By Noah Solomon

Special to Financial Independence Hub

A change, it had to come

We knew it all along

We were liberated from the fold, that’s all

And the world looks just the same

And history ain’t changed

‘Cause the banners, they all flown in the last war

Won’t Get Fooled Again. The Who; © Abkco Music Inc., Spirit Music Group

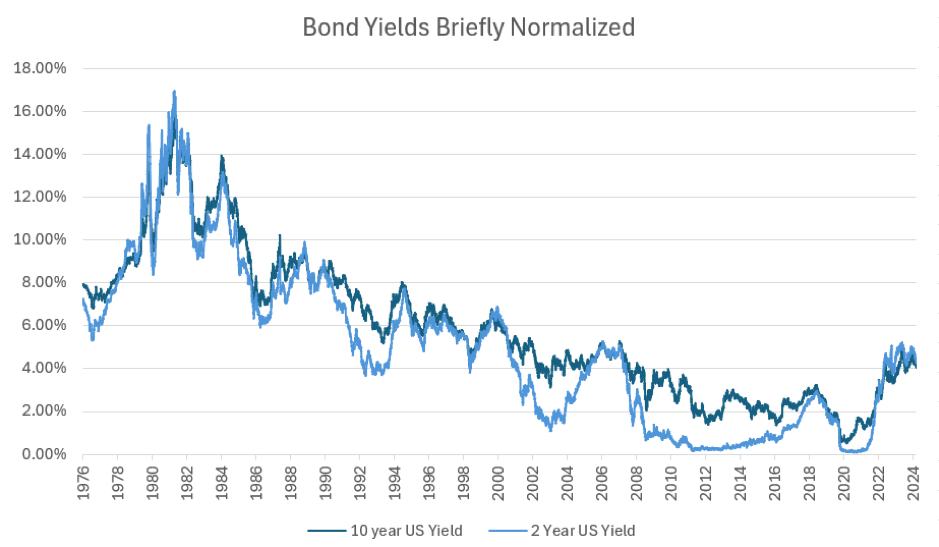

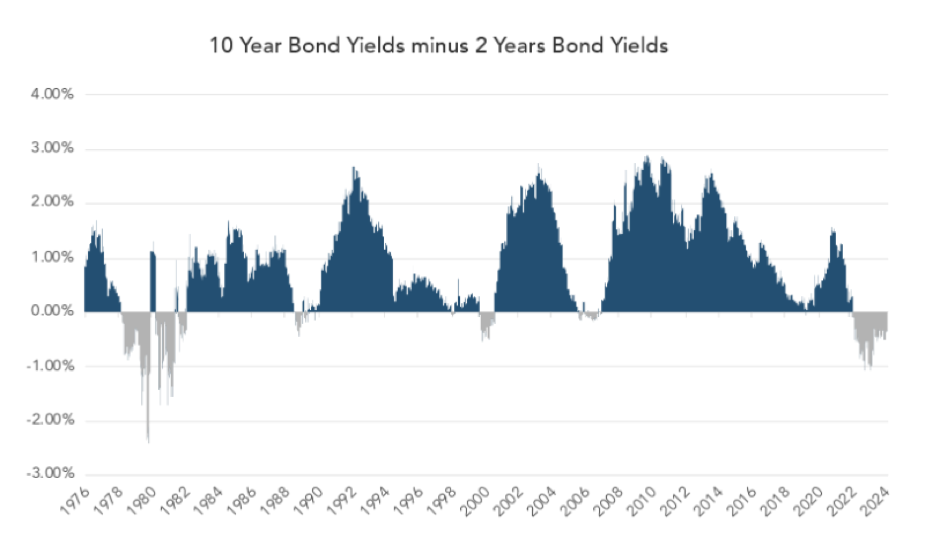

As inflation rapidly accelerated towards the end of 2021, bond yields woke up from their decade plus slumber breathing fire and brimstone. Subsequently, bonds have once again become a worthwhile asset class for the first time since the global financial crisis.

I will explore the historical behaviour and characteristics of bonds. Importantly, I will also discuss how they have reclaimed some of their status as a valuable part of investors’ portfolios.

Riding the Roller-Coaster for the Long Term

Notwithstanding that stocks have periodically caused investors some severe nausea during bear markets, those who have been willing to tolerate such dizzy spells have been well-compensated. In Stocks for the Long Run, Wharton Professor Jeremy Siegel states “over long periods of time, the returns on equities not only surpassed those of all other financial assets but were far safer and more predictable than bond returns when inflation was taken into account.”

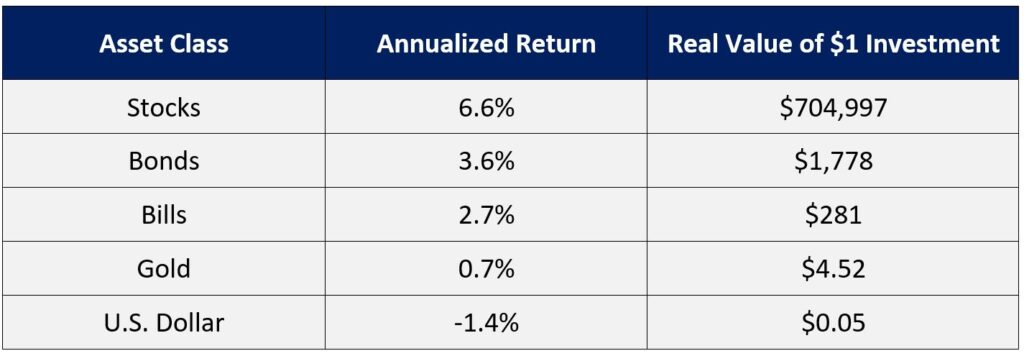

As the following table demonstrates, not only have stocks outperformed bonds, but have also trounced other major asset classes. The effect of this outperformance cannot be understated in terms of its contribution to cumulative returns over the long term. Over extended holding periods, any diversification away from stocks has resulted in vastly inferior performance.

Real Returns: Stocks, Bonds, Bills, Gold and the U.S. Dollar: 1802-2012

With respect to stocks’ main competitor, which are bonds, Warren Buffett stated in his 2012 annual letter to Berkshire Hathaway shareholders:“Bonds are among the most dangerous of assets. Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as these holders continued to receive timely payments of interest and principal … Right now, bonds should come with a warning label.”

The Case for Bonds

Notwithstanding that past performance is not a guarantee of future returns, the preceding table begs the question of why investors don’t simply hold all-stock portfolios. However, there are valid reasons, both psychological and financial, that render such a strategy less than ideal for many people.

The buy-and-hold, 100% stock portfolio is a double-edged sword. If (1) you can stick with it through stomach-churning bear market losses, and (2) have a long-term horizon during which the need to liquidate assets will not arise, then strapping yourself into the roller-coaster of an all-stock portfolio may indeed be the optimal solution. Conversely, it would be difficult to identify a worse alternative for those who do not meet these criteria. Continue Reading…