A bull market in advice? This novel idea is the basis of my latest Motley Fool blog, which came out of the 2017 Vanguard Investment Symposium held this Tuesday.

A bull market in advice? This novel idea is the basis of my latest Motley Fool blog, which came out of the 2017 Vanguard Investment Symposium held this Tuesday.

Hopefully, the title is self-explanatory. Click on the highlighted text to access the whole blog: Lower future returns from balanced portfolios means a bull market in advice.

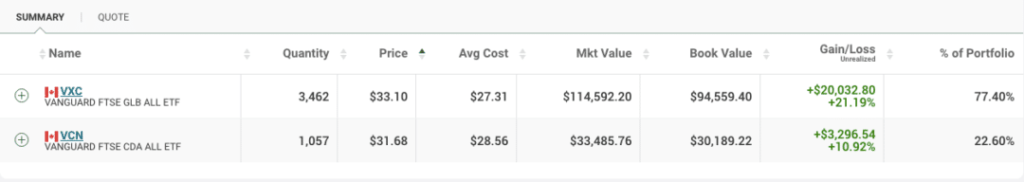

Click through to get Vanguard’s forecasts for future returns. Suffice it to say that they don’t believe the next five years will be as good as the last five years have been for balanced investors.

All of which means good financial advice will be at a premium. Naturally, Vanguard believes that the lower expected future investment returns are, the more important it is to reduce costs and taxes, which of course its low-cost index funds and ETFs facilitate. But it also believes advisors can help investors by addressing the so-called “behaviour gap.” It’s been well documented that poor investing behaviour (buying high, selling low) are destructive to returns, which is why a good financial advisor can more than recoup his/her fees.

Advisors can add 3% value per a year

Many fee-based advisors use the kind of investment funds Vanguard provides and Vanguard believes good advice can “add value” of roughly 3% per year to clients’ investment returns.

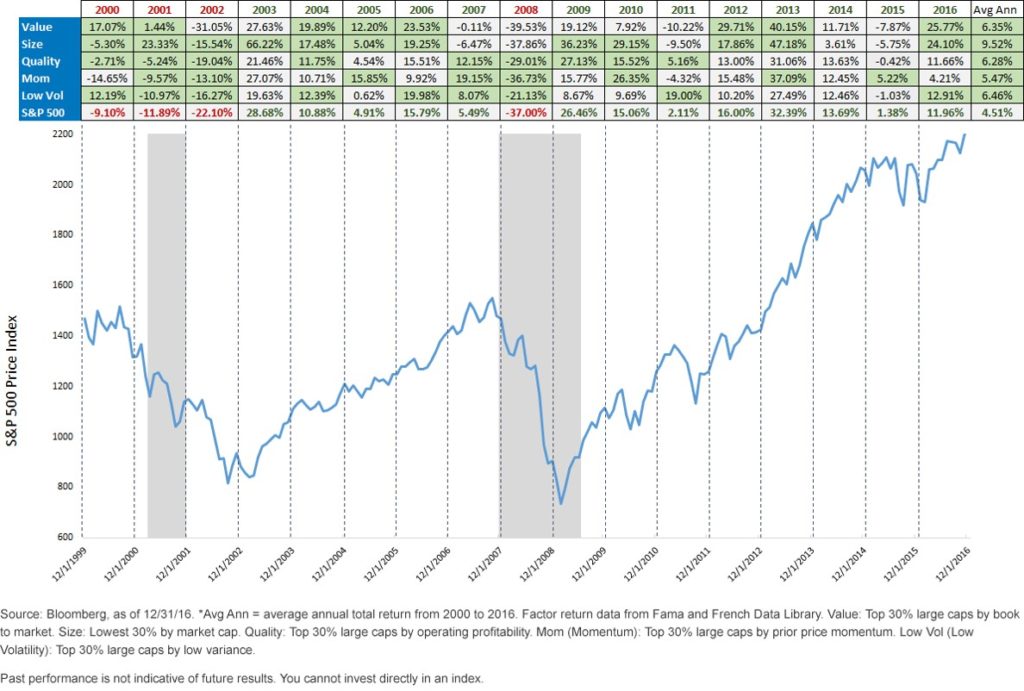

Behavioural coaching is the single biggest value-add: 150 basis points (1.5%). “Staying the course is difficult,” but “a balanced diversified investor has fared relatively well,” said one Vanguard presenter quoted in the Motley Fool piece, Fran Kinniry.

Behavioural coaching is followed closely by 131 beeps for cost-effective product implementation (using low expense ratios). This alone can add 1 to 2 percentage points of value, Vanguard says, attributing the finding to “numerous studies.” Rebalancing accounts for another 47 beeps, and Asset Location between 0 and 42 beeps (as opposed to Asset Allocation, which it says adds “more than 0 beeps.”)

A proper spending strategy (identifying the order of withdrawals in the decumulation stage) accounts for another 0 to 41 beeps. All told, the potential value added comes to “about 3%,” Kinniry says.

Vanguard says a “strong move to fee-based” compensation is accelerating. In 2015, 65% of advisors’ compensation came from asset-based fees, while wealthier investors are “most willing to pay AUM-based fees.” Gradually this will ‘flow down” to less well-heeled clients, “as smaller balances can now be well-served” in a fee-based model because of scale and technology.

Using Cerulli data from 2015, Vanguard estimates the median asset-weighted advisory fee is 1.39% for the mass market ($100,000 assets), 1.28% for the middle market ($300,000), 1.09% for the mass-affluent market ($750,000), 0.92% for the affluent market ($1.5 million to $5 million) and 0.70% for the High Net Worth market ($10 million or more).

On average across all clients, the median fee is 1.07%.