By Dale Roberts, cutthecrapinvesting

By Dale Roberts, cutthecrapinvesting

Special to the Financial Independence Hub

It is probably the greatest (and potentially dangerous) misconception in the investing landscape, that stocks protect you from inflation. That’s simply not true. While stocks have a long term history of besting inflation, they can fail in many periods, short and extended. Stock markets do not always work as an inflation hedge. And Vanguard suggests that their effectiveness will wane as the types of stocks that can work against inflation no longer have strong representation in the broad market stock indices. We’ll show you how to protect against inflation on the Sunday Reads.

Let’s cut to the chase. It’s something I’ve known for quite some time and I’m more than happy to see Vanguard beat the drum. If you want to protect your portfolio from inflation or stagflation (its evil stag cousin) own commodities.

When you own commodities or a commodities index fund or ETF, you own the raw materials that make the products, foods and energy needed to sustain life and society as we know it.

Stocks don’t work

Let’s get this out of the way first, shall we, from this Vanguard post, the potency of commodities as an inflation hedge …

And that’s during a period when we’ve mostly had muted inflation. Stocks don’t like unexpected inflation, like the kind we’re having in 2021. That is, inflation above recent trends and expected trends.

If we go back to the stagflation period of the 1970’s and into the early 1980’s it’s a complete mess for stock investors. Have a look at MoneyChimp and be sure to hit that inflation button. This shows a negative real (inflation adjusted) return from 1968 through 1982, for US stocks. In real dollar terms, $1.00 became 94 cents.

Global stocks did not perform much better. And surprisingly neither did the Canadian stock market that was more commodities and energy-concentrated for the period.

Here’s global stocks for the period showing no return premium vs inflation. The chart is courtesy of ReSolve Asset Management.

And in this post on the Permanent Portfolio, you’ll see that even the traditional stock and bond balanced portfolio failed for an extended period during stagflation. There are other periods of ‘don’t work’ for the balanced portfolio (and for different reasons) within that chart.

Commodities hedge is strong and consistent

While stocks are not a consistent hedge for inflation, commodities have been, historically. And once again, this is during a period of mostly muted inflation, save for a few periods of unexpected inflation. Luckily for investors, that inflation has been transitory in the last few decades.

From that Vanguard post …

Over the last three decades, commodities have had a statistically significant and largely consistent positive inflation beta, or predicted reaction to a unit of inflation. The research, led by Sue Wang, Ph.D., an assistant portfolio manager in Vanguard Quantitative Equity Group, found that over the last decade, commodities’ inflation beta has fluctuated largely between 7 and 9. This suggests that a 1% rise in unexpected inflation would produce a 7% to 9% rise in commodities.

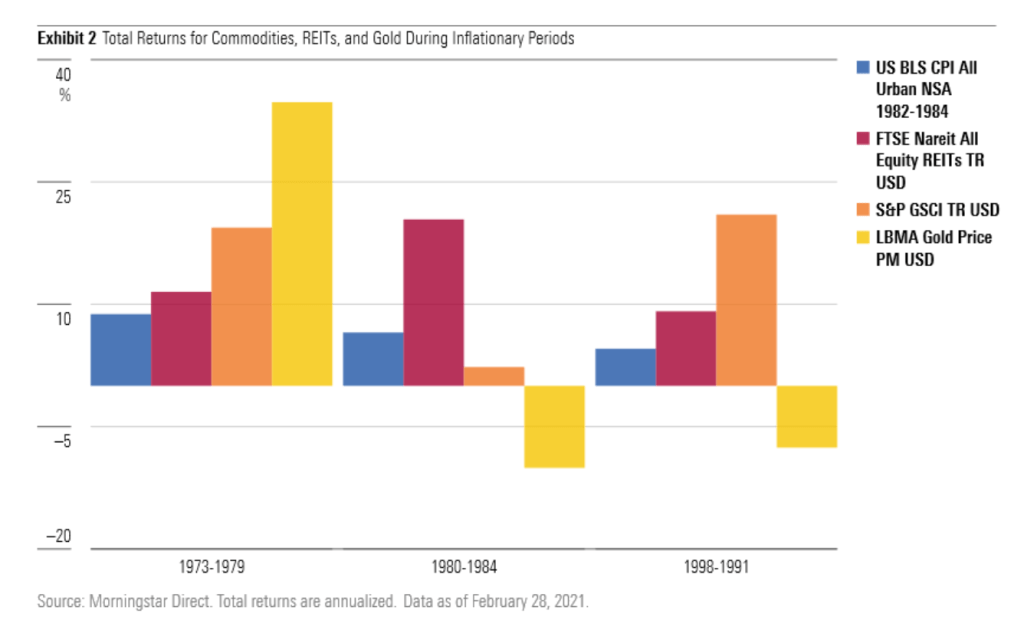

Here’s a great chart that shows gold, commodities and REITs as inflation hedges in periods of meaningful inflation. The orange bar is the commodities index.

While gold was the most explosive during the bulk of the period of stagflation, we see that a commodities basket is more reliable. Admittedly, gold can fall down as an inflation hedge in certain periods. That said, there are other reasons for holding gold as a hedge against declining real bond yields and as a form of disaster insurance and a long term hedge against ongoing currency debasement.

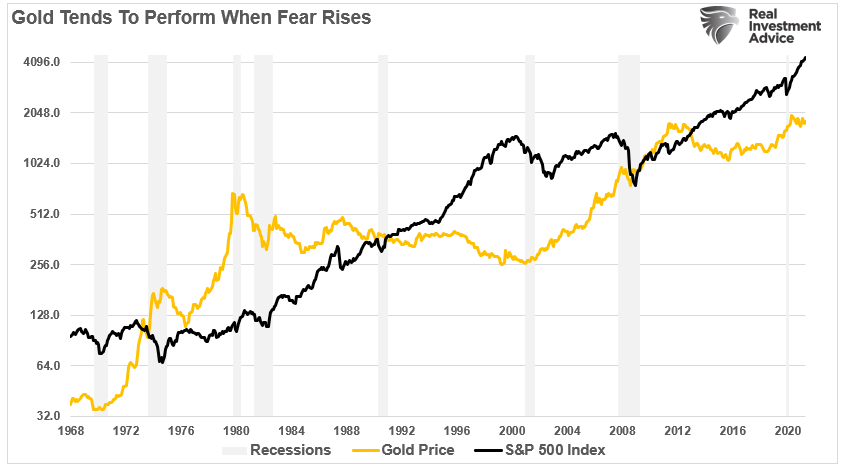

In the above chart we see gold working in all of the stock market failures for the period shown. Again, most notably during stagflation.

I like to also hold some gold and gold stocks on the side in addition to commodities baskets. Readers will also know that I am also investing in bitcoin – that new gold or digital gold. Continue Reading…