By Lorne Marr, CFP

Special to the Financial Independence Hub

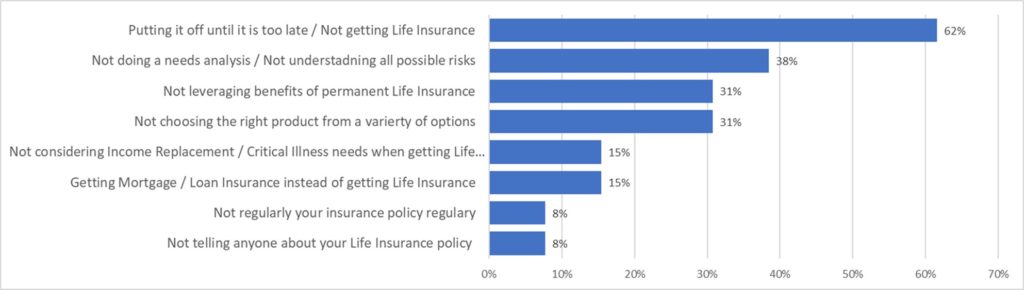

There are numerous life insurance mistakes Canadians are making, and who qualifies better to talk about these mistakes than life insurance experts? We asked numerous life insurance experts to weigh in on the top life insurance mistakes they have seen throughout their careers.

You can find a summary of their replies in the above chart, with more detailed explanations following in their segments (% shows how often a particular mistake has been mentioned).

The top three mistakes are:

1.) Putting off your life insurance purchase until it is too late, or not getting life insurance at all (especially in your younger years).

2.) Not doing a needs analysis and not understanding all possible risks resulting from being underinsured.

3.) Not leveraging the benefits of a permanent life insurance policy due to its higher cost, though there are numerous benefits to this product in the long run.

Tony Bosch – Executive Vice President Broker Development Hub Financial

“Life insurance is a key component in most financial and estate plans”

Three key mistakes people make when purchasing life insurance:

- Not doing a needs analysis: The first step in any life insurance purchase should be to do a proper needs analysis. People often fail to look at the big picture when buying life insurance. The calculation of how much insurance you need should be more detailed than just having your mortgage paid off or replacing a certain multiple of your income. In determining your life insurance needs it is necessary to determine what amount is actually necessary to “allow your family to maintain their standard of living and pay off outstanding debt”under “less than ideal circumstances,” factoring in that the grieving process and the time to recover emotionally may take several months or even years. Life insurance should provide “financial confidence.” allowing a family time to adapt and adjust to life without a loved one.

- Product selection: Life insurance, unlike most forms of insurance, can come in a variety of payment options from low cost term insurance to permanent policies that can build substantial tax sheltered cash values and can help solve estate planning needs and/or serve as an alternative investment. The problem arises when the product selection overrides the need. Clients with a limited budget may be attracted by product features causing them to choose a permanent product with a lower face amount than is required. A family with three kids may like the idea of a shiny sports car but may need a mini van. It is critical to first define the amount of protection required and then choose the product or combination of products that meet this need within a given budget.

- Choosing a solution based on price and/or convenience rather than contract guarantees and flexibility: A simple example may be purchasing loan or mortgage insurance through a lending institution. Although this may seem like an easy and convenient solution, it may require additional underwriting at the time of claim, which could result in a claim being denied. A basic renewable and convertible term plan underwritten by an insurance company may take a little more time to set up, but in most instances provides a better and more flexible policy that can adapt to your changing needs.

Life insurance is a key component in most financial and estate plans. Working with an experienced and trusted independent advisor will help make sure you and your family get the life insurance you require with the flexibility to adjust to your changing needs.

- Putting it off until it is too late: Even though Canada Protection Plan can help get life insurance for people with medical or lifestyle issues, I think it is always best to get insurance when you don’t need it and when you are healthy. It’s not how much you can afford, but rather how healthy you are that gets you the best insurance options.

- Not telling anyone about your life policy: People get a life insurance policy but when they pass away, some beneficiaries don’t even know about it. I always suggest that advisors should acquire contact information for the beneficiaries and where possible, introduce themselves because these beneficiaries will most likely be contacting the advisor to make a claim.

- Regularly reviewing a client’s policy: So many advisors provide the initial policy but never review them. People’s lives are constantly changing and they may need to adjust or add more coverage. If an advisor never contacts their client, then they should not be surprised when the client switches their business to another advisor.

Lawrence Geller – President of L.I. Geller Insurance Agencies

“Everyone has asked to either renew the existing policy or buy a new policy.”

Of the many people who have assured me over the years that they only needed life insurance for a maximum of 10 years, every one has asked to either renew the existing policy or buy a new policy to replace the one that was renewing. Even then, most have deluded themselves by thinking that they would not need the coverage when the term of the contract ended, and almost all have wanted coverage at the end of the term.

Not a single client who bought a guaranteed paid up whole life policy has ever told me that they made the wrong choice of coverage, although many have told me that they wished that they had purchased a larger amount of life insurance.

“Don’t gamble on being uninsured.”

The top life insurance mistake, from a consumer’s perspective, has to be the choice to gamble on being uninsured (or underinsured).

LIMRA reported a year ago in 2019 that 32 per cent of Canadian households do not have any life insurance coverage, while 56 per cent of Canadian households do not have any individual life coverage. Everyone would agree that there are more pleasant things to consider and address than the risk of dying prematurely, and that may be the reason why so many Canadians are shying away from a proper assessment. More likely, the observation comes from a knowledge gap of the risk and associated loss. Many Canadians would not necessarily consider themselves as gamblers, meanwhile the chosen approach of not buying insurance (or not buying enough) is very similar to that of a gambler’s behavior. The gambler “invests” a little wager with a small probability of a large payoff. In comparison the non-insured “saves” paying a small premium hoping he/she wouldn’t die with a significant financial burden. Both types of gamblers have small amounts involved when compared to what is at stake, and the odds of the event, while relatively small, can have a significant impact. They are just at both ends of the spectrum: the casino gambler hoping for the big win, and the life gambler neglecting to consider the major financial loss.

Turning a blind eye to the needs of paying final expenses, replacing income, paying off the mortgage, or paying the estate bills, and choosing not to be insured (or underinsured) is essentially just like gambling the financial state of the loved ones left behind. Several Canadians, when asked why they do not own life insurance, have stated they could not afford it (27 per cent) or that they had other financial priorities (25 per cent). Continue Reading…

Here is a breakdown of these insurance types and below you will find a detailed description of each type:

Here is a breakdown of these insurance types and below you will find a detailed description of each type: