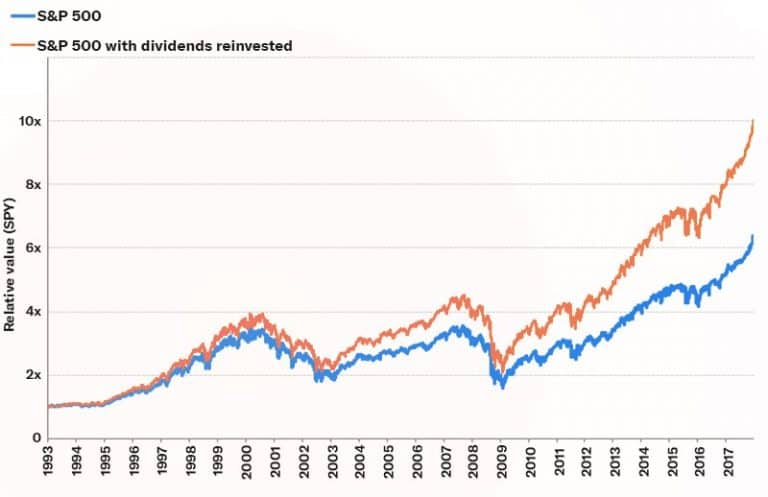

Diversification is an investor’s friend

It’s vital for investors to diversify across different asset classes, economic sectors and regions of the world. As well as reducing your risk, diversification can also improve your returns in the long run, and it is rightly referred to as “the only free lunch in investing.”

Costs make a big difference

The investing industry and the media tend to focus on investment performance. But while performance comes and goes, fees and charges never falter. Continue Reading…